Competition among automakers, battery manufacturers, and stationary storage providers is accelerating the development of advanced batteries that are more cost-effective, perform better, and use materials that are easier and less expensive to source. According to BloombergNEF, numerous companies are expected to introduce significant battery breakthroughs throughout this decade.

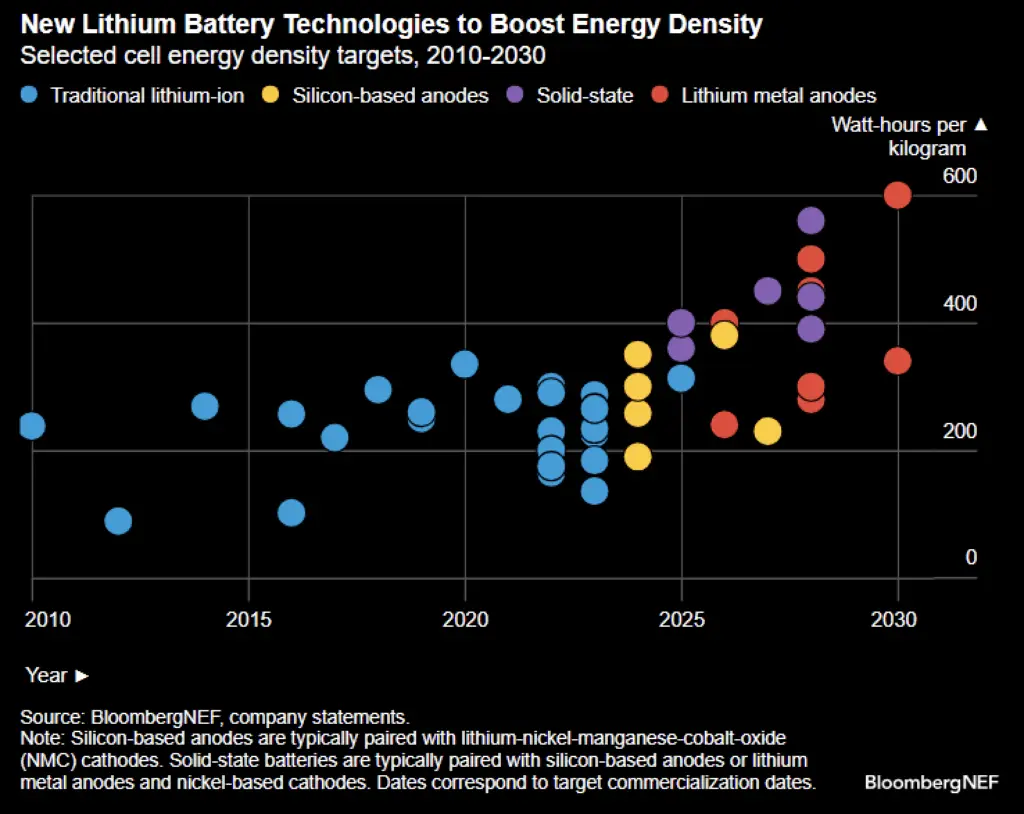

Emerging technologies in cathode, anode, and electrolyte components are anticipated to deliver the next generation of batteries. Lithium-ion batteries have become the industry standard across various sectors due to their high energy density, good performance, long cycle life, and established supply chain. Energy density, which measures how much energy can be stored per unit of mass or volume, remains a critical performance metric, particularly for increasing the driving range of electric vehicles.

While advancements in cathode technology have historically driven improvements in energy density, current cathodes are nearing their theoretical limits. As a result, companies are investing heavily in silicon-based anodes, lithium metal anodes, and solid-state electrolytes, which offer significant potential for enhancing battery performance and energy density.

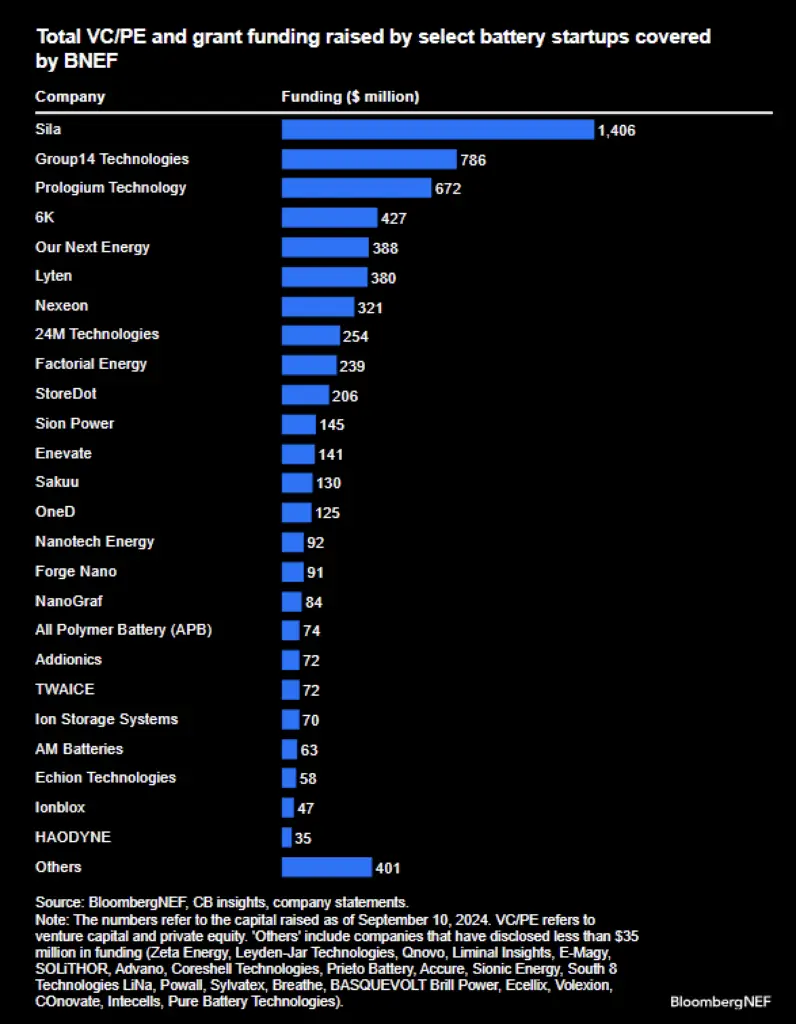

BloombergNEF has identified 61 battery startups working on innovations across anode, cathode, electrolyte, software, manufacturing processes, cell and pack design, coating, and additives. These companies have collectively raised $6.9 billion in private equity, venture capital, and grant funding as of September 2024, representing just a fraction of the active participants in this sector.

Introducing new battery technologies typically involves the development of new components or materials, manufacturing processes, and raw material supply chains. These endeavors require substantial investment, technical expertise, and time. Only a limited number of new technologies advance beyond the pilot production stage, as scaling up from prototype to large-scale production poses significant challenges.

The success of these emerging technologies will depend on how rapidly they can be scaled and integrated into existing manufacturing infrastructures. While production of solid-state batteries is beginning to ramp up this decade, mass production for affordable vehicles may still be some years away. In the meantime, advancements such as silicon-based anodes and dry electrode coating are progressing, with major automakers moving towards their adoption. Initially, these new technologies are likely to be implemented in high-performance applications like aviation and military equipment before being introduced into cost-sensitive mass-market electric vehicles.

Source: BloombergNEF