At the 2025 International Battery Seminar and Exhibit, industry leaders conveyed a positive outlook for the battery sector, particularly regarding electric vehicle (EV) growth, despite ongoing supply chain challenges. The event featured the third iteration of the Battery Venture, Innovation & Partnering event, attracting senior investors, corporate executives, and entrepreneurs from across the battery industry. Discussions included topics such as investment stages, business strategies, and the distinctions between EV and energy storage applications.

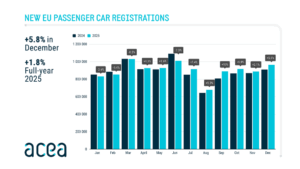

Several speakers emphasized the strong fundamentals supporting the EV market. Libby Wayman, Partner at Breakthrough Energy Ventures, reported a 25% increase in global EV sales in 2024, reaching 17 million units. This growth aligns with Bloomberg New Energy Finance’s optimistic forecasts for 2025. Wayman highlighted that EV-focused companies, particularly BYD, are gaining significant market share compared to traditional OEMs.

Janet Lin of Panasonic discussed the transformative shift towards electrified, connected, and autonomous transportation. She praised Panasonic’s cylindrical battery cells for their versatility and adaptability to different vehicle designs. Lin noted consistent demand growth but emphasized the need for improved profit margins to ensure long-term sustainability in the EV market.

Scott Walbrun of BMW i Ventures addressed concerns about a potential slowdown in EV adoption, attributing it to overcapacity in production relative to current demand. Despite this, Walbrun asserted that year-over-year EV growth remains strong and predicted that EV production costs will eventually fall below those of internal combustion engine (ICE) vehicles.

Emmanuel Lagarrigue, Partner and Co-head of Global Climate at KKR & Co, stated that EVs are inherently superior to combustion engine cars and suggested that achieving price parity will accelerate the transition to EVs.

The discussion on lithium-iron phosphate (LFP) batteries was prominent, with Wayman noting that current prices have dropped to approximately $53/kWh, a 50% decrease driven by Chinese manufacturers. Vivas Kumar, CEO of Mitra Chem, and Michael Delucia of Planeteer Capital compared the competitive landscape of LFP batteries to historical challenges in the solar industry, highlighting the high barriers for new chemistries.

Supply chain issues, particularly in the U.S., were also a key topic. John Busbee, CEO of Xerion, emphasized the necessity of developing a comprehensive supply chain that includes mining and refining. Jeff Johnson of B Capital highlighted the uncertainty surrounding the new Washington administration, which has led to delays in capital expenditures and hiring as companies await clearer policies.

Investment strategies in the battery sector were discussed, with experts advising a focus on incremental technological improvements and strategic partnerships to navigate the complex and capital-intensive nature of the industry. The bankruptcy of Northvolt was reviewed as a cautionary tale about overexpansion and the importance of maintaining strong supply chain partnerships.

Despite these challenges, the demand for stationary energy storage systems remains robust, driven by grid electrification and the needs of data centers. Overall, speakers expressed confidence in the industry’s ability to advance the supply chain and sustain growth.

Source: Battery Power Online