Svolt Energy, a battery manufacturer spun off from Great Wall Motor, has suspended its two battery factory projects in Germany with no set timeline for resumption, according to a Caixin report citing sources familiar with the matter.

The company had planned to build a battery module and pack plant in Saarland and a cell plant in Brandenburg. Announced in November 2020, the Saarland project was expected to be completed by mid-2024, featuring a design capacity of 24 GWh and a total investment of €2 billion. The Brandenburg cell plant, unveiled in September 2022, was slated to have an annual capacity of 16 GWh and commence operations in 2025.

Construction of both plants has come to a standstill. Sources indicate that Svolt’s financial struggles in its domestic Chinese market have hindered its ability to invest in overseas factories requiring substantial capital. The two European projects would require an investment of approximately RMB 30 billion yuan, a significant sum for a company of Svolt’s size.

“The decision was based on Svolt’s own situation, not on technical or local policy factors,” one source noted. “The main issue is the scale of the upfront capital investment. Svolt needs to address its financial challenges first.”

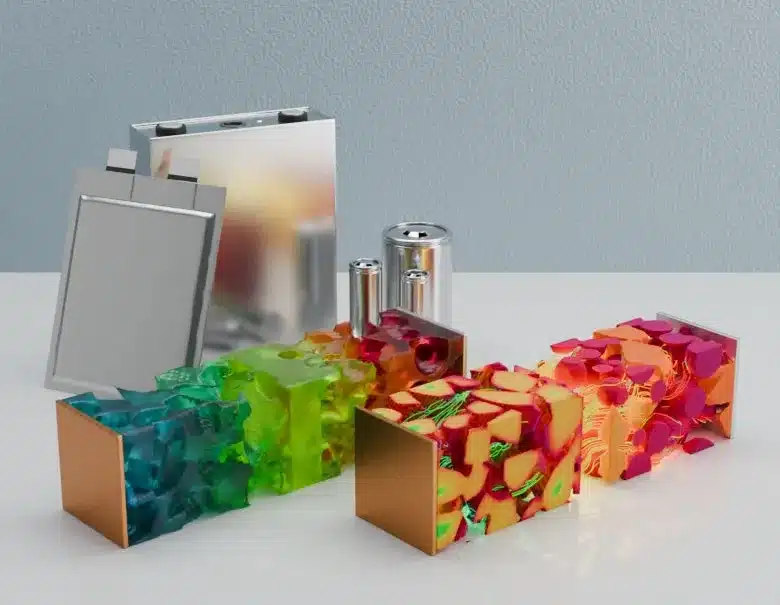

Established as an independent entity from Great Wall Motor in February 2018, Svolt Energy focuses on battery materials, cells, modules, packs, battery management systems (BMS), and energy storage technology. In September, the company ranked eighth in China’s domestic power battery market with a 2.36% share, loading 1.29 GWh of batteries, according to the China Automotive Battery Innovation Alliance (CABIA). The market leaders, Contemporary Amperex Technology Co. Ltd. (CATL) and BYD, held shares of 44.02% and 24.20%, respectively.

Exports account for roughly 20% of Svolt’s capacity, but overseas orders mainly come from Great Wall Motor. Considering that some batteries are installed in China before export, the actual export capacity is less than 20%.

The Chinese power battery market has experienced a significant price decline over the past two years due to slowing growth in the new energy vehicle sector and falling raw material prices like lithium carbonate. Smaller battery manufacturers, which previously relied on low prices to attract customers, now face intense competition from leading players such as CATL.

In February, Svolt Chairman and CEO Yang Hongxin announced on Weibo that the company had initiated major changes in response to industry overcapacity and price competition, including increased elimination of underperforming employees.

Great Wall Motor is also scaling back its European operations. The automaker planned to close its European headquarters in Munich at the end of August, laying off approximately 100 local employees, according to a May 28 report by German media outlet Manager Magazin. In June, Great Wall Motor adjusted its European business strategy by closing its German office, laying off all employees, and resuming direct management of its European dealerships and customers, as reported by Caixin.

Source: CNEVPOST