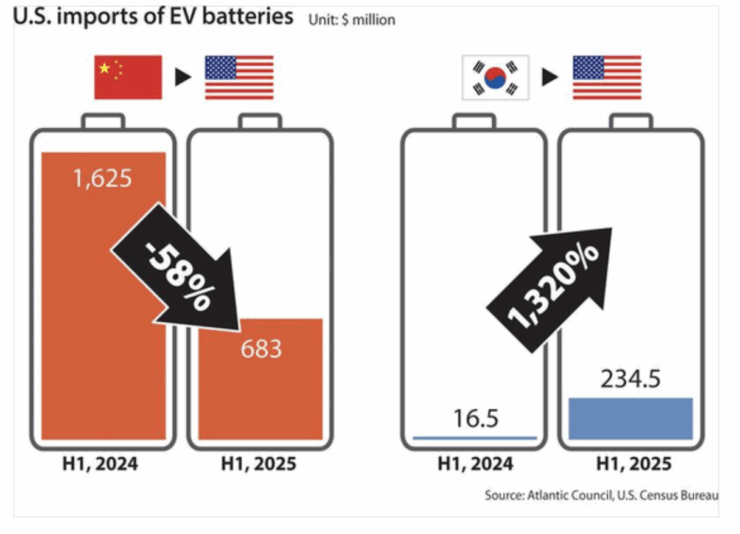

From January to June 2025, the United States imported $234.5 million in lithium-ion EV batteries from South Korea, marking a 1,320 percent increase year-on-year and a 2,850 percent rise compared to the first half of 2023, according to U.S. Census Bureau data analyzed by the Atlantic Council.

During the same period, U.S. imports of Chinese EV batteries declined 58 percent to $683 million from $1.63 billion, with May shipments plunging nearly 85 percent amid heightened tariff tensions.

China’s share of U.S. EV battery imports fell to 38.1 percent from 72 percent a year earlier, while South Korea’s share climbed to 13.1 percent from 0.73 percent. A similar shift is visible in the market for energy storage system (ESS) batteries. U.S. imports of Korean-made ESS batteries rose 84 percent to $934.4 million, lifting South Korea’s share from 7.5 percent to 11 percent. Chinese ESS battery imports grew 23 percent to $5.65 billion but saw their share decline to 67 percent from 69 percent. In June, Korean ESS imports reached $243 million, while Chinese imports were at their lowest since April 2022 at $441 million.

U.S. tariffs—38.4 percent on Chinese EV batteries plus an additional 10 percent “baseline tariff”, and ESS duties rising to 58.4 percent next year—have placed Chinese suppliers at a disadvantage. Korean producers now face a 15 percent tariff under the Korea-U.S. Free Trade Agreement. Experts say these measures are redirecting U.S. buyers toward Korean manufacturers, which have invested heavily in local production. LG Energy Solution operates plants in Ohio, Tennessee and Michigan; Samsung SDI is building facilities in Indiana with Stellantis and General Motors; and SK On runs factories in Georgia and is opening another in Kentucky.

Once fully operational, these facilities will deliver a combined capacity of 600 gigawatt-hours—enough to power about 7.5 million high-performance EVs. LG’s $4.3 billion ESS contract, believed to involve Tesla, and plans by Samsung SDI and SK On to expand local ESS LFP production underline the strategic gains driven by U.S. tariff policy. The U.S. ESS market is projected to grow from $3.68 billion in 2025 to $5.09 billion by 2030, according to Mordor Intelligence.

“The tariff war is likely to reduce imports of Chinese batteries into the United States, which could be positive for Korean battery firms,” said Choi Jae-hee, a senior researcher at the Korea Institute for International Economic Policy. “But to capitalize on the space left by the exclusion of Chinese competitors, Korean companies must strengthen their competitiveness, in particular in LFP technologies, which are widely used in ESS applications.”

Source: Korea JoongAng Daily