As reported by CarNewsChina, citing internal information, BYD is working on two variants of the new Blade battery. The first variant is a short blade format with an energy density of 160 Wh/kg, a charge rate of 8C, and a maximum discharge rate of 16C. The second, longer blade format offers an energy density of up to 210 Wh/kg, a charge rate of 3C, and a discharge rate of 8C.

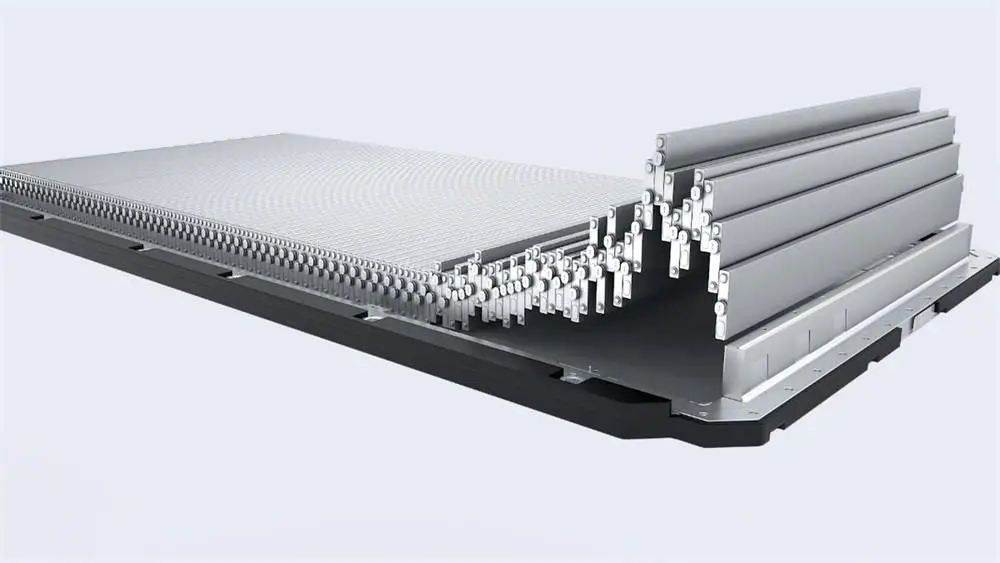

Introduced in 2020, the Blade battery is a proprietary development by BYD. The name references its unique format: the cells are very long, resembling a sword blade. These elongated cells are installed in battery packs perpendicular to the direction of travel. BYD utilizes different variants, including both cell-to-pack and cell-to-body versions, in its electric vehicles. All variations employ lithium iron phosphate cell chemistry. The current Blade battery achieves an energy density of approximately 150 Wh/kg.

BYD has not modified the technology in recent years, making the second generation highly anticipated. If the insider information holds true, future batteries will feature longer or shorter blade cells. The ‘C’ value indicates the ratio of battery capacity to its charging and discharging rates. It indicates how many times a battery can charge within an hour. For example, an average 1C charge rate means that the battery can fully charge in one hour, 2C twice in an hour, and 8C means that the battery can charge eight times in an hour, or, in other words, it can fully charge within 7.5 minutes, assuming a constant charging power

CarNewsChina further reports that the fast-charging battery version with shorter blades and 160 Wh/kg energy density will be priced similarly to or slightly higher than the current generation. This pricing is due to production scaling challenges and limited influence over suppliers. Conversely, the more energy-efficient version is expected to cost 15% less than the current model. Rumors suggest the new Blade battery will be utilized in the U7 sedan of BYD’s Yangwang subsidiary, among others.

In the Chinese battery market, BYD has achieved a market share of 24.4% in the current year after three out of four quarters, according to data from the China EV DataTracker. BYD’s installed electric vehicle battery capacity of 101 GWh represents a 19.4% increase compared to the same period last year. The company relies almost exclusively on LFP batteries. In comparison, CATL secured 46% of the Chinese market with an installed capacity of 183.02 GWh, marking a 45% year-on-year increase. CATL’s growth was primarily driven by LFP batteries, up 60%, with less impact from NMC batteries, which increased by 28%.

Source: Electrive, CarNewsChina