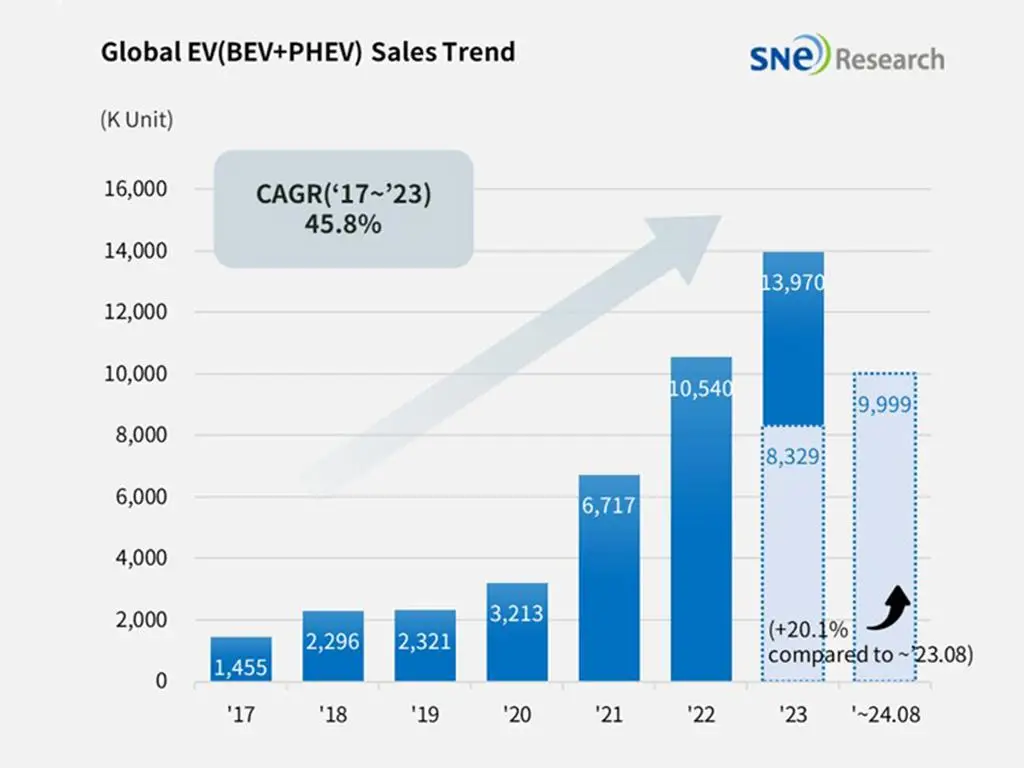

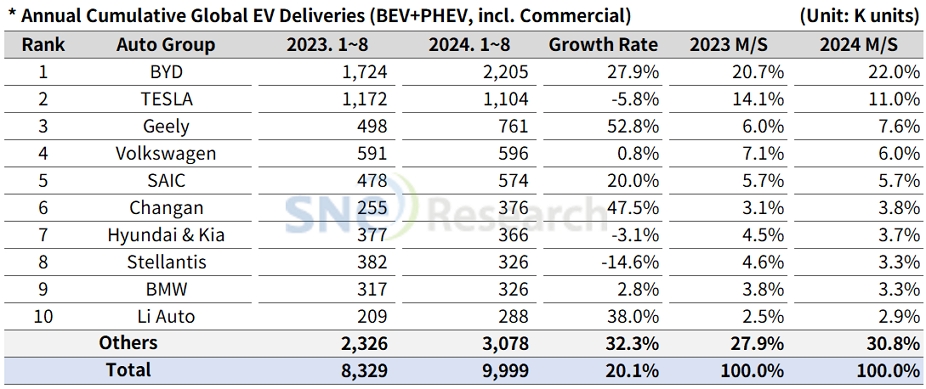

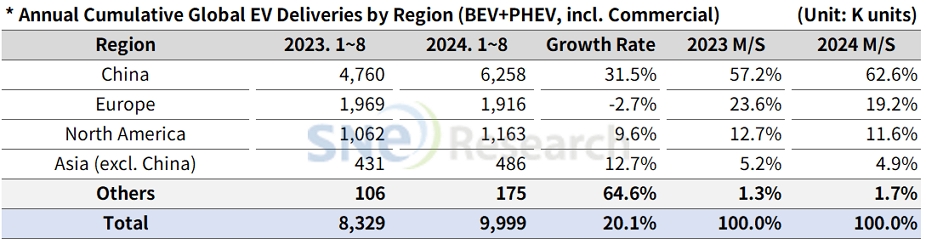

From January to August 2024, global electric vehicle (EV) deliveries reached approximately 10 million units, representing a 20.1% increase compared to the same period last year, according to SNE Research’s Global EV and Battery Monthly Tracker for September 2024.

BYD maintained its position as the world’s leading EV manufacturer, selling 2.205 million units—a 27.9% year-over-year growth. The company’s expansion was driven by strong sales of both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), including popular models like the Song, Seagull, Qin, Dolphin, and Yuan. BYD has diversified its brand portfolio with sub-brands such as Denza, Yangwang, and FangCheong Bao. Notably, BYD’s BEV sales alone reached approximately 980,000 units, nearly matching Tesla’s 1.104 million units, which are exclusively BEVs.

Tesla ranked second, experiencing a 5.8% year-over-year decline in sales. The company’s primary models, the Model 3 and Model Y—which account for about 95% of its total sales—saw decreased demand. Tesla’s sales dropped by 16.2% in Europe and 8.4% in North America.

Geely Group secured the third position. Its premium brand ZEEKR’s model, the ZEEKR 001, and the Panda Mini EV each sold around 70,000 units in China. Internationally, Geely is expanding its market share through brands like Volvo and Polestar.

Hyundai Motor Group sold approximately 366,000 electric vehicles, marking a 3.1% year-over-year decrease. While sales of the IONIQ 5 and EV6 declined, the global rollout of the EV9 expanded, and deliveries of the newly launched EV3 began. Hyundai is expected to benefit from declining sales of GM and Volkswagen in China. New models like the IONIQ 9 and EV4 are scheduled for release in the U.S. and Europe by the end of 2024, potentially reversing the downward trend.

China remained the largest EV market, accounting for 62.6% of global sales and recording over 30% growth compared to the same period last year. Europe’s BEV and PHEV sales declined by 2.7% year-over-year due to market saturation, though hybrid electric vehicle (HEV) sales increased by 17.2%. This slowdown aligns with adjustments to the Euro 7 regulations and concerns among traditional automakers about profit margins as EV demand plateaus.

North America saw a 9.6% year-over-year growth in EV sales. Despite incentives from the Inflation Reduction Act, demand has not met expectations, prompting manufacturers to focus more on hybrid models.

While many countries are trying to limit the influx of Chinese EVs, China’s industry continues to grow robustly. Challenges slowing electrification elsewhere include reduced subsidies, high vehicle prices, and inadequate charging infrastructure. Global automakers are delaying new model launches and restructuring, whereas Chinese manufacturers are expanding into emerging markets by leveraging economies of scale.

The EV market is expected to see modest growth from late 2024 or early 2025 with the introduction of new models in Europe and the U.S. In the U.S., the rising approval ratings of presidential candidate Harris and reinforced carbon emission regulations in Europe, along with the resumption of state subsidies, may stimulate market growth. Additionally, if tariffs on Chinese entry-level EVs in Europe are reduced, EV adoption rates are expected to increase further.

Note: Sales figures are based on BEVs and PHEVs delivered to customers or registered during the relevant period across 80 countries.

Source: SNE Research