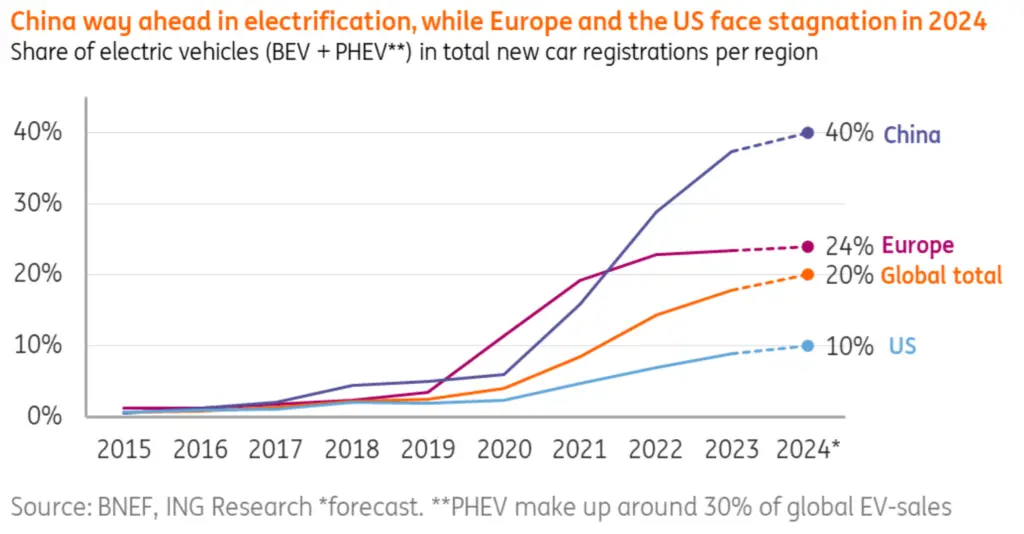

As the global push toward zero-emission vehicles intensifies, the electric vehicle (EV) market is experiencing divergent trends across key regions. Recent data from July 2024 shows China’s continued dominance in the EV sector, while Europe and the United States struggle with slowing adoption rates.

China is expected to account for nearly 60% of global EV sales by mid-2024, with projections indicating that EVs will account for 40% of all new car sales in the country by the end of the year. This growth is attributed to government support, robust domestic supply chains, and aggressive export strategies. Chinese automakers, led by companies such as BYD, have ramped up production to meet both domestic and international demand. The country’s focus on infrastructure development and government incentives has created a favorable environment for EV adoption.

In contrast, Europe and the United States are experiencing a slowdown in EV adoption. Europe’s EV penetration rate is expected to increase slightly from 23% in 2023 to 24% in 2024, due in part to the reduction of government incentives in key markets such as Germany. The United States is expected to see only a small increase in EV market share, from 9% in 2023 to 10% in 2024, hampered by high costs, insufficient charging infrastructure, and rising interest rates.

The divergence between China and Western markets has significant implications for the global automotive industry. China’s continued push for electrification is likely to shift the balance of power in the global auto market, while slower progress in Europe and the U.S. could hinder those regions’ ability to meet climate goals and maintain automotive leadership.

As 2024 unfolds, industry watchers will closely monitor the EV market trajectory in these key regions. Decisions made this year could significantly influence the future of the global automotive industry.

Source: EVMarketsReports.com