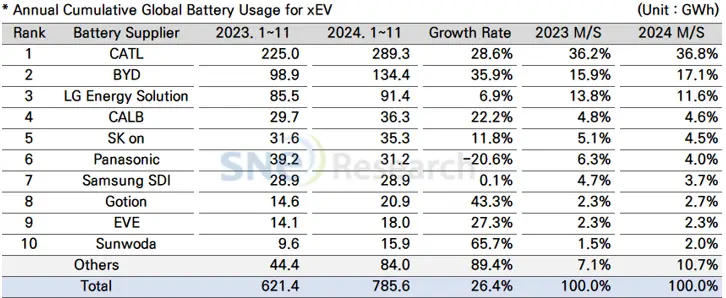

Energy market research firm SNE Research reported that from January to November 2024, the global usage of batteries installed in electric vehicles (EVs), plug-in hybrid vehicles (PHEVs), and hybrid electric vehicles (HEVs) reached 785.6 gigawatt-hours (GWh), marking a 26.4% increase compared to the same period in the previous year. Despite this substantial growth in the EV battery market, South Korea’s leading battery manufacturers—LG Energy Solution, SK On, and Samsung SDI—saw their combined market share decline to 19.8%.

During this period, each of the three Korean companies reported growth in battery usage. LG Energy Solution’s usage rose by 6.9% to 91.4 GWh, maintaining its position as the third-largest global supplier with an 11.6% market share. The company’s batteries are predominantly used in vehicles from Tesla, Volkswagen, Ford, and Hyundai Motor Group.

SK On experienced an 11.8% increase, reaching 35.3 GWh and capturing a 4.5% market share, placing it fifth globally. The company’s performance benefited from the recovery in sales of Hyundai’s Ioniq 5 and EV6 models, as well as increased overseas sales of Kia’s EV9.

Samsung SDI reported a marginal 0.1% increase to 28.9 GWh. Strong sales from BMW and Rivian were offset by decreased sales of the Audi Q8 e-tron. The combined market share of these three Korean manufacturers has declined from over 30% during 2020–2021, to 24.4% in 2022, then to 23.5% in 2023, and now to 19.8%.

In contrast, Chinese battery manufacturers have expanded their global market presence. Contemporary Amperex Technology Co. Limited (CATL), the world’s leading EV battery supplier, increased its usage by 28.6% to 289.3 GWh, securing a 36.8% market share. BYD, ranking second, saw a 35.9% increase to 134.4 GWh, achieving a 17.1% share. BYD’s rapid growth is attributed to its dual focus on pure EV and PHEV markets. CALB (China Aviation Lithium Battery) also advanced from sixth to fourth place with a 22.2% increase to 36.3 GWh.

SNE Research highlighted that while Korean battery companies, focused on European and American markets, are experiencing a decline in market share, Chinese companies continue to grow by leveraging their stable domestic market and expanding into emerging markets. The firm also commented on potential political impacts, noting that the possible repeal of the Inflation Reduction Act (IRA) under a second Trump administration could hinder the electrification shift. They suggested that growth in major regions outside China might fall short of expectations in the short term, prompting companies to diversify strategies, emphasize low-cost models and hybrids, and invest in technological innovation.

Source: BusinessKorea