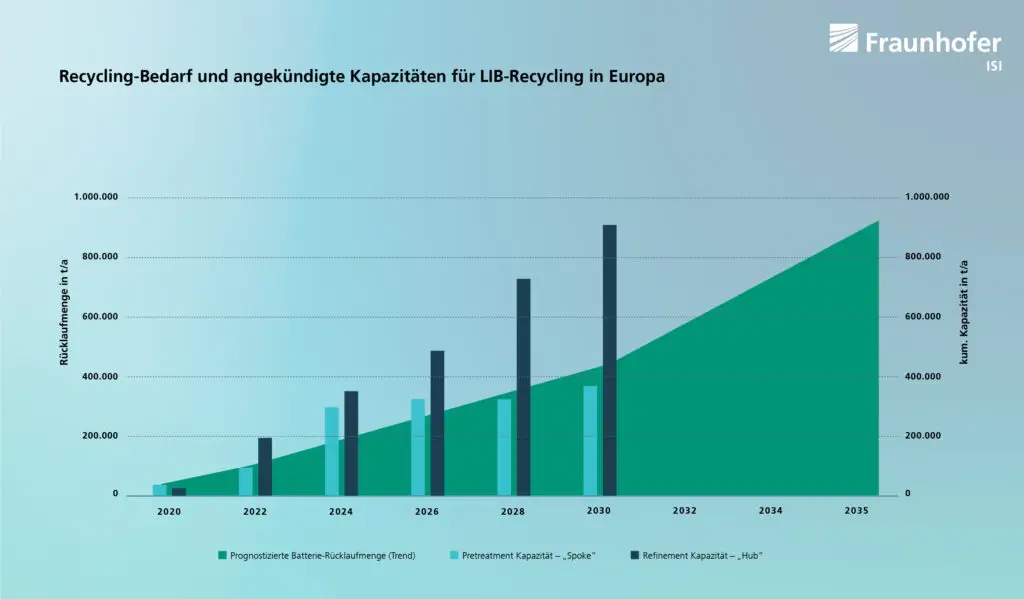

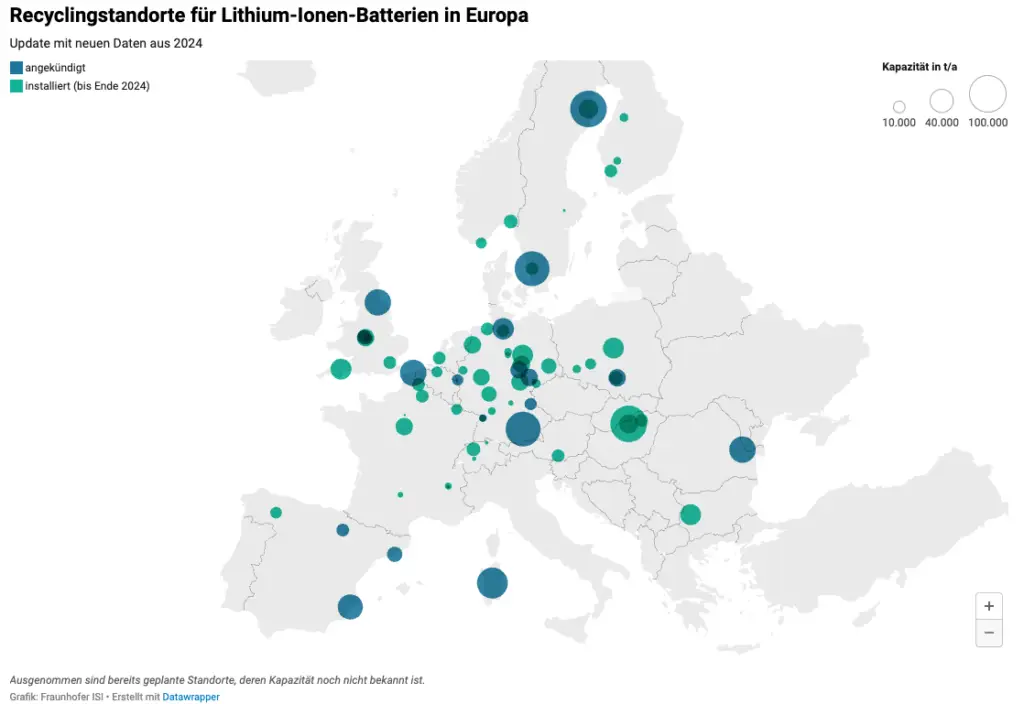

The European lithium-ion battery recycling industry is experiencing unprecedented growth, with total capacity expected to reach a staggering 330,000 tons per year by 2026. This expansion is being driven by a combination of factors, including stringent regulatory requirements, the burgeoning European battery industry, and an expected increase in end-of-life batteries.

By the end of 2024, recycling capacity is expected to more than double from 2023 levels, reaching 300,000 tons per year. The industry is organized around two main types of facilities: “spokes” for pretreatment and “hubs” for materials recovery, with some integrated facilities performing both functions.

Most significantly, planned recycling capacity is expected to exceed the projected supply of recyclable batteries and manufacturing scrap in the near future. This proactive approach positions Europe at the forefront of sustainable battery technology. However, it also carries the risk of overcapacity in the long term.

While European companies currently dominate the recycling market, Asian and American companies are rapidly expanding their presence. They now account for around 40% of spoke capacity and 45% of hub capacity. Germany, in particular, has emerged as a major player, with German companies providing about a quarter of European spoke capacity.

Key players in this growing market include European companies such as Northvolt, Altilium Metals and Librec, as well as international companies such as SungEel and Ecobat.

The growth of the recycling industry is closely linked to the expansion of battery cell production in Europe, as production scrap is a significant source of recyclable material. Hydrometallurgy is emerging as the core process of choice for material recovery in Europe’s recycling hubs, demonstrating the industry’s strong commitment to efficient and environmentally friendly practices.

As the industry continues its dynamic growth, experts expect recycling capacity to become more closely aligned with input streams as returns increase. This development not only supports Europe’s circular economy goals, but also strengthens its position in the global battery value chain.

Source: Fraunhofer ISI Update (in German)