The global lithium-ion (Li-ion) battery recycling market is projected to reach a value of US$52 billion by 2045, according to a recent forecast by IDTechEx. The increasing demand for Li-ion batteries in electric vehicles (EVs), energy storage systems (ESS), and consumer electronics is driving this market growth. Effective lifecycle management of Li-ion batteries, including end-of-life (EOL) processes, is crucial for sustainability. EOL batteries that no longer meet performance standards can be recycled to recover valuable raw materials, which are then reintegrated into new battery production. Additionally, repurposing these batteries for second-life applications can delay the need for recycling, contributing to a circular economy within the Li-ion battery sector.

Recycling Li-ion batteries helps manufacturers mitigate risks associated with volatile raw material prices, ensure a more stable supply chain, and meet regulatory requirements in key regions. Recycling companies benefit by generating revenue from recovered products such as black mass and battery-grade metal salts. With stakeholders recognizing these advantages, the market is expected to grow at a compound annual growth rate (CAGR) of 17% over the next two decades.

The IDTechEx report highlights over 120 recent activities in the recycling sector, including new facility announcements, investments totaling US$3.1 billion, and strategic partnerships. These developments indicate a rapidly evolving and increasingly competitive market, with recyclers expanding operations globally, enhancing technologies, and forming collaborations with automotive OEMs, logistics providers, cell manufacturers, and other key players in the battery ecosystem.

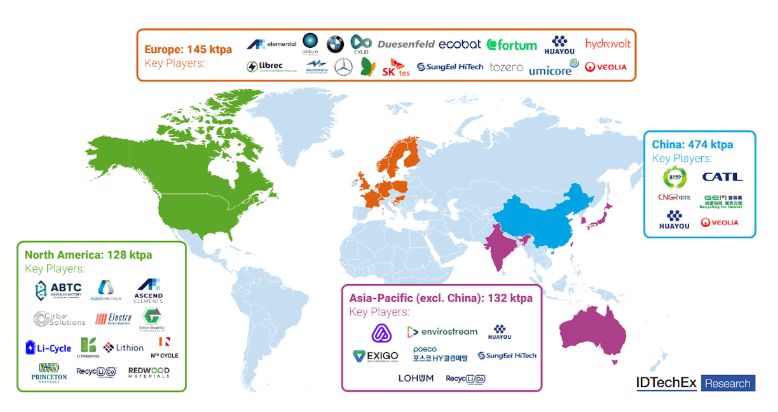

Significant increases in recycling capacity have been noted, particularly in mechanical and hydrometallurgical refining processes. By the end of 2024, global recycling capacity is expected to reach 879 kilotonnes per annum (ktpa) of complete EOL Li-ion batteries. A considerable portion of black mass generated in Europe and North America is being exported to the Asia-Pacific region, where hydrometallurgical refining capabilities are more advanced. To retain critical materials within their regions, recyclers in western countries are seeking to establish additional hydrometallurgical facilities.

Advancements in recycling technologies are also a focal point, with ongoing developments in direct recycling methods, graphite recovery, and binder management. The increasing use of lithium iron phosphate (LFP) cathodes in EVs and ESS markets necessitates more cost-effective recycling solutions, as traditional methods are less profitable for these chemistries.

Regulatory frameworks, particularly in the European Union and India, are setting stringent targets for battery collection rates and material recovery efficiencies, emphasizing the need to expand recycling capacities and enhance technological efficiencies.

The IDTechEx report includes comprehensive forecasts, company profiles, and analyses of key players and technologies shaping the Li-ion battery recycling market.

Source: IDTechEx