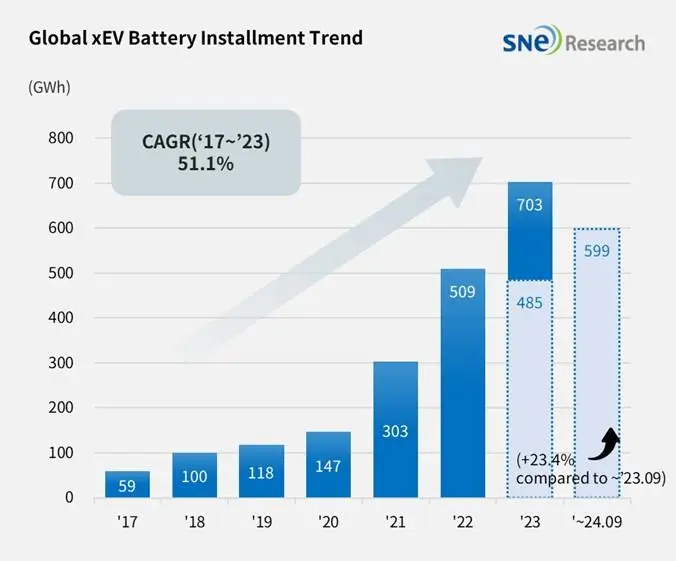

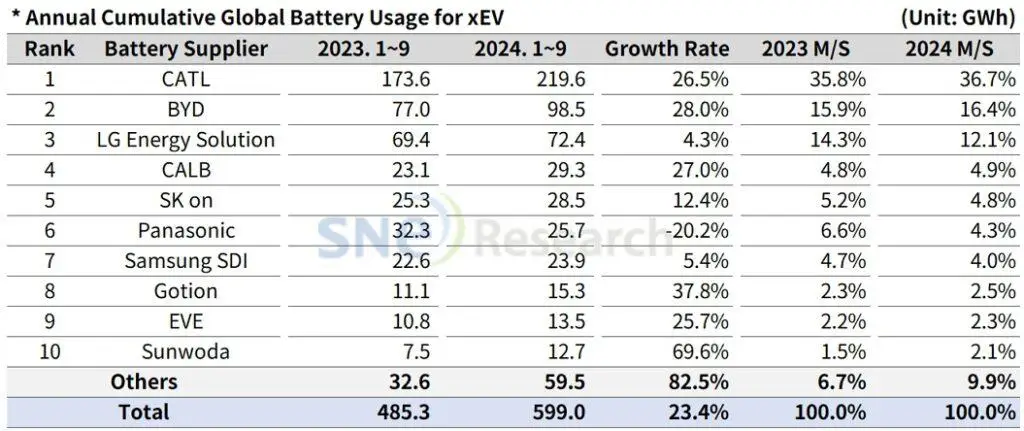

The global usage of batteries for electric vehicles (EVs, PHEVs, HEVs) reached approximately 599.0 GWh from January to September 2024, reflecting a 23.4% increase compared to the same period last year.

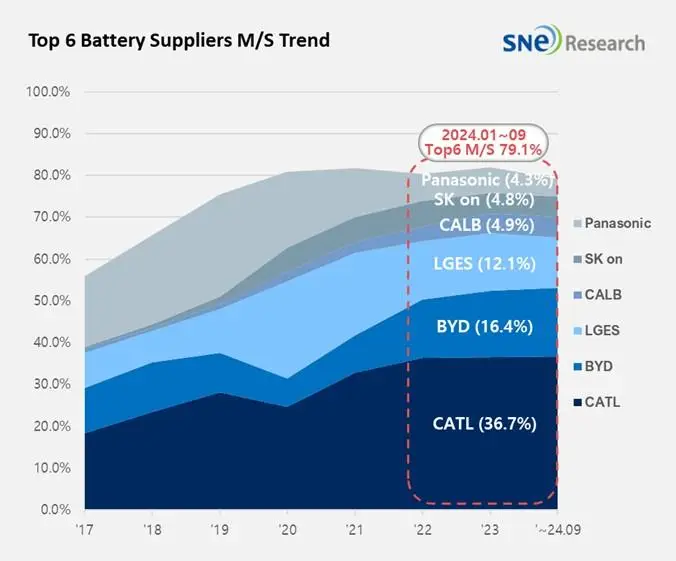

South Korea’s leading battery manufacturers, collectively known as the K-trio—LG Energy Solution, SK On, and Samsung SDI—reported higher battery usage during this period. LG Energy Solution maintained its third-place ranking globally with a 4.3% year-over-year growth to 72.4 GWh. SK On ranked fifth with a 12.4% increase to 28.5 GWh, while Samsung SDI saw a 5.4% rise to 23.9 GWh. However, the combined global market share of the K-trio declined by 3.4 percentage points to 20.8%.

Samsung SDI’s growth was driven by strong sales from BMW and Rivian, along with solid performances of the Audi Q8 e-Tron and Jeep Wrangler PHEV. SK On benefited from increased sales of models from Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. LG Energy Solution saw steady battery usage due to popular models like the Tesla Model 3 and Model Y, Volkswagen ID.4, Ford Mustang Mach-E, and GM Cadillac LYRIQ, especially in European and North American markets.

Despite a 1.4% decrease in EV sales (excluding HEVs) in Europe during this period, the usage of batteries from Samsung SDI and SK On increased due to favorable sales of their associated electric vehicles. This contributed to an overall rise in the usage of South Korean batteries in the region.

Japan’s Panasonic, the only Japanese company in the top ten, recorded 25.7 GWh but faced a 20.2% year-over-year decline, ranking sixth. The decrease was primarily due to a slowdown in Tesla Model 3 sales earlier in the year. With the recent expansion of Model 3 sales and the introduction of advanced 2170 and 4680 cells supplied to Tesla, Panasonic is expected to regain market share.

China’s CATL retained its number one global ranking with a 26.5% increase to 219.6 GWh. CATL’s batteries are widely used by major Chinese automakers like ZEEKR, AITO, and Li Auto, as well as global brands such as Tesla, BMW, Mercedes-Benz, and Volkswagen. BYD ranked second with a 28.0% growth to 98.5 GWh, aggressively targeting both BEV and PHEV markets by launching new hybrid vehicles capable of driving 2,100 km per charge. Together, CATL and BYD now hold over half of the global market share.

While Chinese battery companies reported significant growth and profits in the third quarter of 2024, South Korea’s K-trio showed relatively modest sales growth and profit margins. The K-trio is focusing on diversifying mid- to long-term market strategies, especially as lithium iron phosphate (LFP) batteries gain popularity for their cost-effectiveness and thermal safety. The U.S. market presents opportunities due to reduced competition from China and potential tax credits like the Advanced Manufacturing Production Credit (AMPC). However, challenges remain in Europe, where stricter carbon emission regulations could both aid and complicate market dynamics for South Korean battery makers. Strengthening strategic partnerships with original equipment manufacturers (OEMs) in the U.S. and Europe is becoming increasingly crucial.

Source: SNE Research