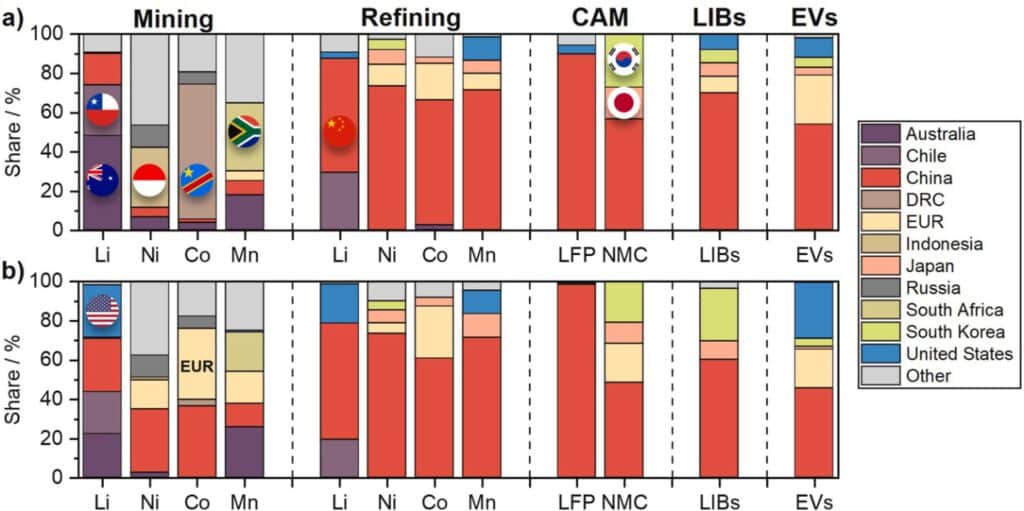

Producing batteries for electric vehicles involves a complex, globally interconnected supply chain. A recent study by researchers from Fraunhofer FFB and the University of Münster examined the ownership structures and geopolitical dependencies within this supply chain, revealing that China dominates almost the entire value chain of lithium-ion batteries. This dominance spans from the extraction of raw materials to battery production, with Chinese control extending to both domestic facilities and those abroad. No other region holds comparable control over the entire battery supply chain.

Lithium, cobalt, nickel, and manganese are critical for manufacturing battery cells. For example, a large battery pack like that in a Tesla Model S Plaid contains approximately 122 kilograms of these mineral raw materials. Only a few countries—China, Australia, and the Democratic Republic of the Congo—possess the necessary quantities of these resources essential for the growth of electromobility. Professor Simon Lux, Director of Fraunhofer FFB, highlighted that Europe is nearly entirely dependent on imports for these mineral raw materials, which are foundational to battery cell production.

The study details China’s extensive ownership of mines, refineries, and production facilities across the battery supply chain. China’s control is pervasive, covering almost all stages from raw material extraction to battery manufacturing, with the exception of manganese. Notably, China produces over 98 percent of lithium iron phosphate active materials, making Europe heavily reliant on this cost-effective battery chemistry. Professor Lux warned that China’s increasing dominance poses a threat to the future of European electromobility, as geopolitical tensions or export restrictions could result in significant economic damage and losses amounting to billions.

Europe and the United States are making efforts to gain more control over the lithium-ion battery supply chain by acquiring mines and refineries. While the U.S. ranks second globally in lithium mining ownership shares, Europe’s holdings are relatively minor. In contrast, Europe holds more significant shares in nickel and cobalt. Key lithium-producing regions like Australia, Indonesia, and the Democratic Republic of the Congo are experiencing increased company acquisitions. For instance, Chinese and U.S. companies own the largest shares of lithium production in Australia and Chile, while Europe lacks substantial lithium investments abroad. These trends underscore the intense global competition for critical raw materials and the strategic realignment of supply chains.

To reduce dependence on China, the study suggests that Europe could invest in expanding its own refinery capacities, promote strategic partnerships for raw materials, and strengthen its local circular economy. These measures aim to create a secure and sovereign battery supply chain, mitigating the risks associated with geopolitical disputes and ensuring the stability of the global battery market.

Source: Fraunhofer FFB