BYD, the world’s leading manufacturer of new energy vehicles (NEVs) and the second-largest battery producer, forecasts that widespread adoption of solid-state batteries will take approximately five years. Chief Scientist Lian Yubo shared this insight during the 2024 World New Energy Vehicle Congress (WNEVC 2024).

Lian noted that solid-state batteries are expected to debut in high-end vehicle models before gradually reaching mid-range and budget options. “Widespread use of solid-state batteries may be difficult to see in the next three years, but it’s expected to be realized in 5 years,” he stated.

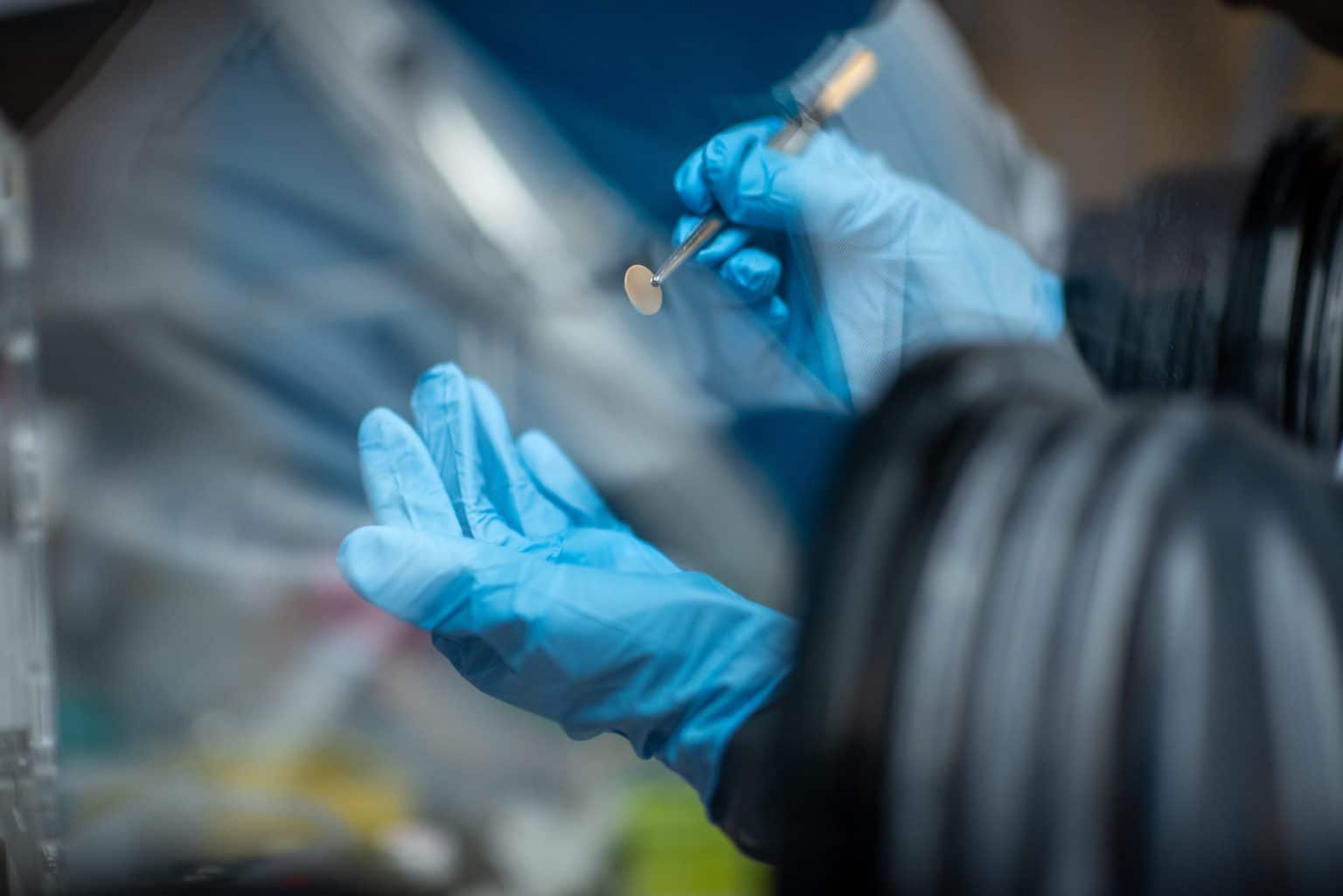

Despite advancements, Lian acknowledged challenges in solid-state battery technology, including high costs, complex manufacturing, and integration issues. Interest in this technology surged after Nio announced a 150-kWh semi-solid-state battery during the ET7 sedan launch in January 2021.

Following delays, Nio’s battery pack began trial operations in May 2024 and became available for daily rentals in June. Co-founder Qin Lihong noted that its cost is similar to the ET5, priced at RMB 298,000 ($42,480).

Lian’s remarks mark the first public comments from a BYD executive on solid-state battery technology in years. Similarly, CATL’s chief scientist, Wu Kai, announced plans to produce all-solid-state batteries in small batches by 2027, acknowledging challenges in cost and production.

From January to July 2024, BYD captured a 16.1% share of the global power battery market, with an installed capacity of 69.9 GWh. This makes it the second-largest battery manufacturer behind CATL, which holds a 37.6% market share and 163.3 GWh of installed capacity.

BYD primarily focuses on lithium iron phosphate (LFP) batteries, holding a 33.53% share of China’s LFP market as of August, trailing CATL’s 36.61%. In contrast, BYD’s share of China’s ternary battery market was just 0.34%.

According to the China Automotive Battery Innovation Alliance (CABIA), LFP batteries dominate the EV battery market in China, accounting for 35 GWh, or 74.2% of the total installed volume in August. Lithium ternary batteries represented 12.1 GWh or 25.7%.

Liam emphasized that LFP batteries would remain relevant for 15 to 20 years, coexisting with solid-state batteries to serve different vehicle classes.

Source: CNEVPOST