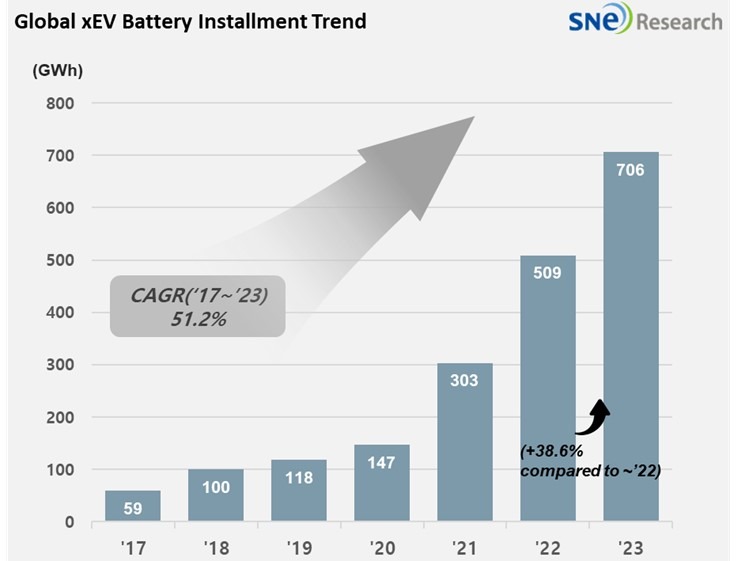

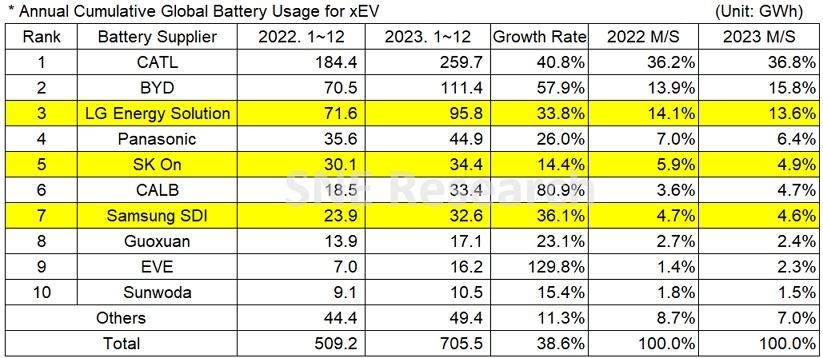

On February 7, data from respected South Korean market analysis firm SNE Research revealed a prominent escalation in global electric vehicle (EV) battery demand in 2023, demonstrating a notable rise over the previous year. The published report shows that the worldwide consumption of batteries for EVs in 2023 climbed to 705.5 GWh, signifying a pronounced 38.6 percent increase over the 509.2 GWh documented in the analogous period in 2022.

At the forefront of this exponential growth is Contemporary Amperex Technology Co. Ltd. (CATL), an eminent figure in China’s power battery industry, which saw its installed battery capacity soar to 259.7 GWh in 2023. This represents an impressive 40.8 percent increase from its previous capacity of 184.4 GWh in the previous year.

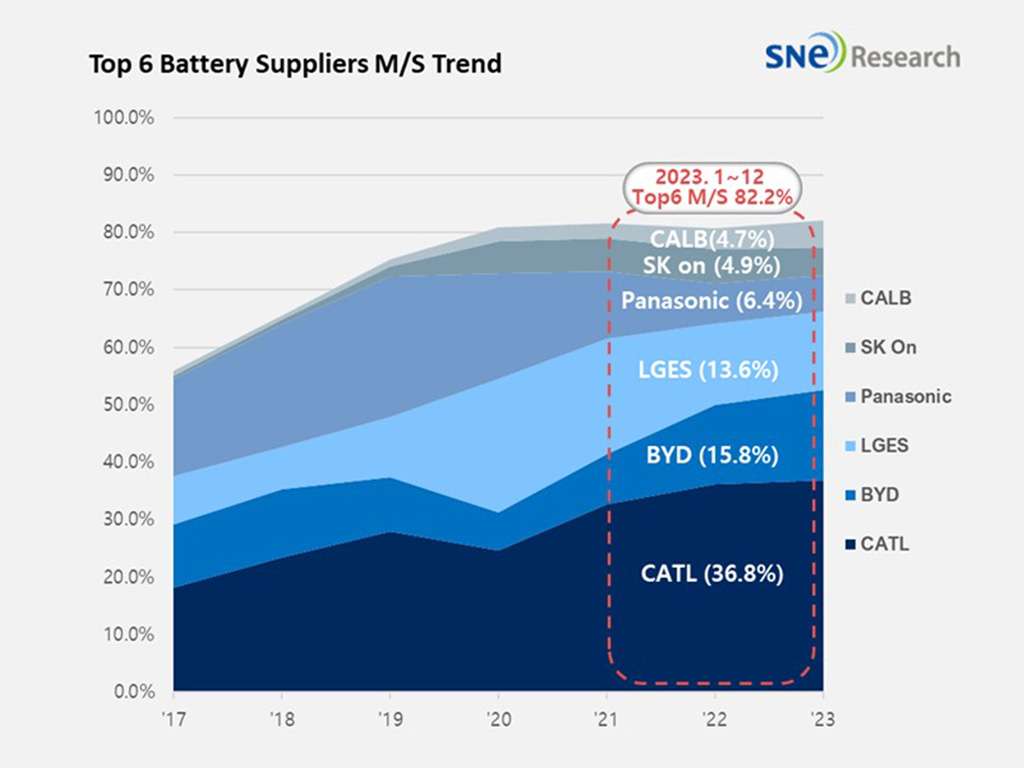

CATL has maintained its apex status as the world’s leading battery supplier, achieving an impressive market share of 36.8 percent in 2023. Despite a slight decline from its 36.2 percent market share in 2022, CATL’s position reinforces its unparalleled dominance as the only battery supplier in the world with a market share of more than 30 percent.

Following CATL, another leading Chinese company, BYD, installed 111.4GWh of power batteries in 2023, representing an extraordinary 57.9 percent growth compared to the preceding year.

With 95.8 GWh of power batteries installed in 2023, South Korea’s LG Energy Solution claimed the third position globally. LG Energy Solution experienced a slight decline in its market share to 13.6 percent, despite a 33.8 percent increase over the previous year.

The industry heavyweights Panasonic of Japan, SK On of South Korea, and CALB of China, each of which has a sizeable market share, further strengthen the worldwide EV battery market.

- K-trio companies maintained an upward trend in battery usage despite a slight market share decline, with LG Energy Solution, SK On, and Samsung SDI showcasing significant growth due to successful EV model sales.

- Samsung SDI targeted the premium EV battery market, achieving record sales.

- SK On expanded its market share with its prismatic and LFP battery development, catering to popular models like Hyundai IONIQ 5 and KIA EV6.

To further intensify competition, China’s Farasis Energy topped SNE Research’s rankings from January to November until Sunwoda took its place. However, Sunwoda managed to reclaim its position and surpass Farasis in the ultimate rankings for the entire year of 2023.

The data shown here essentially demonstrates the steady and dynamic growth of the worldwide EV battery market, led by Chinese giants such as CATL and BYD.

Source: SNE Research