An EV fire incident in Incheon, South Korea, has led to increased scrutiny of battery safety and transparency in the automotive sector. The incident, which involved a Mercedes-Benz EV with a faulty battery, resulted in damage to approximately 140 vehicles and injuries to 23 people.

In response, the South Korean government has taken action following a high-level meeting with relevant ministries and agencies. An advisory is being prepared that will require EV manufacturers operating in the country to disclose their battery suppliers and provide free vehicle inspections. Several prominent automakers, including Hyundai, Kia, BMW Korea and Mercedes-Benz Korea, have already taken steps to comply.

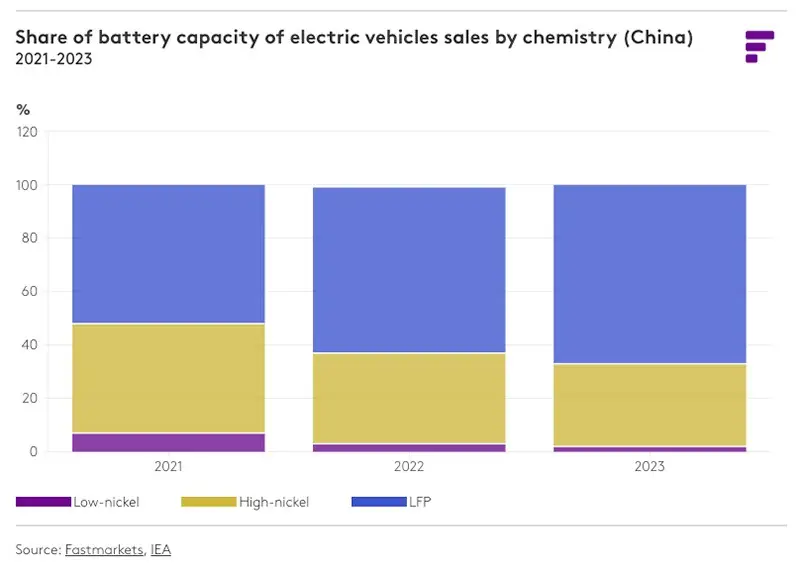

The event has also reignited discussions about battery chemistries, particularly the comparison between nickel cobalt manganese (NCM) and lithium iron phosphate (LFP) batteries. NCM batteries are dominant in markets outside of China due to their higher energy density and extended range. However, LFP batteries are gaining market share due to their improved safety features and cost effectiveness.

LFP batteries are known for their improved thermal stability and lower heat generation, which reduces the risk of fire or explosion compared to NCM batteries. This safety advantage has contributed to their widespread adoption in China, especially in public transportation and energy storage applications.

The cost-effectiveness of LFP batteries is another factor influencing their increasing market presence. In 2023, LFP batteries will account for more than 40% of global EV demand, a significant increase from their market share in 2020. Industry analysts expect this trend to continue as automakers seek to produce more affordable electric vehicles.

The EV industry continues to grapple with the challenge of balancing safety, performance and cost. The recent incident in South Korea demonstrates the importance of ongoing efforts to improve the transparency and safety of EV battery technology.

Source: Fastmarkets