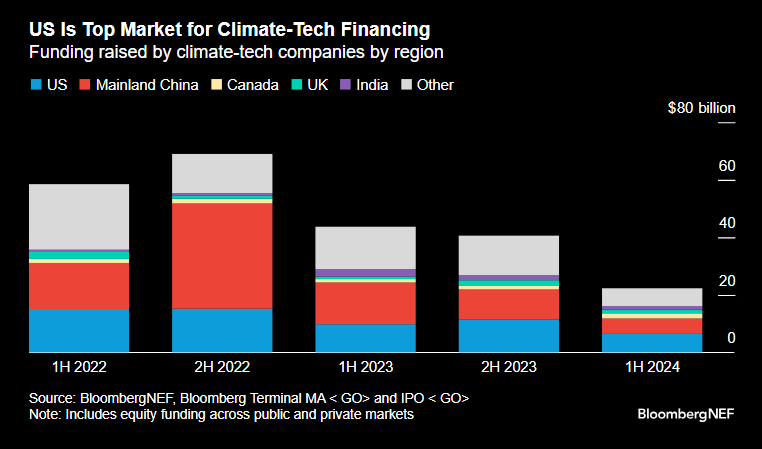

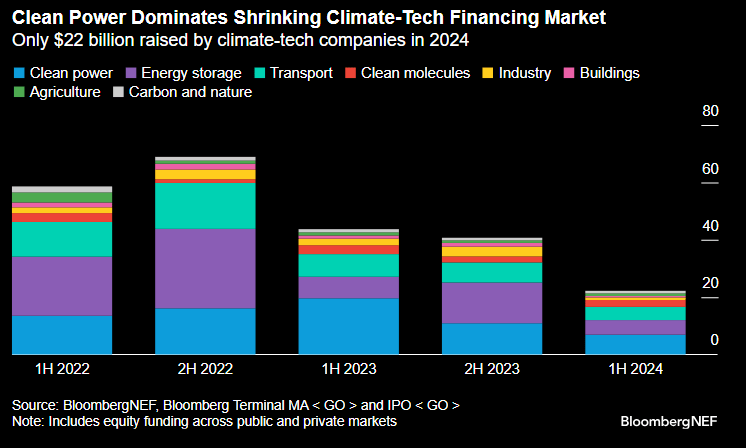

The United States has become the leading market for climate technology financing in 2024, securing $6.7 billion in the first half of the year. This development represents a shift from the previous year when China held the top position. The majority of funding in the US was allocated to clean power companies, including renewable energy equipment manufacturers and project developers, as well as startups in the energy storage sector.

Global Funding Landscape

China maintained a strong position, raising $5.1 billion in climate tech financing, while Canada ranked third with $1.8 billion. However, the overall climate tech equity funding has experienced a significant decrease across both public and private markets this year, reducing to approximately half of the $44 billion raised in the first two quarters of 2023.

The number of deals has also declined, decreasing by about one-sixth compared to the previous year. BloombergNEF’s Climate-Tech Investment Radar recorded approximately 600 deals in the first half of 2024.

Shift in Venture Capital Focus

In the venture capital sector, climate tech firms accounted for 12% of total global venture financing in the first half of 2024, down from 16% in the same period last year. This reduction may be partially attributed to increased investor interest in artificial intelligence (AI) technologies. AI startups raised nearly $47 billion across approximately 1,200 deals in the first half of 2024, representing a 60% increase from 2023 and triple the amount raised by climate tech companies.

US Market Attractiveness and Notable Investments

The US market has attracted more global climate technologies investments, largely due to incentives provided by the Inflation Reduction Act. Nearly 60% of climate tech venture deals in the US during the first half of 2024 involved cross-border investments, an increase from 54% in 2023 and 39% in 2022.

Significant investments in the US included funding for clean energy developers Pine Gate Renewables and Nexamp, as well as small modular reactor developer Oklo Technologies, each securing over $500 million. The largest US listing of a Chinese company since 2021 was electric vehicle maker Zeekr Intelligent Technology’s $441 million listing on the New York Stock Exchange.

Sector Focus and Future Outlook

Globally, clean power, energy storage, and transportation have consistently attracted the most financing in the climate tech sector. While climate tech equity funding appears to be stabilizing, with only a 3% decrease from Q1 to Q2 2024, the total financing for the year is projected to reach approximately $45 billion, which represents half of the amount raised in 2023.

Source: BloombergNEF