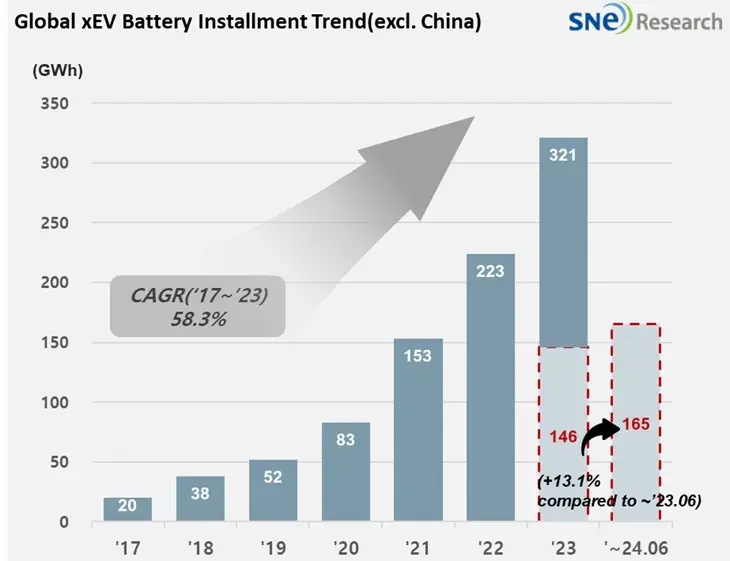

According to a report by SNE Research, global electric vehicle battery usage, excluding the Chinese market, attained 165.3 GWh in the first half of 2024, representing a 13.1% year-over-year increase. This data encompasses batteries utilized in electric vehicles (EV), plug-in hybrid electric vehicles (PHEV), and hybrid electric vehicles (HEV).

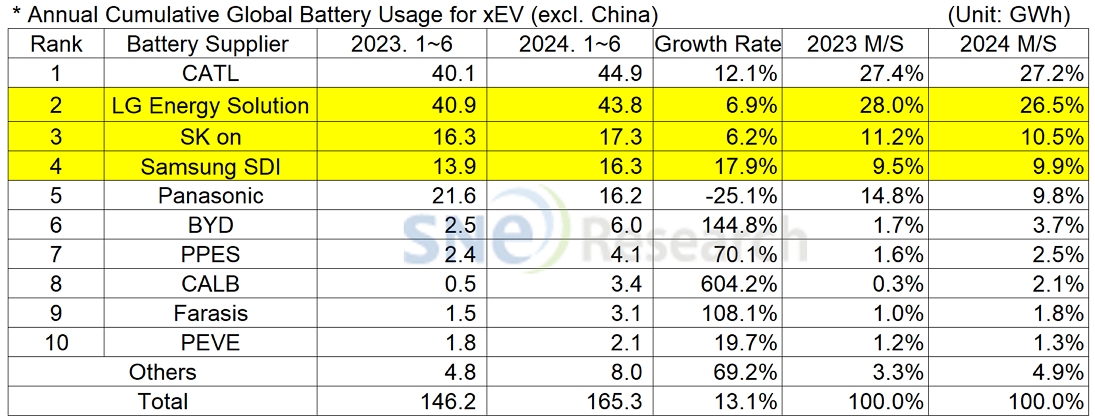

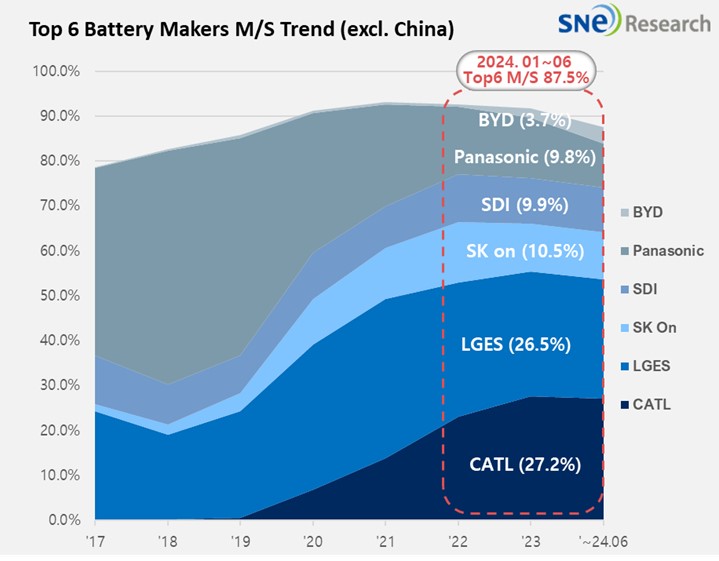

South Korean battery manufacturers (LG Energy Solution, SK On, and Samsung SDI) collectively held a 46.8% market share, a decrease of 1.8 percentage points compared to the same period in the previous year. LG Energy Solution retained its second-place position with 6.9% growth (43.8 GWh), while SK On secured third place with 6.2% growth (17.3 GWh). Samsung SDI exhibited the highest growth among Korean manufacturers at 17.9% (16.3 GWh).

Samsung SDI’s growth was attributed to increased sales of BMW’s EV lineup, Audi Q8 e-Tron, and Jeep Wrangler PHEV in Europe, as well as Rivian models in North America. SK On’s growth was supported by recovering sales of Hyundai’s IONIQ 5 and EV6, alongside strong performance from Ford F-150 and Mercedes EQA/B models. LG Energy Solution benefited from robust sales of Tesla Model 3/Y, Volkswagen ID.4, Ford Mustang Mach-E, and GM Cadillac LYRIQ in European and North American markets.

CATL, a Chinese manufacturer, secured the top position with 12.1% growth (44.9GWh), expanding its presence in markets outside China. Panasonic, the sole Japanese company in the top 10, ranked fifth but experienced a 25.1% decline, primarily due to reduced Tesla Model 3 sales during its facelift transition.

Despite current challenges, including elevated interest rates and market uncertainties, manufacturers maintain a positive outlook on long-term growth in the EV battery sector. Companies are prioritizing production capacity expansion, new technology development, and client acquisition to maintain competitiveness.

The report indicates that while the global EV battery market outside China continues to expand, recent policy changes, such as Europe’s implementation of countervailing duties on Chinese EV imports, may alter market dynamics in the coming period. Korean manufacturers may potentially benefit from these changes, possibly increasing their market presence in Europe.

Source: SNE Research