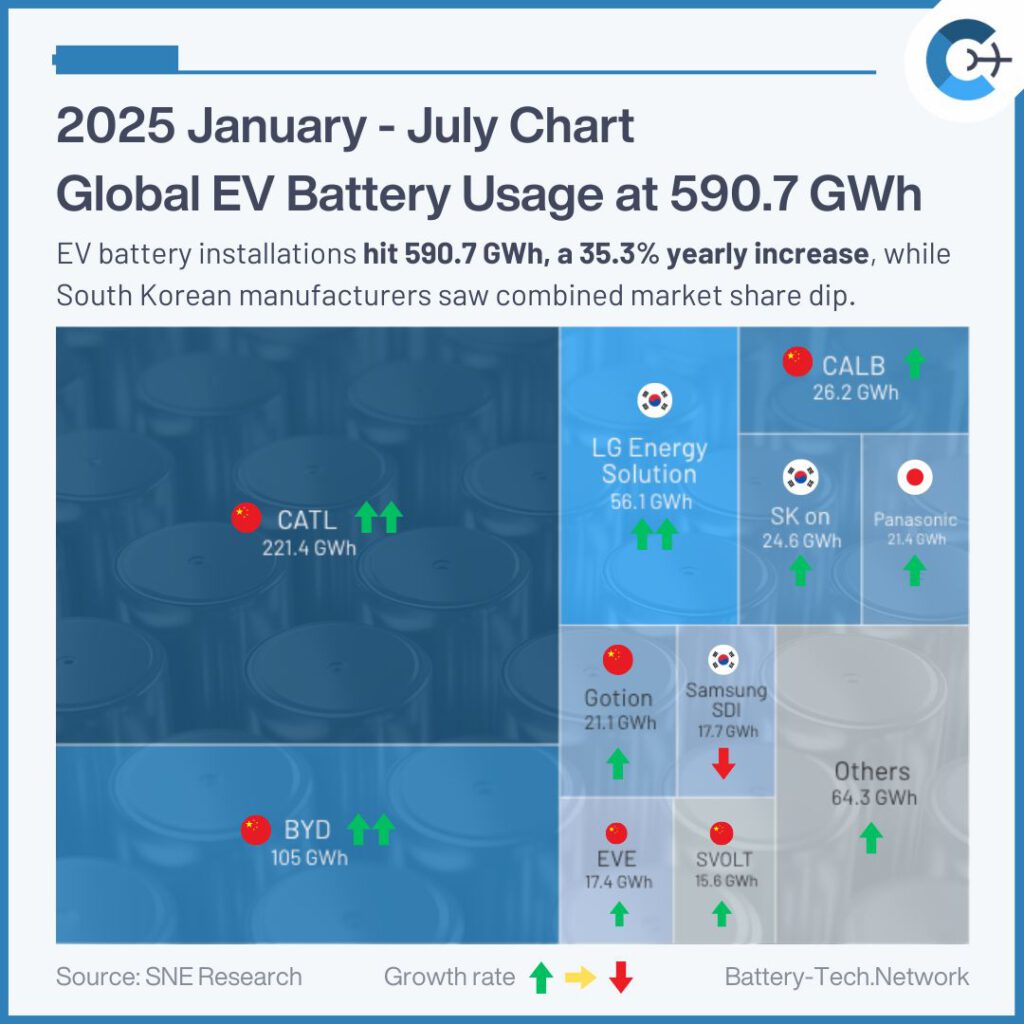

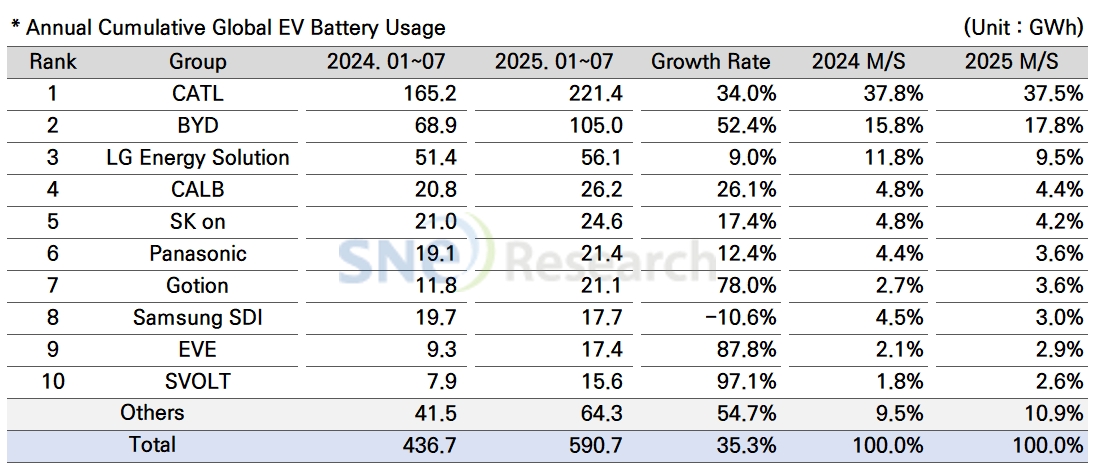

Between January and July 2025, battery energy installed in electric vehicles globally totaled about 590.7 GWh, marking a 35.3 percent year-over-year increase.

In the same period, the combined market share of three South Korean producers—LG Energy Solution, SK On, and Samsung SDI—was 16.6 percent, down 4.5 percentage points from early 2024.

LG Energy Solution held a 9.0 percent share with 56.1 GWh, SK On grew 17.4 percent to 24.6 GWh, while Samsung SDI’s usage fell by 10.6 percent to 17.7 GWh.

Samsung SDI’s batteries are chiefly fitted in models by BMW, Audi, and Rivian. A slowdown in sales of BMW’s i4, i5, i7, and iX contributed to a 5.9 percent decline in battery usage, and Rivian’s launch of a standard-range trim equipped with LFP cells from another supplier further reduced Samsung SDI’s share. Conversely, Audi’s introduction of the Q6 e-Tron generated a 6.1 percent rise.

SK On supplies Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Stronger demand for refreshed IONIQ 5 and EV6 models and steady sales of VW’s ID.4 and ID.7 drove battery usage higher. Although Ford’s F-150 Lightning sales softened, growth in its Explorer EV, E-Transit, and PUMA EV models led to a 12.9 percent increase.

LG Energy Solution’s cells power vehicles from Tesla, Chevrolet, Kia, and Volkswagen. Tesla’s overall sales dip and lower volumes of trims using LG Energy Solution batteries resulted in a 23.6 percent fall in usage, but robust global sales of the Kia EV3 and North American demand for Ultium-based Equinox, Blazer, and Silverado EV models helped offset some losses.

Panasonic ranked sixth with 21.4 GWh, primarily supplying Tesla. The company is diversifying its supply chain to reduce reliance on Chinese materials, secure local sources, and enhance production stability.

Market leaders CATL and BYD held the top two positions with 221.4 GWh (34.0% growth) and 105.0 GWh (52.4% growth), respectively. CATL’s cells back both domestic and international brands, while BYD’s vertically integrated approach supported its strong expansion in China and Europe, where its battery usage surged 260.7 percent to 6.9 GWh.

Regulatory changes—such as reduced incentives and new rules targeting Chinese-linked materials—are prompting automakers and cell makers to localize sourcing and manufacturing in North America. At the same time, Europe’s recovery under stricter CO₂ rules and the U.S. market’s mix of hybrid and full-EV demand are reshaping strategies for portfolio planning, OEM partnerships, and contract sourcing to optimize incentives and cash flow.

Source: SNE Research