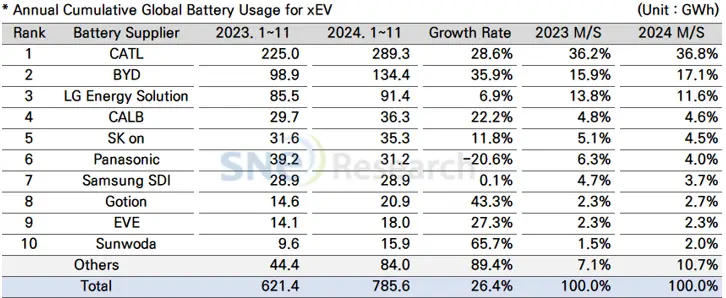

According to data released on January 6 by South Korean market research firm SNE Research, global electric vehicle (EV) battery usage reached 785.6 GWh in the January-November 2024 period. This marks a 26.4 percent increase from the 621.4 GWh recorded during the same period in 2023, highlighting the rapid growth in the EV sector.

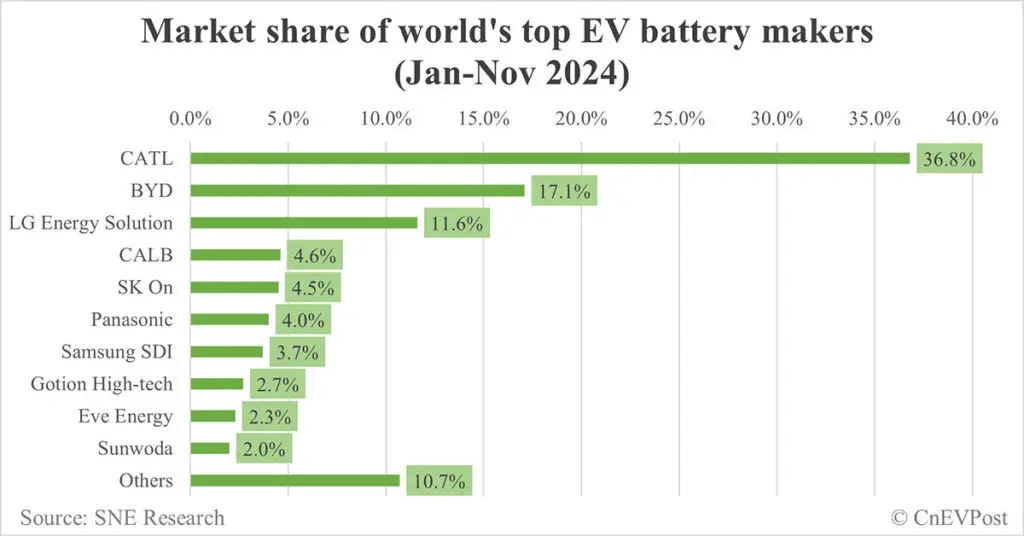

China’s Contemporary Amperex Technology Co. Limited (CATL) maintained its position as the world’s largest EV battery manufacturer. CATL’s battery installations amounted to 289.3 GWh, a 28.6 percent rise from 225.0 GWh in the same period of the previous year. The company’s global market share stood at 36.8 percent, consistent with its share in the January-October 2024 period and slightly higher than the 36.2 percent share in January-November 2023. CATL remains the only battery supplier globally with a market share exceeding 30 percent.

CATL’s batteries are widely used by major automakers both in China and internationally. In the domestic market, leading manufacturers such as Zeekr, Aito, and Li Auto incorporate CATL’s battery technology into their vehicles. Internationally, prominent original equipment manufacturers (OEMs) like Tesla, BMW, Mercedes-Benz, and Volkswagen rely on CATL for their EV battery needs.

BYD, another Chinese battery and EV manufacturer, secured the second position globally. The company’s battery installations reached 134.4 GWh, representing a 35.9 percent increase from 98.9 GWh in the same period in 2023. BYD’s global market share rose to 17.1 percent, up from 15.9 percent in the previous year and an increase from 16.8 percent in the January-October 2024 period. The company’s growth is attributed to its focus on both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). BYD is also expanding its presence in Asian and European markets to further bolster its market share.

South Korea’s LG Energy Solution ranked third with 91.4 GWh of installed battery capacity, marking a modest 6.9 percent year-on-year increase. However, the company’s global market share declined to 11.6 percent from 13.8 percent in the same period last year and from 11.8 percent in the January-October 2024 period.

Other notable players in the global EV battery market include China’s CALB in fourth place with a 4.6 percent market share and South Korea’s SK On in fifth with 4.5 percent. Japan’s Panasonic secured the sixth position with a 4.0 percent share. South Korea’s Samsung SDI, along with China’s Gotion High-tech, Eve Energy, and Sunwoda, occupied the seventh to tenth spots, with market shares of 3.7 percent, 2.7 percent, 2.3 percent, and 2.0 percent respectively.

The data outlines the ongoing expansion and competitive dynamics of the global EV battery industry. Chinese manufacturers, particularly CATL and BYD, continue to lead the market, driven by strong domestic demand and strategic partnerships with international automakers. The increasing adoption of EVs worldwide is fueling growth across the industry, with established and emerging companies competing for market share.

Source: CnEVPost