Technological innovations and decreasing green metal prices are expected to drive electric vehicle (EV) battery prices significantly lower than previously anticipated, according to Goldman Sachs Research. Advances in battery energy density and reductions in the costs of key metals like lithium and cobalt are the primary factors contributing to this trend.

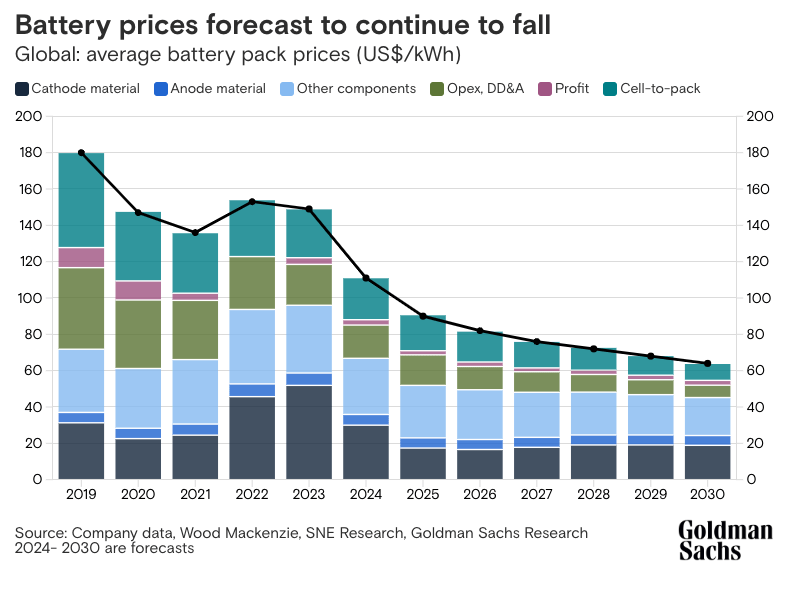

Global average battery prices decreased from $153 per kilowatt-hour (kWh) in 2022 to $149 in 2023. Goldman Sachs Research projects these prices will fall to $111 by the end of this year. By 2026, average battery prices could reach approximately $80/kWh, representing a nearly 50% reduction from 2023 levels. This price point is significant, as it could enable battery electric vehicles to achieve ownership cost parity with gasoline-powered cars in the United States without subsidies.

To understand what’s driving this anticipated decline and its implications for EV demand, we spoke with Nikhil Bhandari, co-head of Goldman Sachs Research’s Asia-Pacific Natural Resources and Clean Energy Research.

Why are EV battery prices declining faster than expected?

“There are two main drivers,” Bhandari explains. “First is technological innovation. We’re seeing multiple new battery products with about 30% higher energy density and lower costs. Second is the continued downturn in battery metal prices, particularly lithium and cobalt. Nearly 60% of battery costs are due to metals, and roughly 40% of the expected decline from 2023 to 2030 comes from lower commodity costs. We experienced significant ‘green inflation’ from 2020 to 2023, with metal prices at very high levels.”

What enables battery makers to increase energy density so dramatically?

“The innovation relates to the structure of the batteries,” says Bhandari. “Cells are getting bigger, and manufacturers are eliminating modules by directly implementing cell-to-pack designs. This simplification saves space and reduces costs while increasing the battery’s energy capacity.”

Which battery types are currently dominating the market?

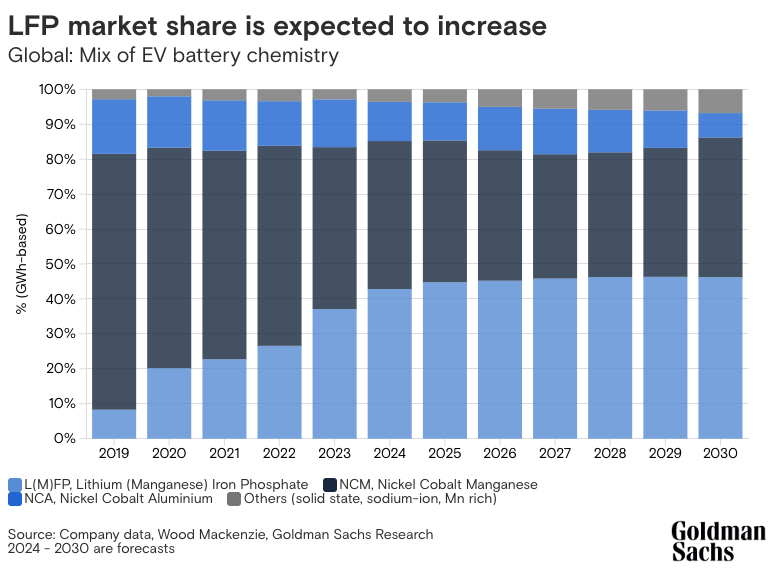

“The leading battery types are both lithium-based,” Bhandari notes. “One is based on nickel chemistry, dominating nearly 60% of the market, and the other is lithium iron phosphate (LFP), which is iron-based and accounts for about 35-40% of the market. A very small share comes from sodium-ion batteries, the only non-lithium option currently, but they are not yet scaled up.”

Do you expect these leading battery types to maintain their dominance?

“In the future, solid-state batteries could be a game changer due to their higher energy density and improved safety, as they lack flammable liquid electrolytes,” Bhandari explains. “However, solid-state batteries have been delayed to the latter part of this decade due to challenges in scaling from lab to mass production. Meanwhile, existing lithium-based chemistries are strengthening, making it harder for solid-state batteries to replace current technologies. We have increased our expectation for LFP batteries to capture 45% of the market by 2025, with advanced nickel batteries continuing to lead in higher energy applications.”

What does this mean for incumbent battery producers?

“The entry barriers in the battery industry are high,” says Bhandari. “It takes about ten years from startup R&D to initial production, and even longer to achieve quality and manufacturing efficiency. Five companies control nearly 80% of the market share, each with over two decades of experience and intensified R&D investments in recent years. This creates a challenging environment for new entrants, especially during cyclical downturns, as they struggle to reach manufacturing efficiency and profitability.”

Will the decline in battery prices boost EV demand?

“When assessing price parity with internal combustion engine (ICE) cars, we traditionally considered the price premium of EVs and the time required to recoup that through fuel savings,” Bhandari explains. “However, we didn’t fully account for consumers’ concerns about falling resale values of EVs, as they anticipate cheaper models in the future. Our enhanced total cost of ownership analysis factors this in. Despite near-term EV battery demand relying more on regulations, we expect total cost of ownership parity in markets like the U.S. to be achieved starting in 2026. We anticipate a strong resurgence in demand that year, initiating a consumer-led adoption phase driven purely by economic factors.”

Source: Goldman Sachs