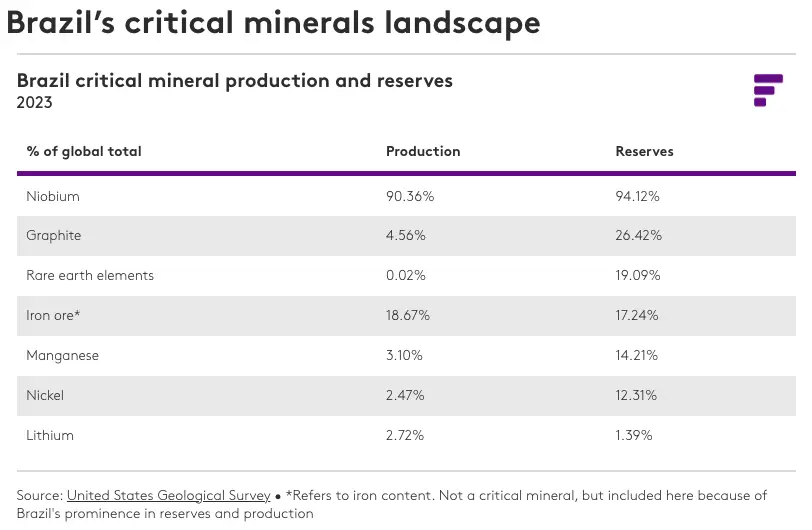

As China imposes tighter controls on the export of critical minerals such as gallium, germanium, and graphite, Brazil is seizing the opportunity to become a key alternative supplier, Fastmarkets reports. With substantial reserves of manganese, graphite, and other essential minerals, the South American nation is launching government initiatives and attracting significant corporate investments to expand its production capacity.

One notable development is Brazil’s first fund to support critical minerals, announced this month and backed by Vale and the Brazilian Development Bank (BNDES), as detailed by Fastmarkets. A consortium comprising JGP Asset Management, BB Asset, and Ore Investments has been selected to manage the 1 billion Reais ($184 million) private equity fund. The fund aims to support research and exploration of strategic minerals essential for the energy transition.

China’s recent export restrictions have disrupted global supply chains for critical materials, leading to significant price disparities between Chinese and European markets. For instance, gallium prices in Europe are substantially higher than in China due to tightened exports. According to Fastmarkets, the price for gallium 99.99% Ga min, in-whs Rotterdam was assessed at $500-550 per kg, compared to 2,650-2,750 yuan ($379-393) per kg in China as of early October.

Industry experts believe that Brazil has the potential to fill the supply gap created by China’s export controls. Speaking at a seminar hosted by the UK Department for Business & Trade and the Embassy of Brazil in London, Kathryn Goodenough, Principal Geologist and International Lead at the British Geological Survey, highlighted Brazil’s production capabilities. “If you look at where China is dominant, Brazil produces various elements,” she said. “Graphite is produced in Brazil… there are many opportunities for the development of supply chains that do not go through China,” Fastmarkets reported.

Brazil is rapidly increasing its production of battery raw materials. In 2023, Serra Verde began commercial production of mixed rare earth concentrate (MREC) in the country. Additionally, in May 2023, Brazil launched the Lithium Valley Initiative, a collaborative effort between the government and the private sector aimed at attracting investments and streamlining development in the lithium mining and processing industries. The initiative focuses on increasing the production of environmentally sustainable “Green Lithium” while promoting social development in the Vale do Jequitinhonha region.

The United States has also recognized Brazil’s potential as a critical minerals partner. A potential Critical Minerals Agreement (CMA) between the U.S. and Brazil could support U.S. needs while countering Chinese influence in the region. Such an agreement could leverage Brazil’s significant reserves of graphite, nickel, and manganese. However, for the agreement to be feasible, Brazil would need to address environmental concerns and streamline its licensing approval process for mining projects, as noted by Fastmarkets.

Despite challenges, Brazil is well-positioned to become a significant player in the global critical minerals market. With ongoing investments and initiatives, the country could provide alternative supply chains for minerals essential to the defense, technology, and energy sectors.

Source: Fastmarkets