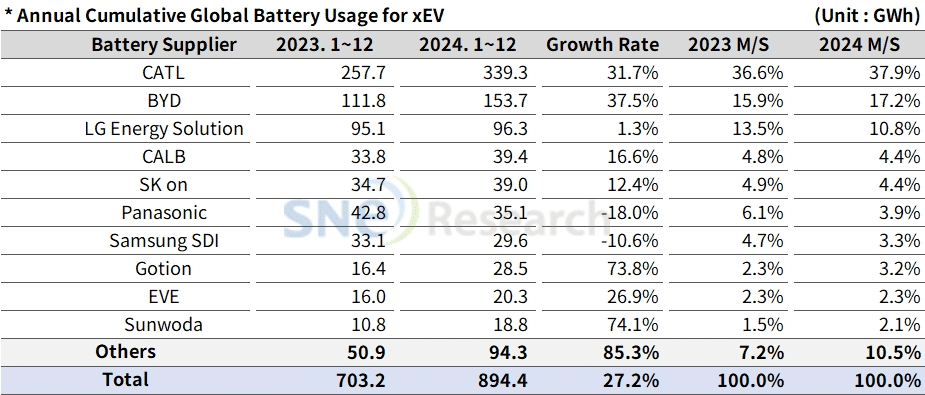

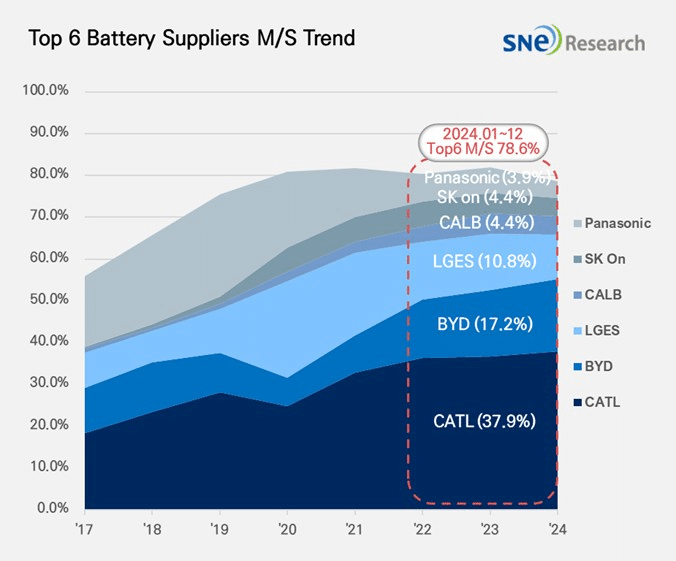

Global electric vehicle battery usage totaled approximately 894.4 GWh between January and December 2024, reflecting a 27.2% increase compared to the previous year, according to SNE Research’s 2025 Jan Global Monthly EV and Battery Monthly Tracker. During this period, the combined market share of the K-trio—LG Energy Solution, SK On, and Samsung SDI—recorded 18.4%, marking a 4.7% decline year-over-year.

LG Energy Solution showed modest gains with a 1.3% increase (96.3 GWh YoY), while SK On experienced a 12.4% increase (39.0 GWh). In contrast, Samsung SDI faced a 10.6% decrease (29.6 GWh), primarily due to reduced demand from major European and North American automotive manufacturers.

Samsung SDI’s batteries were predominantly used by BMW, Rivian, and AUDI. BMW integrated these batteries in its i4, i5, i7, and iX models, with the newly released i5 performing strongly in the market. However, the introduction of Rivian’s standard-range trim featuring an LFP battery, along with a significant drop in AUDI’s Q8 e-Tron sales, negatively impacted Samsung SDI’s overall usage.

SK On’s batteries were largely installed in vehicles from Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. While Hyundai Motor Group saw notable declines in sales for models such as the Bongo 3 EV and Porter 2 EV, a gradual recovery occurred following the facelifted releases of the IONIQ 5 and EV6. Additionally, Kia’s EV9 experienced a substantial increase in battery usage, and steady sales from Mercedes-Benz, Ford, and VW further contributed to SK On’s performance.

LG Energy Solution’s batteries, used primarily in models by Tesla, VW, Chevrolet, and Ford, benefited from rising demand. Tesla’s usage increased by 9.6%, with the facelifted Model 3 showing a remarkable 47.0% jump in battery usage. Chevrolet also saw a 24.0% increase, driven by the expansion of models like the Equinox, Blazer, and Silverado EV.

Panasonic, a key supplier to Tesla, ranked sixth with 35.1 GWh in usage, though it experienced an 18.0% year-over-year decline. This downturn was attributed to reduced sales of the Tesla Model 3 following its early-2024 facelift. Despite these challenges, Panasonic is planning a market recovery by launching advanced 2170 and 4680 cells aimed at regaining its share in the North American market.

Chinese manufacturer CATL maintained its leading position with a 31.7% growth, reaching 339.3 GWh, as both domestic OEMs like ZEEKR, AITO, and Li Auto and international brands such as Tesla, BMW, Mercedes-Benz, and VW continued to opt for its batteries. BYD followed in second place with a 37.5% increase (153.7 GWh), bolstered by robust domestic sales—approximately 4.14 million EV units in 2024—and aggressive market expansion into Asia and Europe, with plans to hit 6 million units in 2025.

Overall, the global EV battery market experienced significant growth in 2024, though regional disparities persist. Chinese companies are expanding their global footprint, while K-battery manufacturers face challenges in the US and European markets amid evolving regulatory frameworks, including changes driven by the US IRA. To secure and grow their market share, these companies must pursue strategic initiatives such as diversifying their supply chains, reducing costs, innovating technology, and establishing strategic partnerships. Developing long-term, sustainable strategies will be essential for industry players navigating an ever-changing market landscape.

Source: SNEResearch