Between January and August 2024, global electric vehicle (EV) battery usage reached approximately 510.1 gigawatt-hours (GWh), reflecting a 21.7% increase compared to the same period last year, according to SNE Research’s September Global Monthly EV and Battery Tracker.

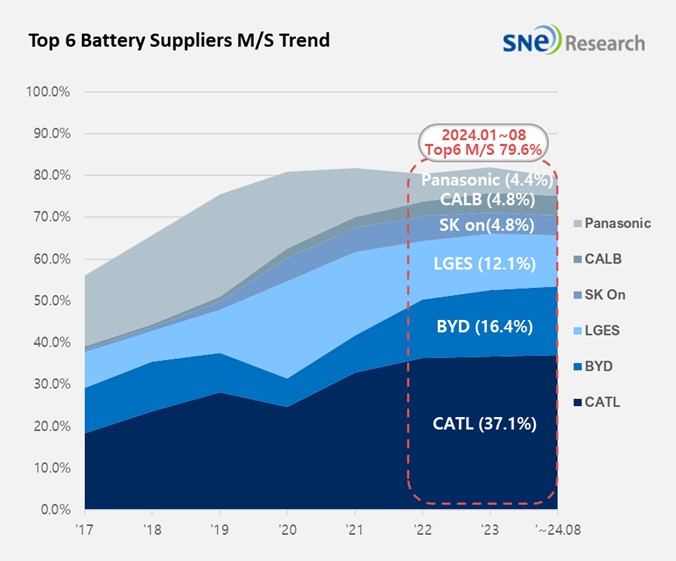

South Korea’s leading battery manufacturers—LG Energy Solution, SK On, and Samsung SDI, collectively known as the K-trio—saw higher battery usage during this period. LG Energy Solution maintained its third-place position with a 2.5% year-over-year growth to 61.8 GWh. SK On ranked fourth, recording an 8.0% increase to 24.4 GWh. Samsung SDI achieved the highest growth among the trio, expanding by 9.2% to 21.3 GWh. Despite these gains, the combined market share of the K-trio declined by 3.4 percentage points to 21.1%.

Samsung SDI’s growth was driven by strong sales of BMW and Rivian models equipped with its batteries, including the BMW i4, i5, i7, and Rivian R1S and R1T. Additional contributions came from solid sales of the Audi Q8 e-Tron and Jeep Wrangler PHEV.

SK On’s increased battery usage aligned with sales growth from Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Models such as Hyundai’s IONIQ 5, EV6, and EV9; Mercedes-Benz EQA and EQB; and the Ford F-150 Lightning experienced a recovery in sales after earlier slowdowns.

LG Energy Solution continued its upward trajectory, supported by robust sales of popular EV models in Europe and North America, including the Tesla Model 3/Y, Volkswagen ID.4, Ford Mustang Mach-E, and GM Cadillac LYRIQ. Notably, the Hyundai IONIQ 6 and KONA Electric saw significant sales increases in Europe compared to the previous year.

While EV sales in Europe (excluding hybrid electric vehicles) declined by approximately 2.7% year-over-year, and LG Energy Solution faced a decrease in battery usage in the region, the overall usage of Korean batteries increased due to strong performances by Samsung SDI and SK On.

Panasonic, the sole Japanese company in the top ten, recorded 22.4 GWh, ranking seventh but experiencing a 22.5% year-over-year decrease. This decline was largely attributed to slower sales of the Tesla Model 3 earlier in the year. With the recent uptick in Model 3 sales and the introduction of advanced 2170 and 4680 cells supplied to Tesla, Panasonic is anticipated to regain market share.

China’s CATL solidified its global leading position with a 27.2% year-over-year growth, reaching 189.2 GWh. The company’s batteries are widely used by major Chinese automakers such as ZEEKR, AITO, and Li Auto, as well as international brands like Tesla, BMW, Mercedes-Benz, and Volkswagen.

BYD ranked second, posting a 25.6% increase to 83.9 GWh. The company has aggressively expanded in the battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) markets by introducing new hybrid models capable of driving up to 2,100 km on a single charge. BYD is rapidly increasing its market share not only in China but also across Asia and Europe.

Chinese battery manufacturers are making significant inroads globally, particularly as more EVs adopt lithium iron phosphate (LFP) batteries known for their thermal safety and cost-effectiveness. In China, reduced government subsidies for high-energy-density batteries have spurred the rise of LFP-equipped models. Internationally, automakers are adopting LFP batteries to enhance price competitiveness.

While Chinese companies currently dominate the LFP battery market, Korean manufacturers are preparing to enter the sector. LG Energy Solution has agreed to supply pouch-type cell-to-pack batteries to Renault, and both Samsung SDI and SK On are gearing up for mass production of LFP batteries, aiming for market entry by 2026.

Source: SNE Research