For the first time in eight years, South Korea’s battery exports have taken a hit, signaling a notable shift in the electric vehicle (EV) market’s landscape and presenting new challenges for the country’s battery industry. This downturn is attributed to a combination of slowing growth in the EV sector and heightened competition from international players.

In 2023, South Korea’s battery exports fell 1.6% to $9.8 billion. This was the first dip since 2015, and it came against the backdrop of a global slowdown in the EV market. January 2024 saw even worse decreases, with battery exports falling by 26.2% from the previous year. This was in stark contrast to the growth observed in 13 of 15 important product categories, including semiconductors and the automotive segments.

The Ministry of Trade, Industry, and Energy points to falling raw material prices and delays in EV production plans by global automakers as key factors behind the export slump. As Korean battery makers expand their operations abroad, particularly in North America and Europe, this too has impacted exports negatively. Notably, LG Energy Solution, Samsung SDI, and SK On have all set up factories outside of South Korea.

One significant development was the start of operations by Ultium Cells, a joint venture between LG Energy Solution and General Motors, at its Ohio plant, which boasts a capacity of around 45 gigawatt-hours as of late 2022.

Exports to the European Union fell by 25.1% in 2023, alongside a slowdown in the growth rate of eco-friendly vehicle sales, which saw an 80% increase in 2023, down from 116% growth in 2021. In the U.S., EV inventories hit a record high in December, with a supply lasting 114 days, more than double the figure from the previous year.

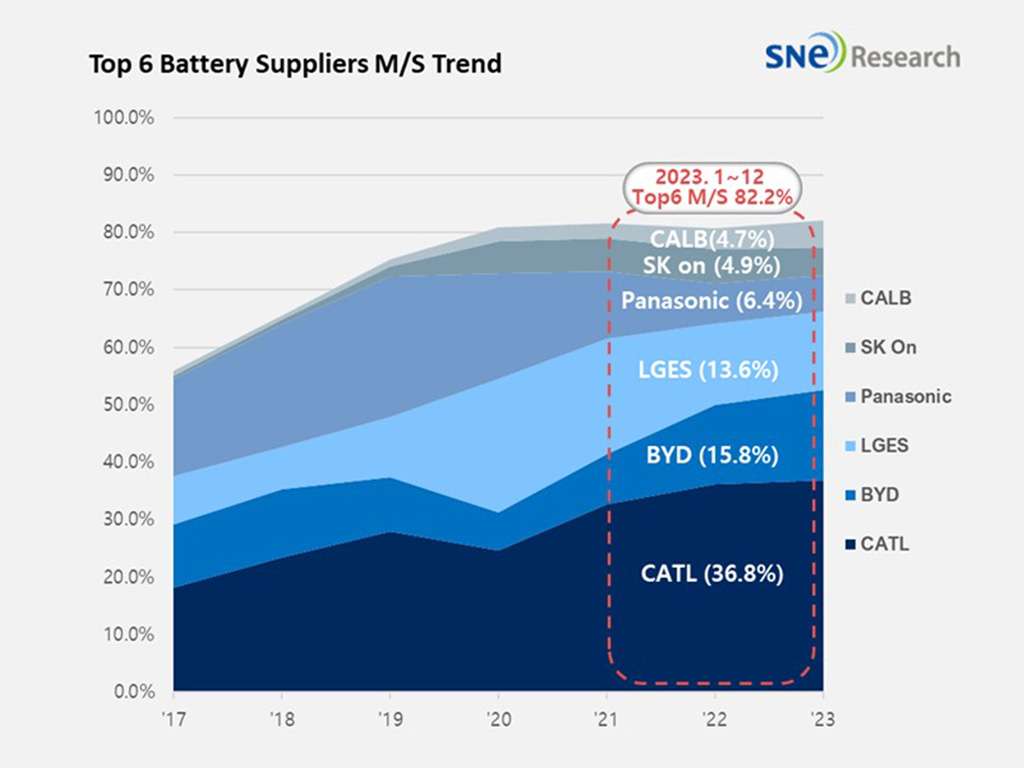

The top three battery manufacturers in South Korea saw a decline in market share, while Chinese rival CATL saw an increase.

Read more: CATL Leads Global EV Battery Market with 36.8% in 2023

To remain competitive, experts suggest that Korean battery manufacturers need to secure raw materials more effectively, diversify their product range, and invest in the development of next-generation battery technologies.

Source: Korean Times