BASF Venture Capital GmbH (BVC) is the corporate venture capital arm of the BASF Group, launched in 2001 to back innovative startups and specialized funds that align with BASF’s current and future business sectors. With seven offices in Ludwigshafen, Toronto, Boston, Los Angeles, Hong Kong, Shanghai and São Paulo, BVC invests worldwide and taps into BASF’s global research and partner network to support emerging companies. Its evergreen fund of around €250 million provides flexibility for long-term partnerships that combine financial returns with collaborative development of new products and technologies.

BVC focuses on early and growth-stage companies—typically from seed through Series B—in areas such as decarbonization, the circular economy, agricultural technology, advanced materials and digital solutions. The team looks for ventures that have achieved proof of concept and demonstrate customer-oriented business models. Individual commitments usually range from €1 million to €5 million and are often syndicated with other investors, giving portfolio companies access to a broad capital network and BASF’s operational expertise.

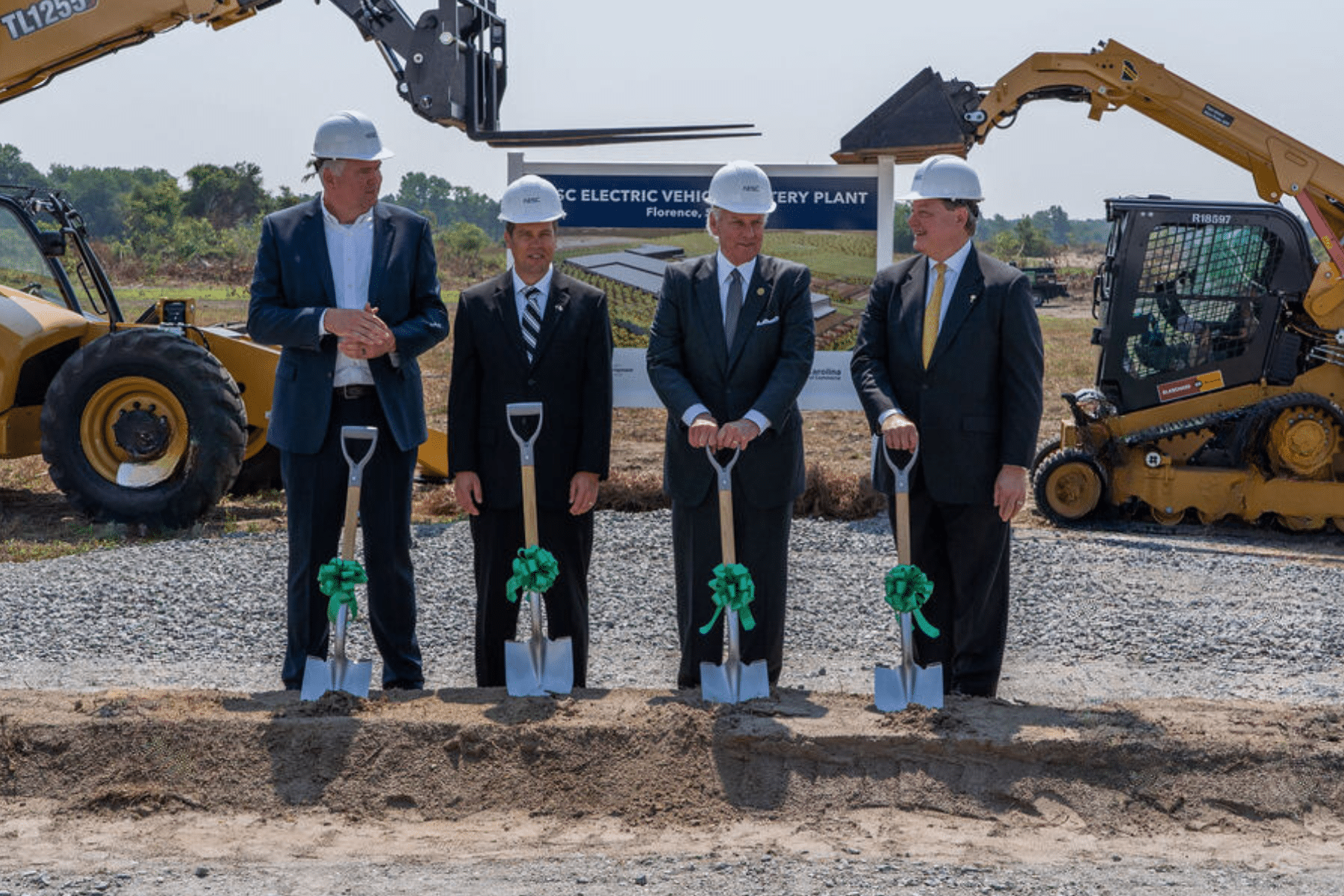

Clean technology and battery materials are a core emphasis. In 2025, BVC led a €7.5 million Pre-Series A round for ACT-ion Battery Technologies, which develops energy-efficient processes for single-crystalline cathode materials for lithium-ion batteries. Earlier investments include pH7 Technologies, focused on sustainable recycling of critical raw materials for electronics and batteries, and Phomera Metamaterials, a specialist in photonic crystal metamaterials and microspheres. These commitments illustrate BVC’s commitment to advancing sustainable energy solutions and materials innovation.