The global battery market is experiencing significant growth as demand increases and prices continue to decline. In 2024, electric vehicle (EV) sales rose by 25%, reaching 17 million units, which pushed annual battery demand beyond 1 TWh — a historic achievement. Concurrently, the average price of a battery pack for electric cars fell below USD 100 per kilowatt-hour, a crucial benchmark for competing economically with traditional vehicles.

A key driver of reduced battery costs is the substantial decrease in battery mineral prices, particularly lithium, which has fallen by over 85% since its peak in 2022. Additionally, advancements within the battery industry, supported by significant investments, have expanded global manufacturing capacity to 3 TWh in 2024. Projections suggest that production capacity could triple over the next five years if current projects proceed as planned.

These developments indicate that the battery industry is entering a new phase, transitioning from regional and smaller markets to a global and large-scale sector characterized by increasing standardization. Factors such as economies of scale, supply chain partnerships, manufacturing efficiency, and the ability to rapidly introduce innovations are becoming essential for competitiveness. This trend is likely to lead to greater consolidation within the sector, alongside government-driven efforts to diversify battery supply chains geographically.

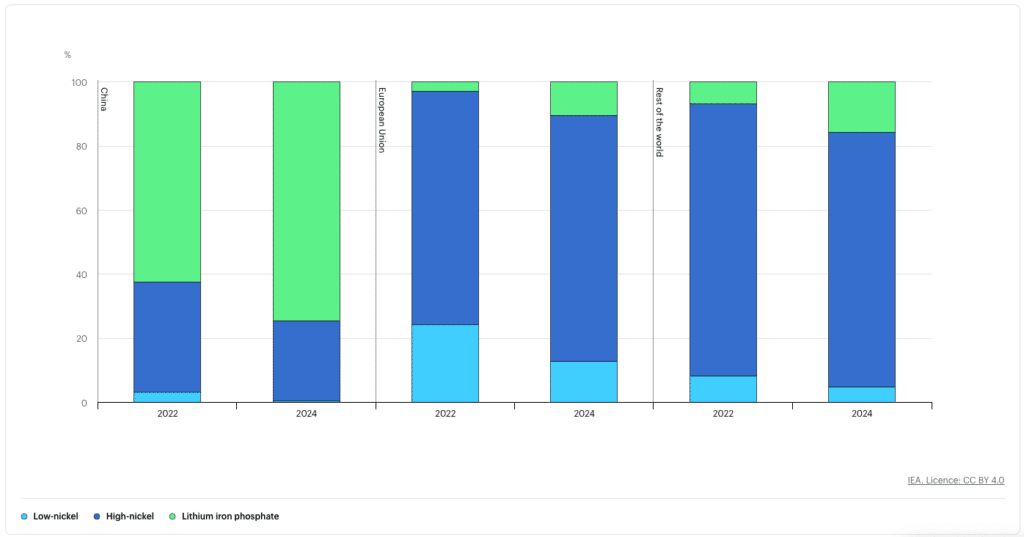

China remains the dominant battery producer, accounting for over three-quarters of global sales. In 2024, battery prices in China decreased by nearly 30%, making them more affordable than those in Europe and North America by over 30% and 20%, respectively. This price advantage is attributed to several factors:

- Extensive Manufacturing Expertise: Over 70% of all EV batteries are produced in China, fostering the growth of major manufacturers like CATL and BYD. These companies have scaled production efficiently, achieving higher manufacturing yields.

- Integrated Supply Chains: Through acquisitions and close cooperation among leading firms, Chinese producers have achieved cost reductions and accelerated innovation. The Chinese battery ecosystem encompasses all stages of the supply chain, from mineral extraction to final battery and EV production.

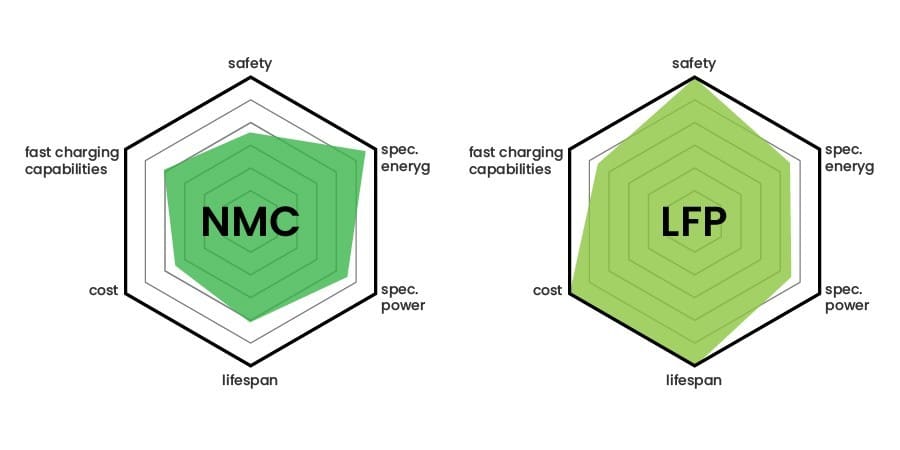

- Focus on Lithium-Iron Phosphate (LFP) Batteries: Chinese manufacturers have prioritized LFP batteries, which are about 30% less expensive than lithium nickel cobalt manganese oxide (NMC) batteries while still providing competitive ranges for EVs. LFP batteries now account for nearly half of the global EV market.

- Intense Domestic Competition: With nearly 100 producers in China, fierce competition has driven companies to lower prices by reducing profit margins to maintain or gain market share.

However, the rate of price declines may slow due to intense competition and shrinking margins, potentially leading to a reduction in the number of battery manufacturers in China while larger firms gain more market influence. Despite these challenges, China is expected to remain the largest battery manufacturer in the medium term.