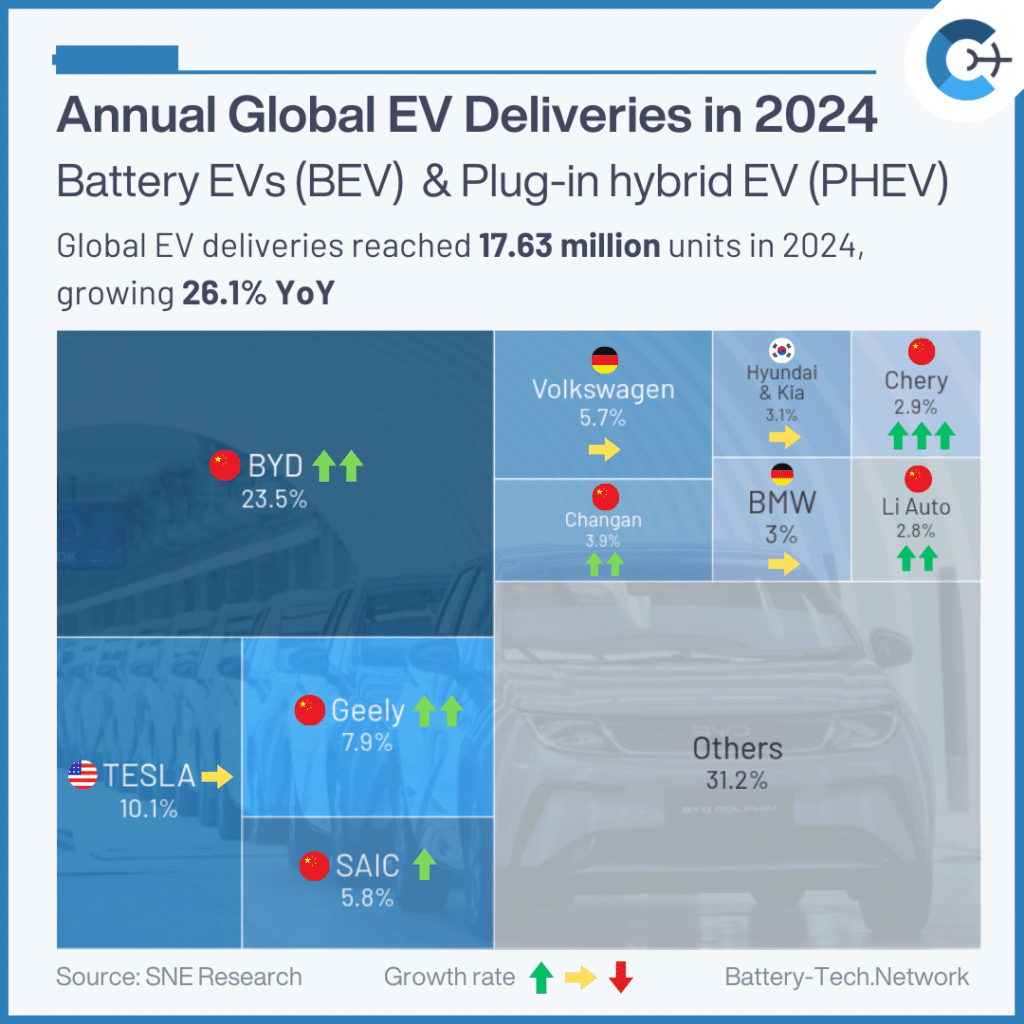

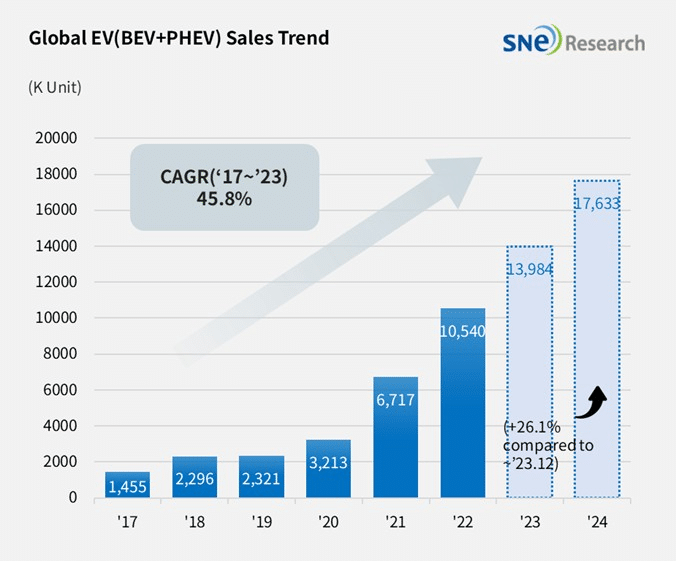

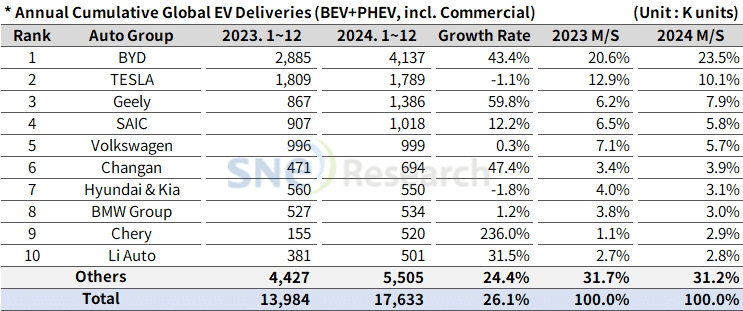

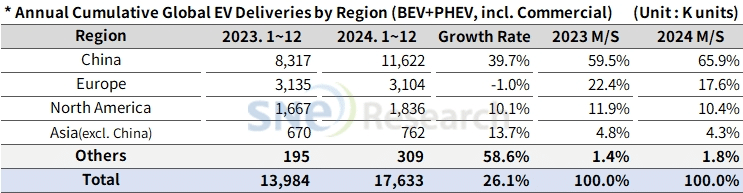

From January to December 2024, global electric vehicle registrations reached approximately 17.63 million units, marking a 26.1% increase over the previous year. According to data from the Global EV and Battery Monthly Tracker (January 2025, SNE Research), this growth reflects strong consumer demand and expanding market penetration across multiple regions.

BYD secured the top position in global EV sales by delivering 4.137 million units—a 43.4% year-over-year growth. The company’s success is driven by robust performance in its domestic market, particularly with models like Song, Seagull, and Qin, as well as its expanding presence overseas with the Atto 3 and 4 Dolphin. BYD’s diverse lineup, spanning both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) under sub-brands such as Denza, Yangwang, and FangCheong Bao, has reinforced its market dominance.

Tesla ranked second globally despite a slight 1.1% decline in sales. The decrease was largely due to lower demand for its Model 3 and Model Y, which comprise approximately 95% of its sales, particularly in Europe and North America where the EV market has shown signs of stagnation. Tesla plans to introduce a new entry-level model in the first half of 2025 and improve its full self-driving (FSD) technology, which could enhance its market position in the future.

Geely Group claimed third place with strong growth of 59.8%. The group’s impressive performance was buoyed by over 130,000 sales of its light EV Panda Mini in China and around 110,000 units of the premium ZEEKR 001. By focusing on midsize and premium segments through brands like Galaxy and LYNK & CO, Geely is well-positioned to compete in emerging markets, particularly as it expands its footprint in Europe and Southeast Asia.

Other Chinese manufacturers have also maintained robust growth, with companies such as Chery and Li Auto expanding their market share. Chery notably increased brand awareness by offering a range of vehicles with various powertrains, while Li Auto is transitioning from extended-range EVs (EREVs) to battery electric vehicles (BEVs) to capture more of the market.

