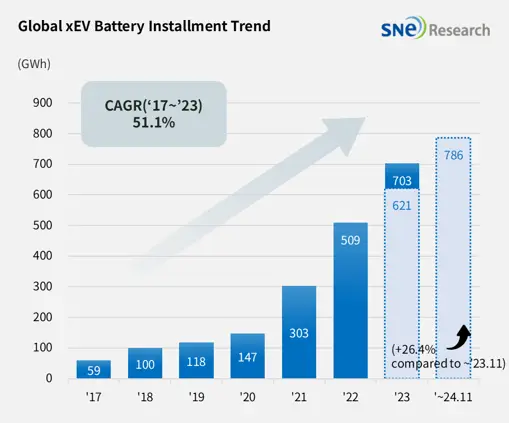

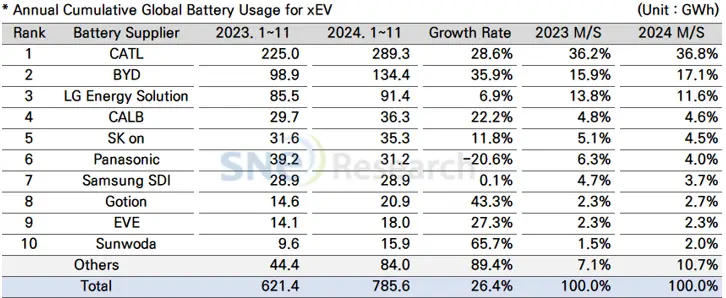

From January to November 2024, global electric vehicle (EV) battery usage reached approximately 785.6 gigawatt-hours (GWh), marking a 26.4% year-over-year increase, according to SNE Research’s December 2024 Global Monthly EV and Battery Tracker.

South Korea’s leading battery manufacturers—LG Energy Solution, SK On, and Samsung SDI, collectively known as the “K-trio”—experienced growth during this period. LG Energy Solution maintained its third-place global ranking with a 6.9% increase in battery usage, totaling 91.4 GWh. SK On secured fifth place with an 11.8% growth to 35.3 GWh, while Samsung SDI posted a marginal growth of 0.1%, reaching 28.9 GWh. Despite these increases, the K-trio’s combined global market share declined by 3.7 percentage points from the previous year, settling at 19.8%.

Samsung SDI’s batteries were predominantly used in BMW models, including the i4, i5, i7, and iX. The newly released i5 received a positive market response. Rivian’s R1S and R1T maintained steady sales in the U.S., contributing to Samsung SDI’s performance. However, a decrease in sales of Audi’s Q8 e-Tron resulted in a 26% reduction in Samsung SDI battery installations in Audi vehicles compared to the previous year.

SK On’s batteries were mainly installed in vehicles from Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Hyundai’s Ioniq 5 and EV6 experienced a sales recovery following facelifts, and the Kia EV9 performed well with expanded overseas sales. Mercedes-Benz’s compact SUVs, the EQA and EQB, recorded stable sales consistent with the previous year. Robust sales of the Ford F-150 Lightning and Volkswagen’s ID.7 positively impacted SK On’s battery usage.

LG Energy Solution’s batteries were chiefly found in Tesla models. While sales of the Model Y equipped with LG batteries saw a dip, the facelifted Model 3 experienced a significant surge, driving growth. Additionally, Ford’s Mustang Mach-E, Hyundai’s Ioniq 6, and the Kona EV, all utilizing LG batteries, maintained solid sales and contributed to the company’s growth trajectory.

Panasonic, ranking sixth globally, supplied 31.2 GWh of batteries but faced a 20.6% year-over-year decline. The decrease was largely due to reduced sales of Tesla’s Model 3 during its facelift transition and overall Tesla sales declines in 2024. Panasonic is expected to regain market share by launching advanced 2170 and 4680 cells, primarily supplied to Tesla.

China’s CATL maintained its leading global position with a 28.6% growth, reaching 289.3 GWh. The company’s batteries are widely used in domestic Chinese EVs from manufacturers like ZEEKR, AITO, and Li Auto, as well as global OEMs such as Tesla, BMW, Mercedes-Benz, and Volkswagen. BYD ranked second with a 35.9% increase to 134.4 GWh. BYD sold approximately 3.67 million electric vehicles during this period, including around 1.59 million pure EVs, surpassing Tesla’s sales by 8,000 units. BYD’s strategy of targeting both the pure electric and plug-in hybrid markets has facilitated rapid growth, especially as it expands into Asian and European markets.

Considering shifting political landscapes, including the inauguration of the second Trump administration and potential nullification of the Inflation Reduction Act (IRA), the pace of electrification in the U.S. is expected to slow. This slowdown may impact demand for electric vehicles, leading to decreased operating rates for battery manufacturers, particularly those focused on European and U.S. markets like the K-trio. Conversely, Chinese companies are expanding into emerging markets to mitigate domestic slowdowns. Analysts anticipate that automotive and battery companies will focus on securing future competitiveness through strategic diversification, such as exploring low-cost models, hybrids, and technological innovations.

Source: SNE Research