LG Electronics is significantly reducing its energy storage system (ESS) business after more than a decade of operation. The company has disbanded its product development team and is now concentrating on maintaining ESS products that have already been sold. This decision comes amid increased competition from Chinese companies, whose aggressive expansion in the ESS market has made it challenging for other players to remain competitive.

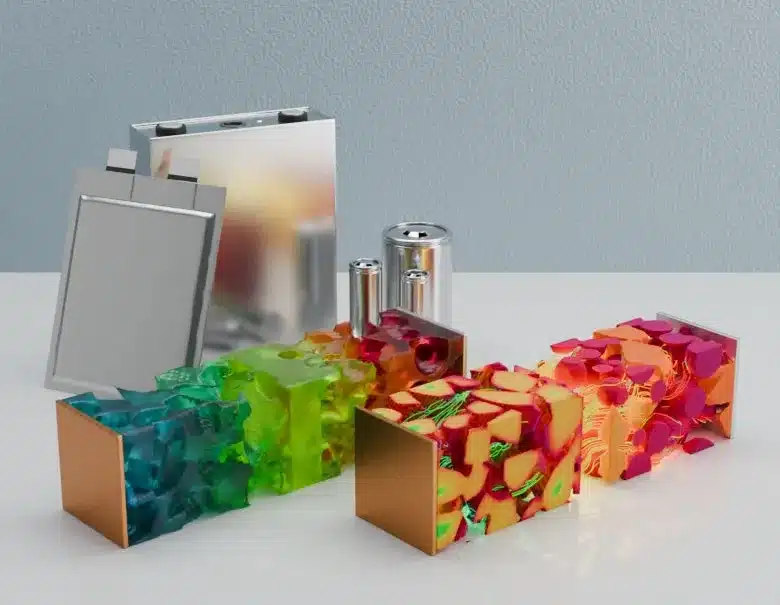

LG Electronics initially entered the ESS market by acquiring the Power Conversion System (PCS) division of LG Uplus for approximately 7.7 billion won. However, the company has faced mounting challenges, particularly from Chinese competitors. According to market research firm SNE Research, China held an overwhelming 86% of the global ESS market share last year. Chinese companies have captured the market through competitive pricing and the introduction of lithium iron phosphate (LFP) batteries. While LFP batteries have a lower energy density compared to LG’s nickel cobalt manganese (NCM) batteries, they offer superior price competitiveness and significantly more charge-discharge cycles.

An industry insider explained, “Chinese companies introduced LFP batteries, which naturally took over the market due to their price competitiveness and longer cycle life.” This price sensitivity is a significant factor for home ESS, where the consumer base is individuals. Nam In-ho, a professor at Chung-Ang University’s Department of Chemical and Materials Engineering, stated, “ESS is ultimately used for storing energy, so efficiency and size are not the most critical factors. For home ESS, the consumer base is individuals, making price the most important factor, which is why domestic companies struggled against China.”

LG Electronics’ decision to scale back its ESS business follows its previous exit from the solar panel business in 2021, also due to competition from China. The company had focused on the home ESS market, aiming to create synergy with its smart home hub ThinQ and home appliances, particularly in the United States and Europe. The expansion of solar installations driven by eco-friendly energy policies in various U.S. states has increased the demand for ESS in the country, which is the world’s largest ESS market. LG Electronics had trained ESS installation experts and formed financial partnerships to encourage ESS purchases.

Despite these efforts, the rise of Chinese companies has slowed LG’s growth in the ESS market. Although the company initially performed well in the U.S. and Europe, it eventually lost market share to Chinese competitors. Additionally, there have been reports of challenges in LG’s electric vehicle charging business. CEO Cho Joo-wan had ambitious plans to grow this segment into a one-trillion-won industry, but progress has been limited.

As LG Electronics aims to transform into a comprehensive solutions company, the underperformance of certain B2B businesses suggests a need for strategic adjustments. CEO Cho had announced plans to increase the B2B revenue share to 45% by 2030. It is expected that the company will accelerate the reorganization of its B2B business, focusing on sectors with strong performance and future growth potential. According to industry sources, many members of the ESS development team have been reassigned to B2B areas such as chillers and air conditioning systems. Considering emerging technologies like artificial intelligence and political factors such as potential changes in U.S. leadership, the portfolio reorganization is likely to accelerate.

Source: Business Korea