Recent battery market data shows that major battery manufacturers are facing challenges in the electric vehicle (EV) sector, with several companies reporting declining sales and profits. LG Energy Solutions, Samsung SDI, and Panasonic’s battery division all experienced financial setbacks, while CATL, the world’s largest battery manufacturer, reported its first quarterly profit decline.

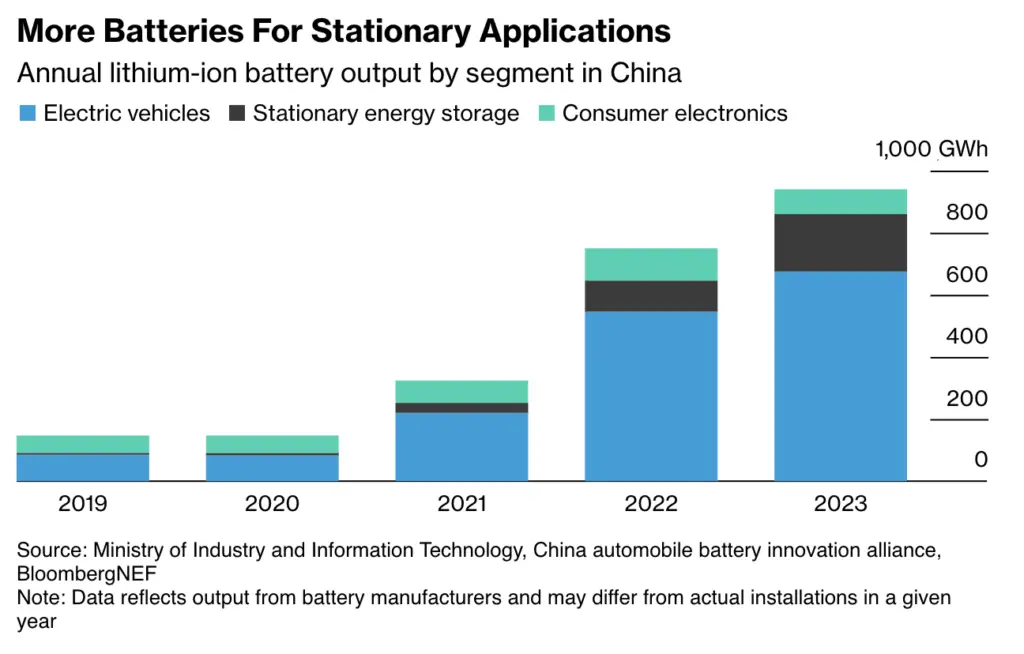

The slowdown in EV sales growth has led to lower battery volumes, increased competition, and price adjustments as companies struggle to maintain market share. China’s battery manufacturing capacity will reach 2.2 terawatt-hours by the end of 2023, well above the projected global demand of 1.2 TWh in 2024, indicating an industry-wide overcapacity problem.

At the same time, the energy storage market is showing significant growth, partially mitigating the slowdown in the EV sector. BloombergNEF analysts forecast a 61% increase in energy storage installations this year, helped by a 43% year-over-year decline in the price of turnkey energy storage systems.

In China, energy storage applications have surpassed consumer electronics as the second largest application for battery production. Globally, energy storage now accounts for 13% of total battery demand, up from 6% in 2020. The ratio of EV battery demand to stationary battery demand has shifted from 15:1 to 6:1 over the past four years.

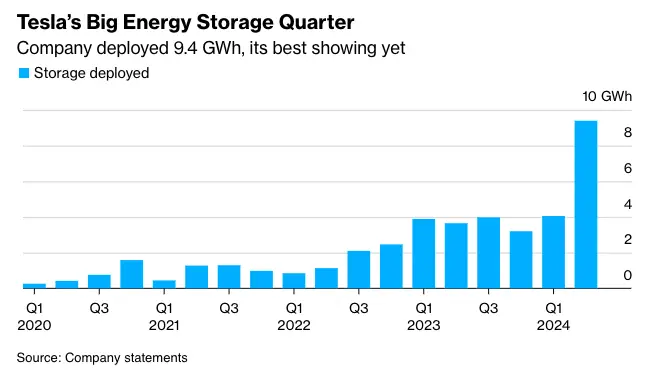

Tesla’s recent financial results are consistent with this trend, with the company’s energy generation and storage division deploying 9.4 GWh in the second quarter, more than double the 4.1 GWh deployed in the first quarter. This trajectory represents a significant increase over the 14.7 GWh deployed in 2023.

The majority of energy storage deployments are now being used for energy shifting applications, including price arbitrage and renewable integration. This shift is due in part to Chinese provincial mandates requiring wind and solar projects to include energy storage.

As battery manufacturers explore new markets to address overcapacity, innovative solutions are emerging, such as residential energy storage systems designed for balcony installation in Europe.

While the EV market remains the primary driver of battery demand, the expanding energy storage sector presents new opportunities for the industry as it navigates current market dynamics.

Source: BloombergNEF