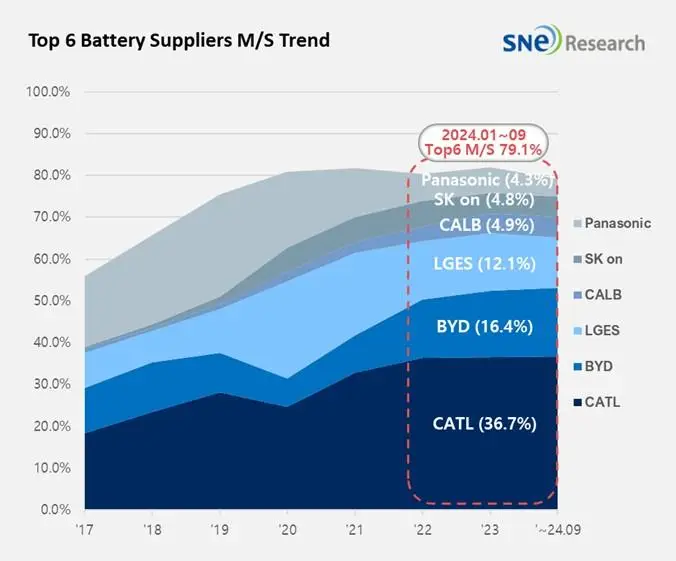

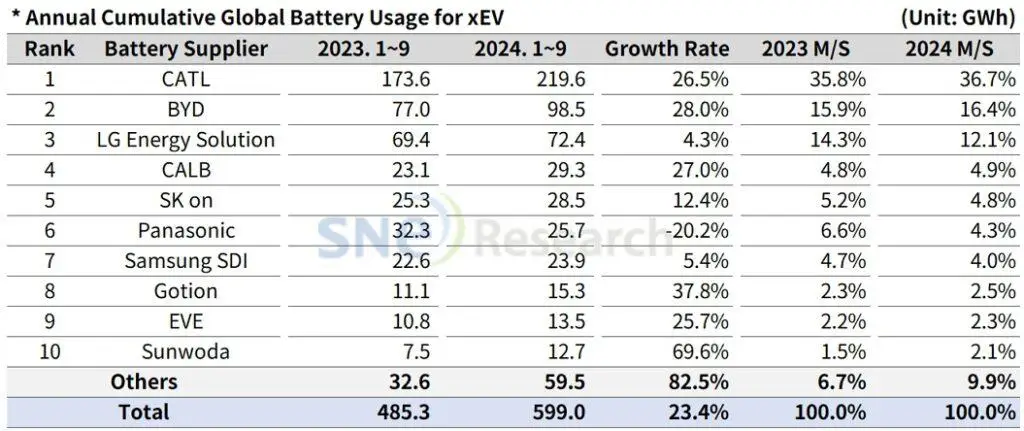

The global electric vehicle (EV) battery market experienced significant growth from January to September this year, with total battery usage reaching 599.0 gigawatt-hours (GWh), a 23.4% increase over the same period last year, according to SNE Research. Despite this overall expansion, the combined market share of the three major Korean battery manufacturers—LG Energy Solution, SK On, and Samsung SDI—declined, reflecting intensifying competition in the industry.

The collective market share of the Korean companies dropped to 20.8%, down 3.4 percentage points from the previous year. This decrease is largely due to the aggressive global expansion of Chinese battery producers, which have rapidly increased their market presence.

LG Energy Solution maintained its third-place ranking, marking a 4.3% year-over-year increase and securing a 12.1% market share. The company’s growth was driven by steady sales of popular EV models in Europe and North America, including the Tesla Model 3 and Model Y, the Volkswagen ID.4, and significant sales increases of Hyundai’s Ioniq 6 and Kona Electric in Europe.

SK On reported a 12.4% increase from the same period last year, attributed to recovering sales of Hyundai Motor Group’s Ioniq 5, EV6, EV9, and the Mercedes-Benz EQA. Despite the growth, SK On’s market share ranking slipped to fifth place, holding a 4.8% share.

Samsung SDI, ranking seventh, recorded a 5.4% increase, bolstered by strong sales of BMW and Rivian vehicles, resulting in a 4.0% market share.

In contrast, China’s Contemporary Amperex Technology Co. Ltd. (CATL) retained its leading position globally with 219.6 GWh, a 26.5% increase year-over-year, capturing a 36.7% market share. BYD ranked second with 98.5 GWh, a 28.0% increase, holding a 16.1% share. BYD’s success is attributed to its new hybrid vehicles capable of traveling 2,100 kilometers on a single charge, targeting both pure EV and plug-in hybrid electric vehicle (PHEV) markets.

CALB advanced to fourth place with 29.3 GWh, a 27.0% increase from the same period last year. Meanwhile, Japan’s Panasonic experienced a 20.2% decline, recording 25.7 GWh and ranking sixth, primarily due to decreased sales associated with the Tesla Model 3 facelift.

SNE Research noted the challenges faced by Korean battery manufacturers, stating, “The three major Korean battery companies showed relatively low sales and profit margins in the third quarter, but they are diversifying their strategies to respond to the mid-to-long-term market. Strengthening strategic partnerships with OEMs in the U.S. and Europe and securing new customers has become increasingly important.”

Source: Business Korea