Li-Cycle Holdings Corp., a prominent global lithium-ion battery resource recovery company, announced that it has secured additional waiver extensions from its convertible note holders, Glencore Canada Corporation and Wood River Capital, LLC. These extensions allow Li-Cycle’s common shares to continue trading on the OTCQX® Best Market until 11:59 p.m. ET on May 13, 2025.

Previously, Li-Cycle had received similar waiver extensions permitting its shares to trade on the OTCQX until May 9, 2025. Despite these extensions, the company has indicated that it may need to significantly alter or cease its operations. This could include dissolving and liquidating its assets in accordance with applicable insolvency laws or filing for insolvency protection.

In light of its current financial situation, Li-Cycle has engaged Alvarez & Marsal Corporate Finance and its affiliates to assist in identifying potential buyers for the company’s business or assets. This includes the possibility of selling the entire company or specific parts of its operations. However, Li-Cycle has stated that there are no guarantees regarding the successful identification of buyers or the terms of any resulting transactions.

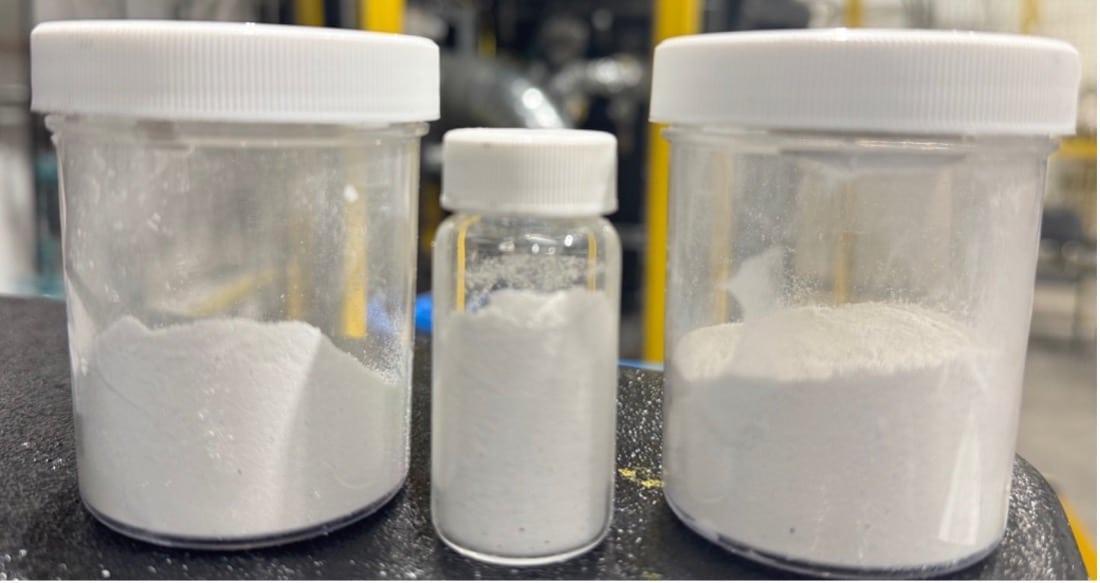

Li-Cycle was established in 2016 and is dedicated to recovering critical battery-grade materials to support a domestic closed-loop battery supply chain, contributing to a sustainable energy future. The company serves major customers and partners globally, emphasizing its role in the lithium-ion battery resource recovery sector.

The company also issued a forward-looking statements disclaimer, highlighting that certain statements in the press release may involve risks and uncertainties. These factors could cause actual results to differ materially from those projected in any forward-looking statements. Li-Cycle has clarified that it is not obligated to update or revise these statements unless required by applicable laws.

Li-Cycle’s efforts to secure waiver extensions and seek potential buyers reflect its ongoing challenges and strategic considerations as it navigates the complexities of the battery resource recovery industry.

Source: Business Wire