Hyundai Motor Group experienced a modest 1.8% decline, selling approximately 550,000 EV units. Despite lower sales for flagship models like the IONIQ 5, EV6, and NIRO compared to the previous year, the company showed strong momentum in the North American market. The Group’s full-scale operation of HMGMA in the United States allows it to produce a variety of EVs eligible for up to US$7,500 in tax credits under the US Inflation Reduction Act. However, policy shifts and potential tariff adjustments may affect future performance.

In Europe, the market saw a 1.0% year-over-year decline in EV sales, with a noticeable shift toward hybrid electric vehicles (HEVs), which grew by 22.1%. Challenges such as limited charging infrastructure and pricing pressures have contributed to a more cautious consumer approach toward fully electric vehicles.

The United States faces its own set of challenges, including regulatory changes, the potential revocation of EV mandates, and additional tariffs on vehicles imported from Mexico, Canada, and China. While these measures have slowed growth, advancements in full self-driving technology may help reignite demand for electric vehicles in the region.

Elsewhere in Asia (excluding China) and other emerging markets, EV growth has remained robust, largely driven by Chinese manufacturers. In China—accounting for 59.5% of the global EV market—the sector experienced a 39.7% increase in deliveries, bolstered by strong domestic demand and full government support. However, rising tariffs in key export markets may prompt Chinese EV makers to reconsider their export strategies.

Industry experts anticipate that, following 2026, the introduction of new models and mass production of batteries will spark a fresh phase of growth in the electric vehicle market. In response to evolving regulatory environments and shifting consumer preferences, manufacturers are urged to focus on cost competitiveness, hybrid strategies, and the integration of autonomous driving technologies to sustain long-term success.

Source: SNE Research