The rapid adoption of clean energy technologies offers significant opportunities for countries aiming to manufacture and trade these technologies but also presents challenging policy decisions, according to a new report by the International Energy Agency (IEA).

“Energy Technology Perspectives 2024 (ETP-2024)” focuses on the outlook for six key mass-produced clean energy technologies: solar photovoltaics (PV), wind turbines, electric vehicles (EVs), batteries, electrolyzers, and heat pumps. Based on current policy settings, the global market for these technologies is projected to grow from $700 billion in 2023 to over $2 trillion by 2035, approaching the value of the global crude oil market in recent years. Trade in clean technologies is also expected to rise sharply, more than tripling within a decade to reach $575 billion, making it over 50% larger than today’s global trade in natural gas.

The report provides a first-of-its-kind analytical framework for policymakers navigating the evolving landscape of clean energy manufacturing and trade. Built on a new bottom-up dataset and quantitative modeling based on countries’ policies, ETP-2024 maps out the current state of clean energy manufacturing and trade and how they are set to evolve. It explores how countries at different stages of development can capture the benefits of the emerging energy economy while ensuring secure and cost-effective clean energy transitions.

“The market for clean technologies is set to multiply in value in the coming decade, increasingly catching up with the markets for fossil fuels. As countries seek to define their role in the new energy economy, three vital policy areas—energy, industry, and trade—are becoming more and more interlinked. While this leaves governments with tough and complicated decisions ahead, this groundbreaking new IEA report provides a strong, data-driven foundation for their decisions,” said IEA Executive Director Fatih Birol. “Clean energy transitions present a major economic opportunity, as we have shown, and countries are rightly seeking to capitalize on that. However, governments should strive to develop measures that also foster continued competition, innovation and cost reductions, as well as progress towards their energy and climate goals.”

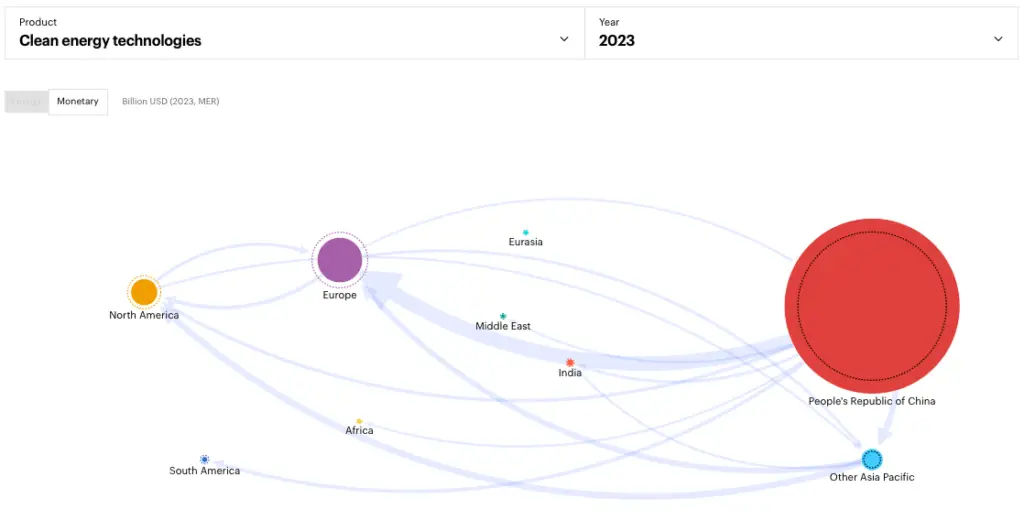

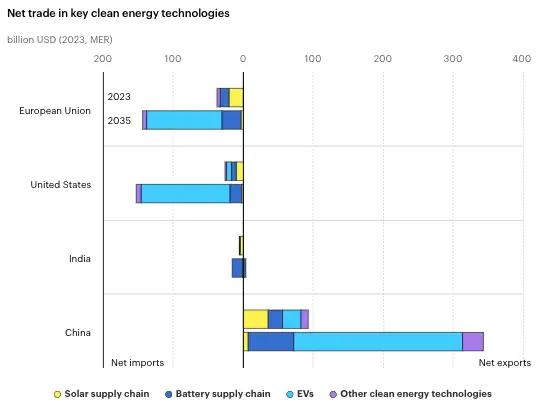

The surge in the global clean technology market is accompanied by a record wave of investment in manufacturing as countries look to bolster energy security, maintain economic competitiveness, and reduce emissions. Most of this spending is concentrated in countries and regions that already have an established foothold in the sector: China, the European Union, the United States, and increasingly India.

