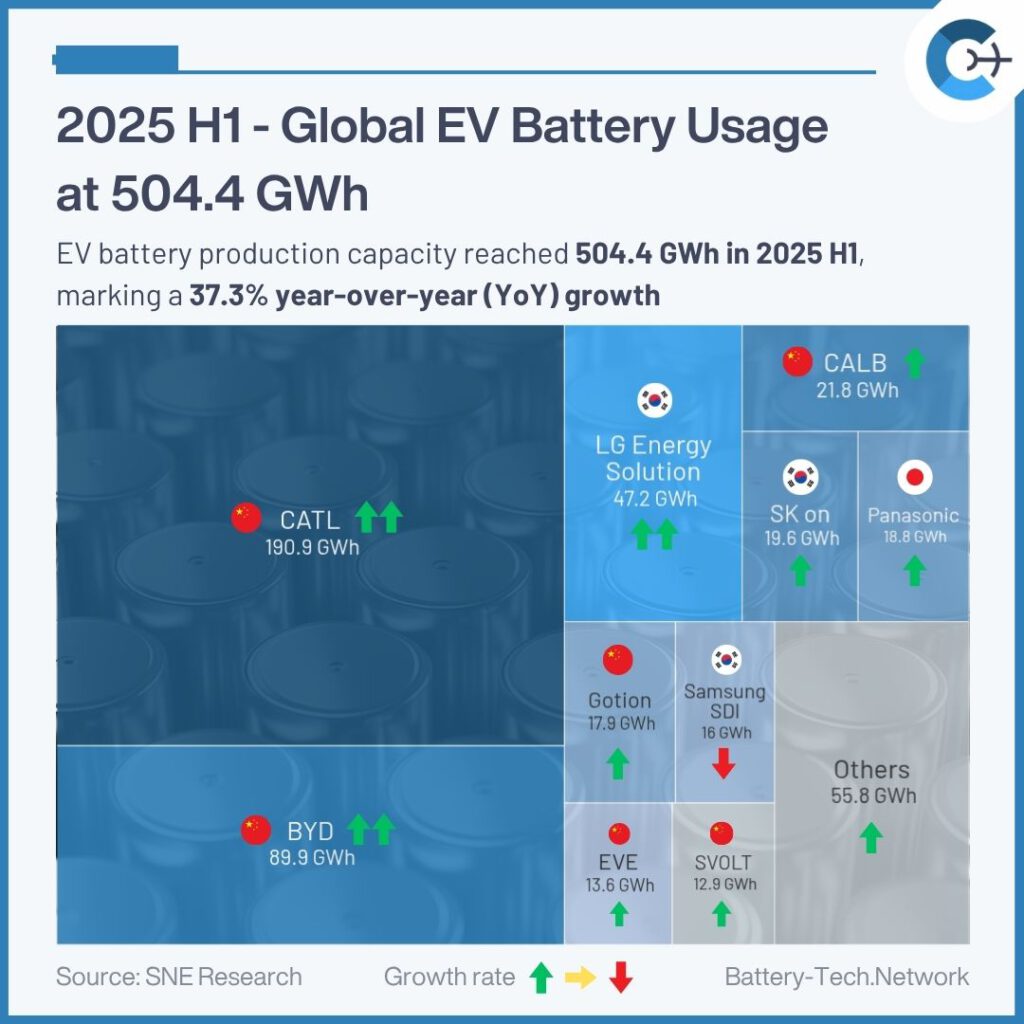

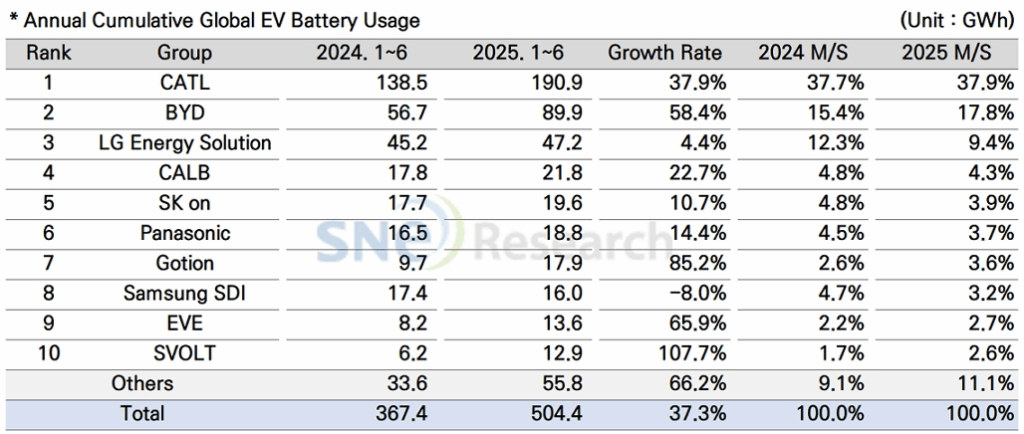

From January to June 2025, electric-vehicle (EV, PHEV, HEV) battery installations worldwide totaled 504.4 GWh, representing a 37.3% increase over the same period in 2024.

- CATL led all companies with 190.9 GWh (37.9% growth), supplying models from both Chinese OEMs (e.g., ZEEKR, Li Auto, Xiaomi) and global brands (Tesla, BMW).

- BYD ranked second at 89.9 GWh (58.4% growth), benefiting from strong in-house BEV+PHEV sales and rapid expansion in Europe (6.0 GWh; +313.4% YoY).

The combined market share of South Korea’s “K-trio”—LG Energy Solution, SK On, and Samsung SDI—fell by 5.4 percentage points to 16.4%. Among them:

- LG Energy Solution grew battery usage by 4.4% (47.2 GWh), ranking third.

- SK On saw 10.7% growth (19.6 GWh), securing fifth place.

- Samsung SDI experienced an 8.0% decline (16.0 GWh), driven by lower volumes in BMW’s i4 model and competition from LFP-equipped Rivian trims; Audi’s Q6 e-Tron demand helped offset some declines.

Other key suppliers:

- Panasonic, primarily a Tesla supplier, recorded 18.8 GWh (sixth place) and is diversifying away from Chinese materials to bolster North American production stability.

Emerging U.S. and European policies—including the U.S. One Big Beautiful Bill Act and the IRA’s Foreign Entity of Concern rule—are reshaping battery supply chains. In response, South Korean manufacturers plan to expand local capacity, reduce reliance on Chinese raw materials, and strengthen non-China supply networks, while Europe promotes local production incentives and strategic stockpiling. Chinese firms are also accelerating regional plant construction, intensifying competition.

Battery makers now face a pivotal moment demanding not only technological excellence but also resilient, geographically diversified supply strategies.

Source: SNE Research