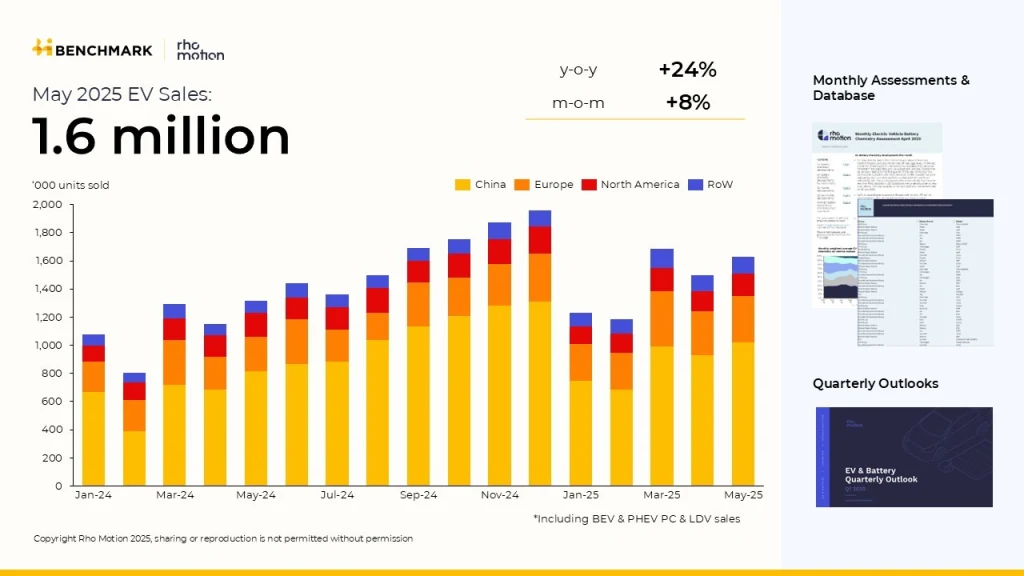

Global electric vehicle (EV) sales reached 1.6 million units in May 2025, pushing the year-to-date (YTD) total to 7.2 million, according to Rho Motion. This represents a 24% increase compared to May 2024 and an 8% rise over April 2025. Overall, the EV market has grown 28% YTD versus the same period in 2024.

By region, China led with 4.4 million EVs sold YTD, a 33% year-over-year gain. May marked the first time this year that monthly Chinese sales exceeded one million units, a level last seen in August 2024. Month-on-month sales were up 10%, and year-on-year sales climbed 25%. Domestic manufacturers continue to expand into overseas markets. For example, BYD introduced its Dolphin Surf compact EV in Europe at an approximate price of USD 25,000. Hybrid models from Chinese brands also benefit from exemption from the additional EU tariff on fully electric vehicles.

Europe recorded 1.6 million EVs sold YTD, up 27%. Growth in major markets remained strong: Germany posted a 45% increase, the UK 32%, Spain 72%, and Italy 58%. In June, Germany launched a new incentive plan offering enhanced depreciation and corporate tax breaks for electric fleets. Rho Motion expects these measures to boost sales, noting that corporate purchases account for over half of new vehicle registrations.

North America—including the US, Canada, and Mexico—saw 0.7 million EVs sold YTD, a 3% rise. The US experienced moderate growth of 4% as federal tax credits for eligible EVs remain in place through 2025, though they will phase out significantly in 2026 and end by 2027. Canada’s market fell approximately 20% after pausing its EV incentive program earlier this year.

“Regional policy shifts continue to shape market dynamics,” said Charles Lester, Data Manager at Rho Motion. “Incentives in Europe are fueling rapid adoption, while subsidy pauses in Canada have had a noticeable impact.”

Source: Rho Motion