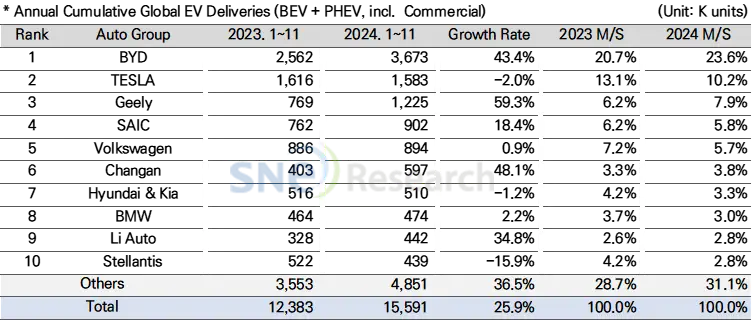

Global electric vehicle (EV) deliveries from January to November 2024 reached approximately 15.59 million units, marking a 25.9% increase compared to the same period in the previous year, according to SNE Research. BYD led global EV sales, delivering 3.673 million units and achieving a 43.4% year-on-year growth rate.

BYD’s strong performance is attributed to robust sales of its Song, Seagull, and Qin models in China, as well as the Atto 3, Atto 4, and Dolphin models in overseas markets. The company has expanded its brand portfolio with sub-brands such as Denza, Yangwang, and FangCheong Bao. Employing a competitive pricing strategy in regions like Europe, the ASEAN-5, and South America, BYD is expected to sustain global sales growth. Its vertically integrated supply chain management structure allows for flexible margin adjustments to address increasing tariff barriers.

Tesla ranked second, experiencing a 2.0% year-on-year decline, with the Model 3 and Model Y accounting for approximately 95% of its total sales. In Europe, Tesla’s sales fell by 12.9%, while North America saw a 7.0% drop. The company plans to introduce a budget-friendly new model by mid-2025 and aims to enhance its performance through advancements in Full Self-Driving (FSD) technology.

Geely Group secured third place, with its compact EV, the Panda Mini, selling over 120,000 units in China. The premium brand ZEEKR achieved sales of 99,000 units of the ZEEKR 001, recording the highest growth rate among major automakers at 59.3%. Geely is focusing on the mid-to-high-end market with sub-brands like Galaxy and LYNK & CO.

Hyundai Motor Group sold approximately 510,000 units, showing a 1.2% year-on-year decline. While flagship models like the Ioniq 5 and EV6 underperformed, global sales of Kia’s EV3 and EV9 expanded. Notably, Hyundai surpassed Stellantis, Ford, and GM in EV deliveries in the North American market. The group plans to produce at least five new EV models in the U.S. by 2025 to meet Inflation Reduction Act (IRA) requirements, potentially qualifying for tax credits of up to $7,500 per unit. In response to potential policy changes from the incoming administration, Hyundai is expected to adapt its strategies to strengthen its U.S. market presence.

Regionally, China accounted for 58.8% of the global EV market, maintaining its position as the largest EV market with a year-on-year growth rate of 39.7%. Europe experienced a 0.8% decline in EV deliveries, while sales of hybrid electric vehicles increased by 16.2%. The European Union’s easing of Euro 7 automotive regulations has reduced the pressure on automakers to increase EV sales. However, tariffs on Chinese EVs have negatively impacted sales of brands like Geely and SAIC, slowing electrification efforts in Europe.

In North America, EV sales grew by 10.1% year-on-year. Despite the implementation of the IRA policy, EV demand remains sluggish. The President-elect has announced plans to end mandatory EV adoption, leading to increased demand for hybrid vehicles and prompting original equipment manufacturers (OEMs) to focus on hybrid development. Several OEMs, including Hyundai, have announced plans to develop extended-range electric vehicles (EREVs) to respond to this growing demand.

The EV market in Asia (excluding China) and other regions continued to expand rapidly, recording double-digit growth rates. Chinese EV manufacturers are leading in emerging markets, accelerating the adoption of EVs in developing countries. In major markets like the U.S. and Europe, measures such as raising tariff barriers have been implemented to protect domestic industries from competitively priced Chinese EVs. Traditional automakers are challenged to bridge the price gap between EVs and internal combustion engine vehicles while exploring new areas like autonomous driving technology.

Source: SNE Research