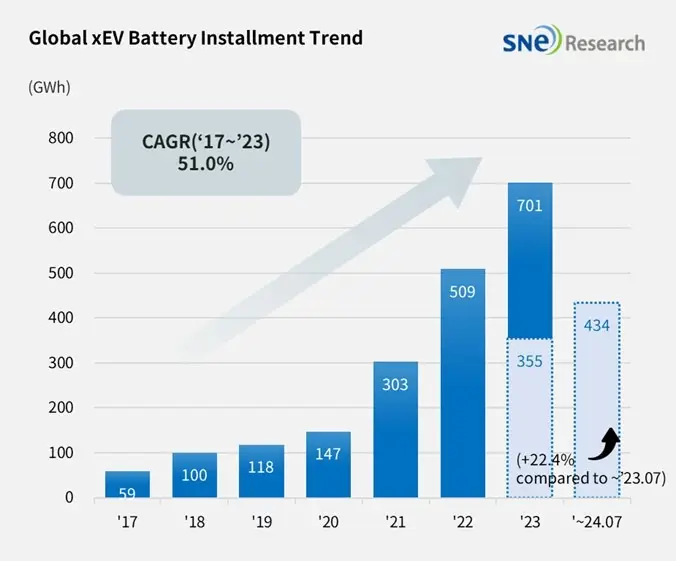

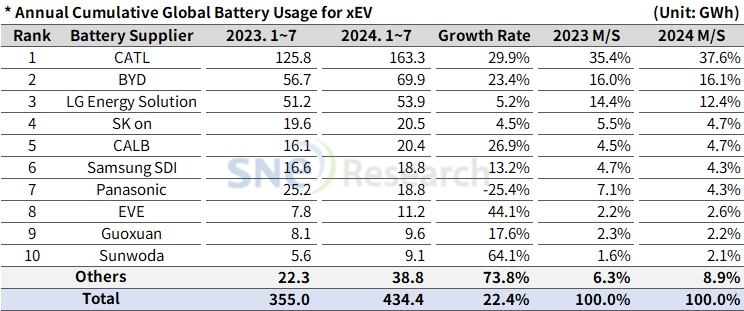

According to the latest data from SNE Research, global electric vehicle battery consumption from January to July 2024 totaled 434.4 GWh, an increase of 22.4% year-over-year. This figure includes batteries used in all-electric, plug-in hybrid, and hybrid electric vehicles in 80 countries.

Key findings from the report:

South Korean Battery Manufacturers:

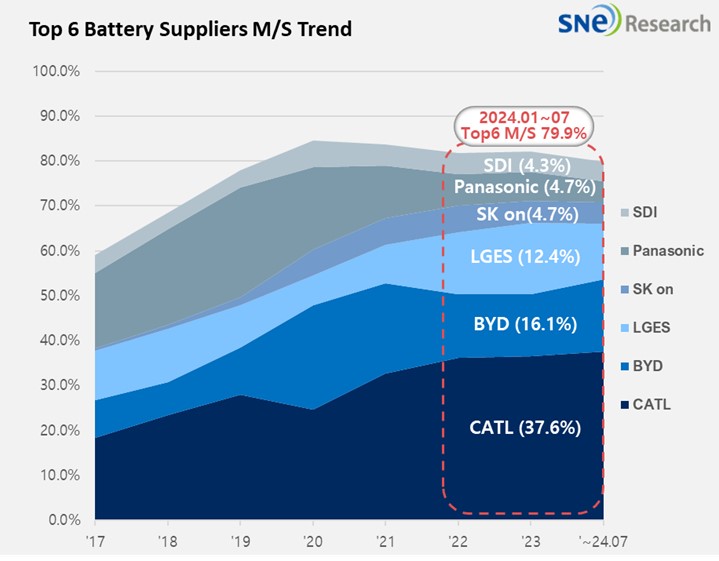

- The combined market share of LG Energy Solution, SK On, and Samsung SDI (the “K-trio”) decreased to 21.5%, down 3.1 percentage points year-over-year.

- LG Energy Solution maintained third place with 5.2% growth (53.9 GWh), driven by strong sales of Tesla Model 3/Y, Volkswagen ID.4, Ford Mustang Mach-E, and GM Cadillac LYRIQ.

- SK On held fourth place, growing 4.5% (20.5 GWh), benefiting from increased sales of Hyundai IONIQ 5, EV6, EV9, and Ford F-150 Lightning.

- Samsung SDI led the K-trio with 13.2% growth (18.8 GWh), supported by BMW, Audi, Jeep, and Rivian models.

Chinese Battery Manufacturers:

- CATL retained its global leadership, growing 29.9% (163.3 GWh), supplying major Chinese and global automakers.

- BYD ranked second with 23.4% growth (69.9 GWh), expanding in both BEV and PHEV markets.

Japanese Battery Manufacturers:

- Panasonic, the only Japanese company in the top 10, experienced a 25.4% decline (18.8 GWh), primarily due to Tesla Model 3 sales slowdown during its facelift transition.

Battery Market Dynamics:

- The global EV battery market maintained about 20% growth in the first half of 2024.

- Korean manufacturers faced challenges, including reduced factory utilization (around 50%) and postponed investments due to slowing demand and surplus stocks.

- Positive factors include stabilizing metal and cathode material prices, new vehicle model launches, and potential reduced risks related to former US President Donald Trump.

- Chinese manufacturers are expected to perform strongly as automakers plan to expand LFP battery adoption.

Future Outlook:

- Korean battery makers are advised to focus on developing low and mid-priced products, localizing production, and advancing technological capabilities to maintain competitiveness.

- North American market uncertainties persist, with OEMs announcing additional vehicle production postponements.

- The industry anticipates potential demand recovery in Q4 2024, with long-term high growth expectations despite short-term challenges.

Financial Performance:

- Samsung SDI reported a 40% drop in Q2 operating profit due to EV market demand slowdown.

- SK On has been in the red for 11 consecutive quarters, with Q2 operating losses of KRW 460.1 billion.

- LG Energy Solution managed to earn an operating profit of KRW 195.3 billion in Q2, up 24.2% quarter-over-quarter, benefiting from increased IRA tax credits in North America.

The report emphasizes the need for continued investment and technological advancement in the EV battery sector to meet evolving market demands and maintain competitiveness in the face of shifting global dynamics.

Source: SNE Research