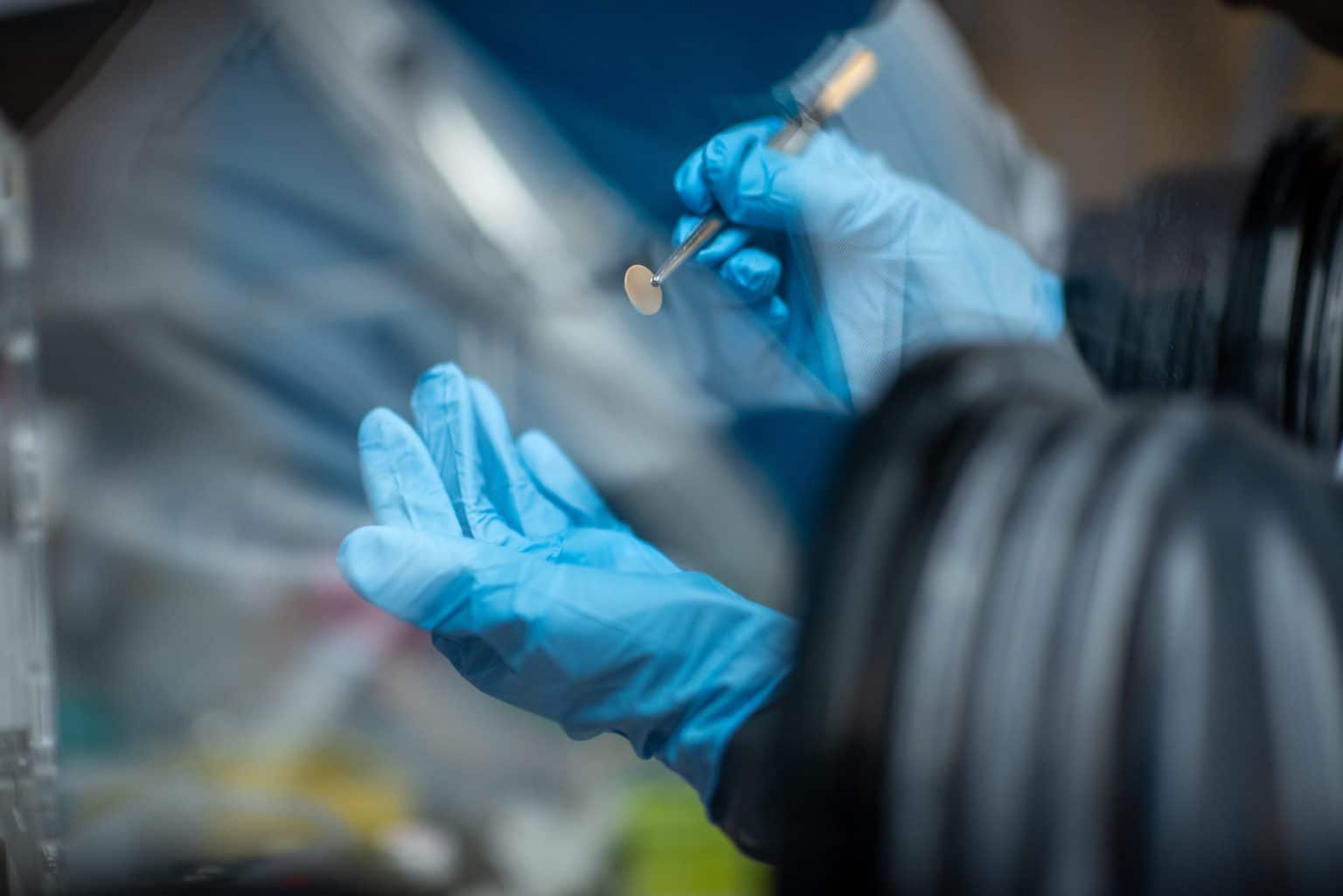

South Korean battery and materials manufacturers are deferring completion of their new facilities to manage expenses as weak electric vehicle (EV) demand slows orders, leaving expanded production capacity underutilized. According to industry sources on January 7, Kumyang has delayed finishing its secondary battery plant in Gijang, Busan, from December last year to May this year. The 610 billion won (420 million USD) factory, which started construction in September 2023, covers 124,479 square meters and plans to produce two types of cylindrical batteries—2170 (21mm diameter, 70mm height) and 4695 (46mm diameter, 95mm height). At full output, it can produce 300 million cells annually, enough for around 216,000 EVs per year.

Kumyang had already completed the exterior of the plant in August and begun installing equipment, but a shortage of orders caused delays. The company signed its first major contract on December 4 with U.S.-based Nanotech Energy for 2170 batteries worth 81.2 billion won, followed by a 78.8 billion won deal with Korea’s electric bus maker Pline Motors on December 8 to provide batteries for 750 buses over five years. However, these agreements account for only a quarter of the plant’s investment cost.

EcoPro BM has pushed back completion of its Pohang cathode material factory by two years, from December last year to December 2026, due to insufficient orders. The facility was designed to produce advanced NCMX (nickel-cobalt-manganese-additive) and single-crystal cathode materials.

Lotte Energy Materials, a copper foil producer, postponed the completion of its factory in Catalonia, Spain, from late this year to June 2027. The initial 560 billion won investment intended to address European demand was scaled back, dropping last year’s planned spending from 180 billion won to 25 billion won following the delay.

POSCO Future M, grappling with competition from lower-cost Chinese anode materials, adjusted its expansion strategy for synthetic graphite anode production at its Pohang Blue Valley plant from 18,000 tons to 13,000 tons annually as of August last year. Its 2026 production target was also cut from 221,000 tons to 113,000 tons, effectively halving the goal. The plant’s utilization rate dipped from 80–90% in 2020 to about 30% last year.

SNE Research data indicates that the global market share of South Korea’s top three battery producers in EV battery usage decreased to 19.8% between January and November last year, down 3.7 percentage points from the previous year. In response, the battery and materials sector has adopted emergency management strategies. EcoPro’s former Chairman Lee Dong-chae called the circumstances critical, saying survival hinges on radical transformation across all management areas.

Despite the slowdown, some experts anticipate a rebound starting next year. LG Energy Solution CEO Kim Dong-myung projects the EV market will regain momentum by 2026–2027, when electric models match combustion-engine vehicles in price while also improving range, charging, and safety, thus driving steady long-term growth.

Source: The Chosun Daily