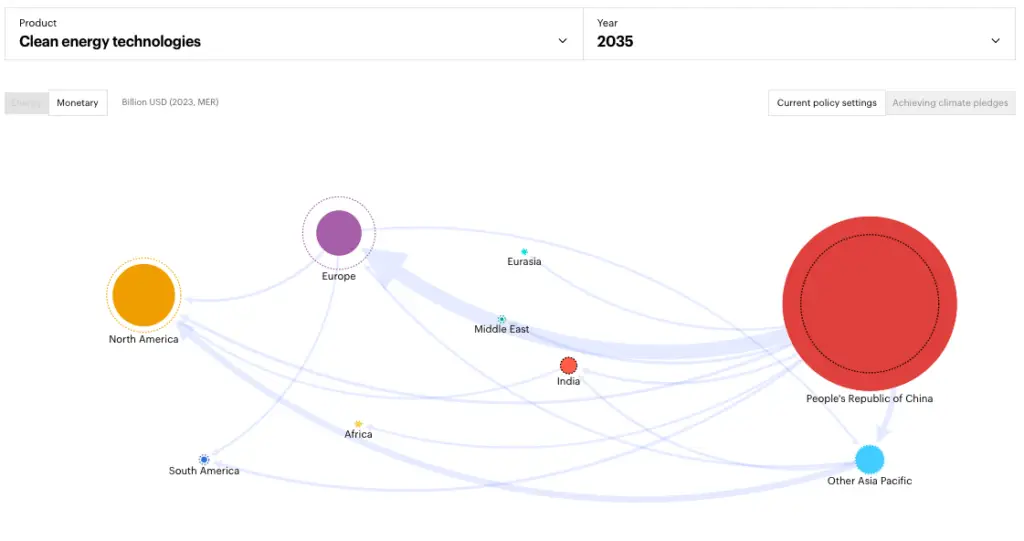

Despite significant initiatives like the Inflation Reduction Act and Bipartisan Infrastructure Law in the United States, the EU’s Net-Zero Industry Act, and India’s Production Linked Incentive Scheme, China is set to remain the world’s manufacturing powerhouse for the foreseeable future. Under current policies, China’s clean technology exports are on track to exceed $340 billion in 2035, roughly equivalent to the projected oil export revenue this year of Saudi Arabia and the United Arab Emirates combined.

Currently, countries in Southeast Asia, Latin America, and Africa account for less than 5% of the value generated from producing clean technologies. However, ETP-2024 emphasizes that the door to the new clean energy economy remains open to countries at different stages of development. It identifies key opportunities for emerging and developing economies based on a country-by-country assessment of more than 60 indicators, such as the business environment, infrastructure for energy and transport, resource availability, and domestic market size.

The report finds that emerging and developing economies could leverage their competitive advantages to move up the value chain beyond the mining and processing of critical minerals. For example, Southeast Asia could become one of the cheapest places to produce polysilicon and wafers for solar panels within the next 10 years. Latin America—particularly Brazil—has the potential to scale up its wind turbine manufacturing for export to other markets in the Americas. North Africa has the ingredients to become an EV manufacturing hub within the next decade, while various countries in sub-Saharan Africa could produce iron with low-emissions hydrogen.

“Growth in the manufacturing and trade of clean energy technologies should be for the benefit of many economies, not just a few,” Dr. Birol said. “This report shows that countries in Southeast Asia, Latin America, Africa and beyond have strong potential to play important roles in the new energy economy. And it finds that with sound strategic partnerships, increased investment and greater efforts to bring down high financing costs, they can achieve this potential.”

The report also explores the global implications as trade in clean energy technology expands. The shift from importing fossil fuels to importing clean technologies could increase the resilience of energy supplies. While fossil fuel supplies need continual replenishment, importing clean technologies provides a durable stock of energy equipment, resulting in greater efficiency. A single journey by a large container ship filled with solar PV modules can provide the means to generate the same amount of electricity as the natural gas from more than 50 large LNG tankers or the coal from over 100 large bulk ships.

However, new energy security dimensions need consideration. Today, around half of all maritime trade in clean energy technologies passes through the Strait of Malacca, connecting the Indian and Pacific Oceans. While the implications for energy security differ, it’s notable that this is significantly more than the roughly 20% of fossil fuel trade that passes through the Strait of Hormuz.

Source: IEA