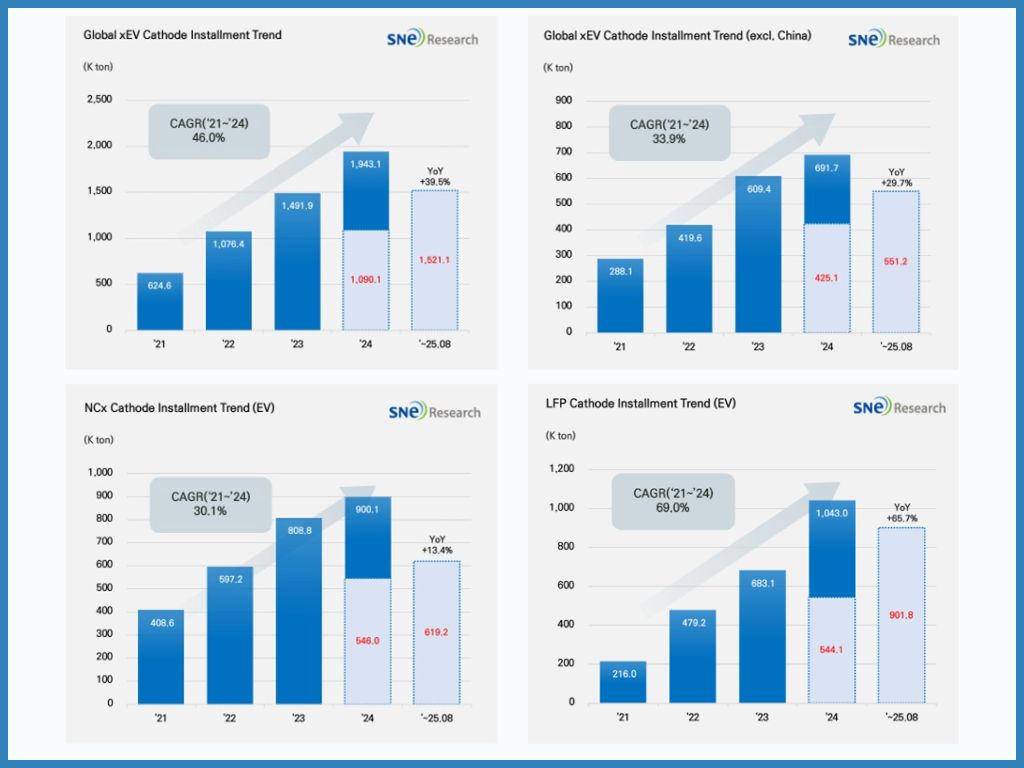

Between January and August 2025, global installations of cathode materials for electric vehicles (EV, PHEV, HEV) reached approximately 1.521 million metric tons, representing a 39.5% year-on-year increase. Installations outside China accounted for about 551,000 metric tons, up 29.7% compared to the same period in 2024.

Cathode materials, which determine lithium-ion battery capacity, output value and driving range, are principally supplied in two chemistries: nickel-cobalt-manganese (NCx) ternary and lithium iron phosphate (LFP). Both segments are driven by distinct technical and economic advantages.

Ternary cathode materials saw installations of 619,000 metric tons, a 13.4% increase year over year. Leading suppliers included Ronbay and LG Chem, followed by Korean firms L&F (52,000 tons), Ecopro (40,000 tons) and POSCO (31,000 tons). Meanwhile, Chinese manufacturers—Reshine, Easpring and ShanShan—recorded notable growth, leveraging strong domestic demand, aggressive pricing strategies and rapid capacity expansions to capture additional global share.

LFP chemistry installations rose 65.7% to 902,000 metric tons, accounting for roughly 59% of total cathode material weight. This surge reflects the expansion of entry-level EV production in China, the cost competitiveness of LFP chemistry, and growing adoption by international automakers. Among suppliers, Hunan Yuneng led with 214,000 tons, followed by Wanrun (145,000 tons), Dynanonic (111,000 tons) and Lopal (95,000 tons). The dominance of Chinese companies in the LFP segment underscores China’s reinforced position in the global battery materials supply chain.

The market is at a strategic inflection point, as regulatory and supply-chain shifts exert new pressures. China’s restrictions on overseas technology transfers and the European Union’s tightening of recycling-efficiency standards are prompting manufacturers to rethink production and distribution. Success will likely favor companies that develop in-house cathode technologies, secure material supply through recycling and establish localized production networks.

Additionally, portfolio diversification into LMFP, solid-state and sodium-ion chemistries is becoming a strategic imperative. Experts recommend phased capacity expansions, regional manufacturing modularization and alignment with U.S. foreign-entity and tariff policies to build resilient, localized supply chains.

Source: SNE Research