Europe’s car industry is currently facing sales challenges that some interpret as signs of an industry-wide crisis. However, Transport & Environment (T&E), a leading European clean transport campaign group, explains that these challenges are better understood as a transitional phase as manufacturers adjust to upcoming regulations and evolving electric vehicle (EV) market dynamics.

Unrepresentative Market Conditions in 2024

According to T&E, the slowdown in EV growth after 2021 is linked to stricter CO2 standards set to take effect in 2025, reducing immediate incentives for carmakers to boost EV sales. Despite this, EV sales increased by 28% in 2022 and 37% in 2023. The abrupt removal of EV subsidies in Germany—the continent’s largest car market—led to a temporary dip in overall sales during the first half of 2024. However, a rebound is anticipated in the fourth quarter. Excluding Germany, the EV market in the rest of the EU grew by an average of 9% in the first half of the year.

Historically, similar stagnation have occurred before new regulations come into force. T&E notes that manufacturers held back EV supply in 2019, only to significantly increase deliveries in 2020 once new CO2 targets were implemented. Additionally, carmakers are currently prioritizing the UK market to meet new zero-emission vehicle (ZEV) mandates, resulting in a surge of EV sales there—24% market share in August 2024 compared to 14.4% in the EU.

Compliance Pathways for 2025 CO2 Targets

T&E highlights that European carmakers have multiple strategies to meet the 2025 CO2 emissions targets without incurring fines. These include increasing sales of EVs, hybrids, and more fuel-efficient combustion engine vehicles. Regulatory flexibilities also allow manufacturers to lower their reported CO2 emissions artificially and pool emissions with other carmakers. While this may require selling fewer high-polluting SUVs, it aligns with the objectives of the CO2 regulations.

EV sales are projected to reach 20–24% in the coming year as manufacturers introduce more affordable models priced under €25,000, such as the Citroën ëC3 and Renault 5. A total of 12 new affordable European EV models are planned, expected to boost consumer demand. Major carmakers like Stellantis, Renault, and BMW have expressed readiness to meet the new targets.

Significance of the 2035 Zero-Emission Target

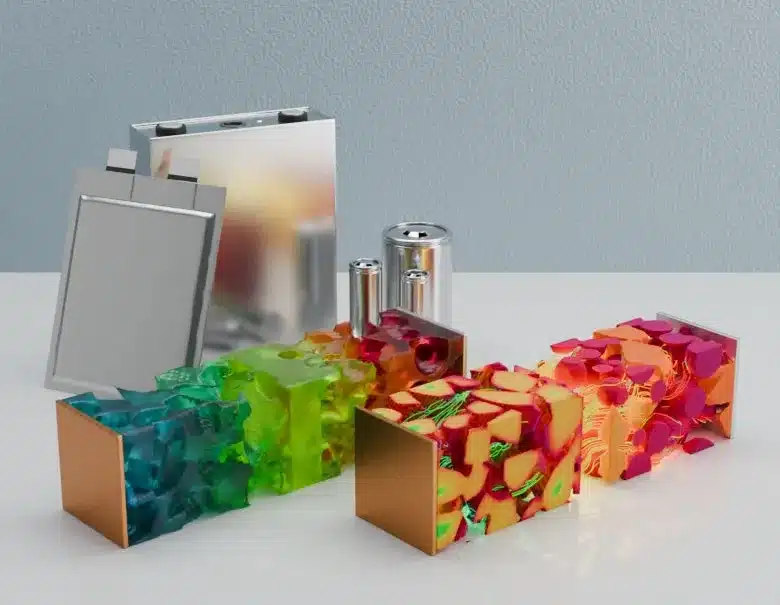

The 2035 zero-emission car target is pivotal for achieving Europe’s climate goals, stimulating economic growth, and creating jobs. T&E emphasizes that meeting this target will secure investments in EVs, battery production, and charging infrastructure, offsetting job losses in traditional automotive sectors through new opportunities in the e-mobility industry.

The car CO2 regulation has been a key driver of investment in Europe’s EV value chain in recent years. However, uncertainty about the 2035 target and a lack of robust industrial policy are making Europe less attractive to EV manufacturers. Weakening these targets could deter investment, threatening the industry’s long-term viability and employment prospects.

Delaying or diluting CO2 targets may also discourage carmakers from expanding their mass-market EV offerings, potentially allowing competitors from countries like China to gain a stronger foothold in the European market. Regulatory certainty is crucial for continued investment in Europe’s battery sector and broader automotive industry.

Calls to Maintain Regulatory Timelines

T&E points out that some industry voices have advocated for reviewing the 2035 zero-emission target in 2025 instead of 2026 as originally planned. However, advancing the review is considered inadvisable for several reasons:

- Premature Assessment: Insufficient data would be available by 2025 to evaluate the impact of new market developments and consumer responses.

- Disruption of Planning: Frequent reviews can unsettle industry planning and delay critical investments.

- Inadequate Consultation Time: A thorough assessment requires ample time for analysis and stakeholder consultation, which is not feasible within the shorter timeframe.

- Strategic Focus: The priority should be developing a comprehensive green automotive industrial strategy rather than revisiting established regulations.

Volkswagen’s Specific Situation

According to T&E, Volkswagen’s recent challenges are attributed to its specific business decisions rather than an industry-wide issue. A declining market share in China—from 21% in 2019 to 12.7% in 2024—has impacted profitability. Delays in releasing affordable EV models like the ID2, now expected in significant volumes only by 2026, have also played a role. The withdrawal of EV subsidies in Germany affected its mass-market sales, but recovery is expected as the company offers discounts on key EV models.

Overall, European carmakers have pursued a “value over volume” strategy, focusing on high-margin models at the expense of production volumes. Despite selling 25% fewer cars, Europe’s six largest carmakers generated €130 billion in profits between 2022 and 2023.

Strengthening the Green Deal

T&E underscores that passenger cars and vans account for about half of transport-related emissions, making EV adoption critical for meeting climate objectives. EVs produce, on average, three times less CO2 than their petrol counterparts. Weakening CO2 regulations could undermine the EU’s climate agenda and hinder the attainment of its targets. Instead, T&E encourages the European Commission to bolster the existing framework with a comprehensive green automotive industrial strategy. This would support EV demand, enhance investment in local manufacturing and infrastructure, and ensure the long-term competitiveness of Europe’s automotive industry.