Contemporary Amperex Technology Co. Limited (CATL) has suspended its lithium lepidolite operations in Jiangxi Province, according to industry reports. The decision comes in response to concerns about oversupply in the global lithium market.

UBS analyst Sky Han confirmed the suspension in a note dated September 11, noting that CATL made the strategic decision following a meeting on September 10. The suspension is interpreted as a measure to address the current oversupply of lithium carbonate equivalent (LCE) in the market.

The announcement of CATL’s production suspension had a significant impact on the share prices of Australian lithium miners. Pilbara Minerals experienced a share price increase of up to 17%, while Liontown Resources saw its share value increase by 13%. In particular, Liontown, which began production earlier this year, has secured major lithium supply agreements with prominent companies in the electric vehicle sector, including Tesla, Ford and LG Energy Solution.

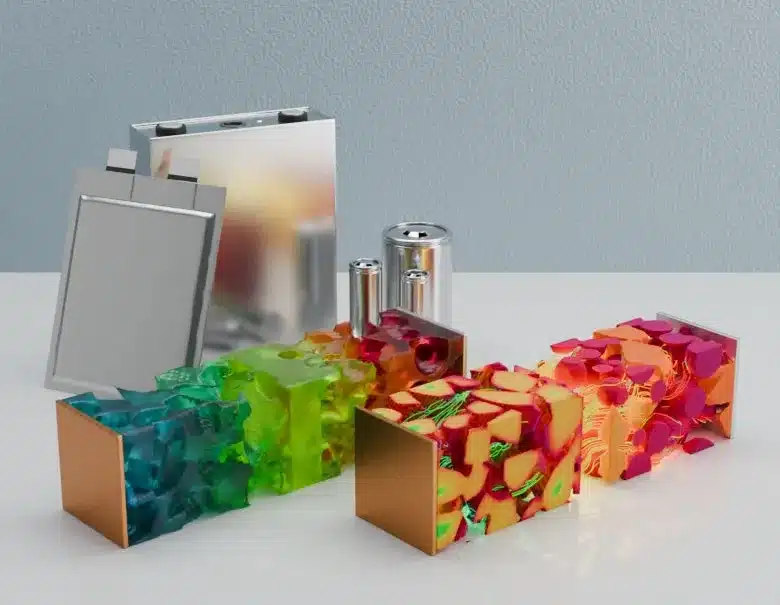

CATL’s decision to reduce supply comes at a time when increased global lithium production has put downward pressure on prices. This move may help stabilize the market as demand for lithium, an essential component in electric vehicle batteries, continues to grow globally.

The suspension of operations in Jiangxi, a key lithium mining region in China, is likely to have a broader impact on the global lithium supply chain and price dynamics in the electric vehicle industry. Market watchers will be closely monitoring the impact of this development on lithium availability and costs in the coming months.

Source: EVMAGZ