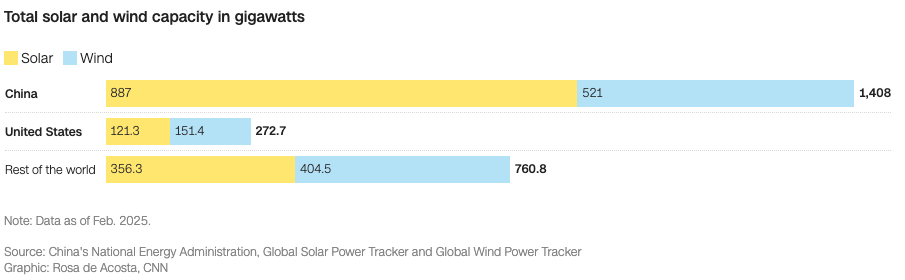

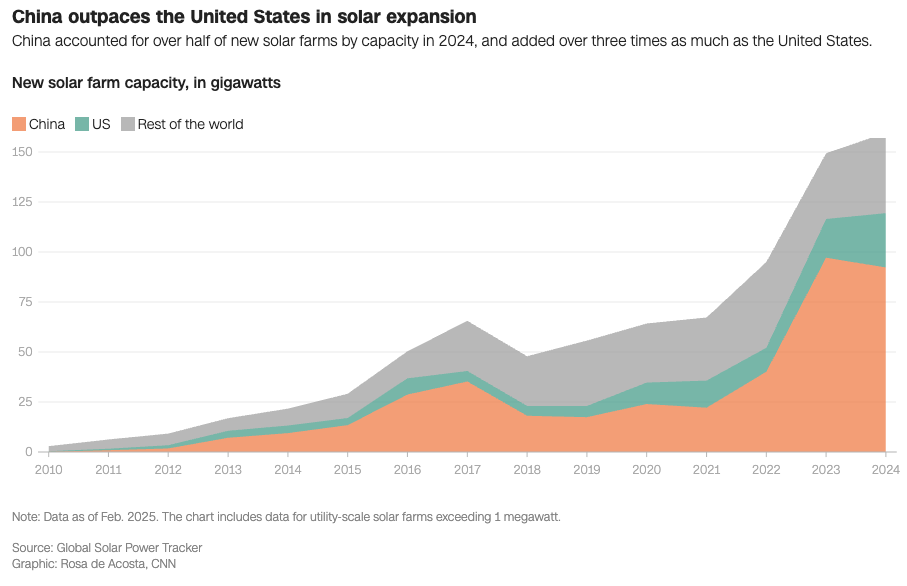

New data from Global Energy Monitor indicates that China installed more wind and solar capacity in a single year than the entire amount of renewable energy currently operating in the United States. At the end of 2024, the US had approximately 275 gigawatts of wind and solar capacity online, with another 150 gigawatts planned for construction through 2031. By contrast, China already has 1,400 gigawatts of utility-scale solar and wind capacity in operation and is building an additional 510 gigawatts.

Earlier in July, President Donald Trump signed a spending bill that phases out tax credits for wind and solar projects. Industry experts and modeling from the nonpartisan Rhodium Group suggest that eliminating these incentives will raise electricity costs for businesses and consumers, as more expensive natural gas generation displaces lower-cost renewable power. The law is projected to halve planned additions of renewable capacity in the United States over the next decade compared with previous projections.

In China, developers accelerated construction to qualify for government subsidies that expired in June, contributing to the surge in new installations. Although most large-scale wind and solar farms are located far from major population centers, renewable power covered the country’s entire increase in electricity demand over recent months without adding to greenhouse gas emissions. Analysts also note that China’s rapid adoption of electric vehicles has reduced oil consumption, especially in cities like Beijing, where most ride-hailing drivers have switched to EVs to cut fuel costs.

In the US, the reduction in renewable incentives may introduce challenges for future industrial investment. Companies that require large amounts of power—such as data centers and semiconductor manufacturers—could face higher electricity prices and longer lead times for gas-fired generation, potentially discouraging new projects. With fewer renewables coming online and limited capacity to build natural gas plants quickly, some analysts warn that the US may struggle to meet growing electricity demand.