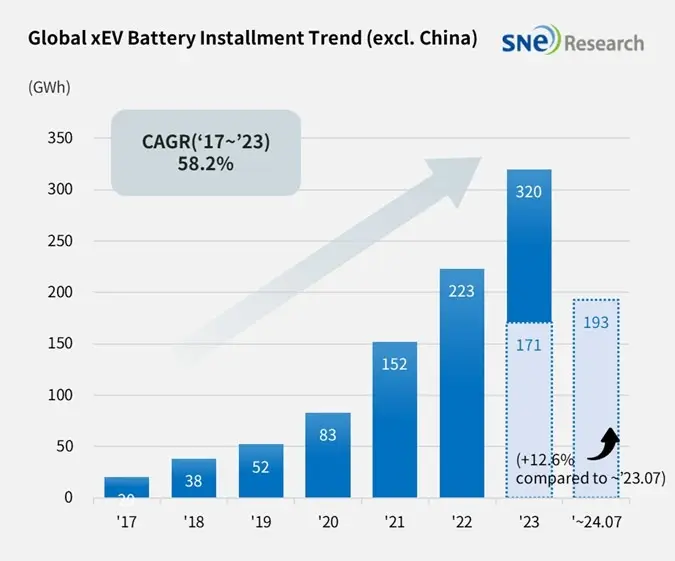

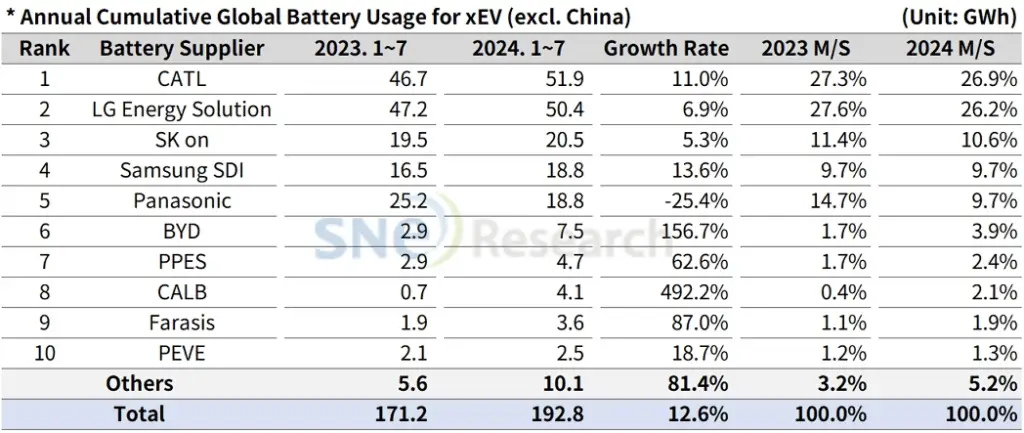

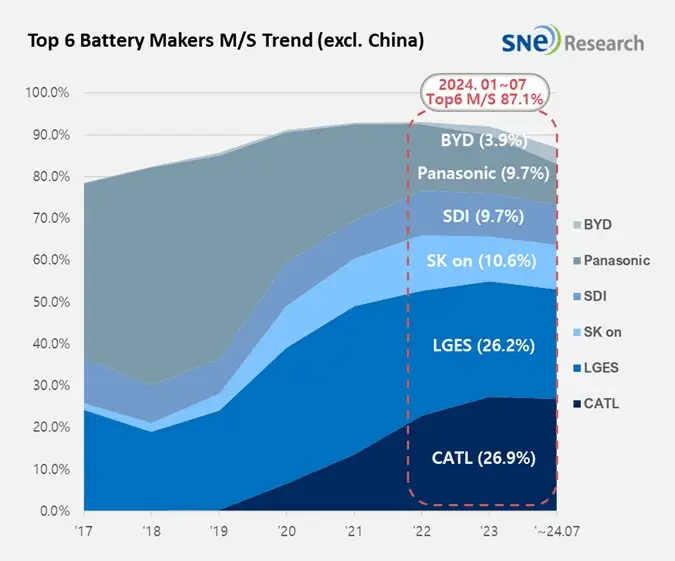

According to a recent report by SNE Research, global electric vehicle (EV) battery consumption, excluding the Chinese market, reached 192.8GWh from January to July 2024, an increase of 12.6% year on year.

Korean battery manufacturers (LG Energy Solution, SK On, and Samsung SDI) maintained a strong presence with a combined market share of 46.5%, despite a slight decline of 2.1 percentage points year-on-year. LG Energy Solution maintained its second place position with 50.4GWh, growing 6.9% year-on-year. SK On secured third place with 20.5GWh, an increase of 5.3%. Samsung SDI had the highest growth among Korean manufacturers with 18.8%, reaching 18.8GWh.

CATL, a Chinese manufacturer, led the market with 51.9GWh, up 11% year-on-year and expanding its presence in non-Chinese markets. Panasonic, the only Japanese company in the top 10, experienced a 25.4% year-on-year decline, dropping to fifth place with 18.8GWh.

The report notes that while the global EV battery market outside of China continues to grow steadily, Chinese manufacturers are rapidly expanding their presence in Europe and emerging markets. This expansion is being driven by Chinese government policies to support domestic market growth and the increasing adoption of LFP batteries by global automakers.

SNE Research suggests that Korean manufacturers will need to focus on establishing stable supply chains and developing competitive, high-quality products in the low- to mid-price range to maintain and grow their market share in the future.

The data presented is based on battery installations for electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) registered during the period in 80 countries, excluding the Chinese market.

Source: SNE Research