Moore Venture Partners, known as MVP FUNDS, was founded in 2010 and is based in Carlsbad, California. Under Managing Partner Terry Moore, the firm draws on extensive experience in investing in technology and life sciences ventures. As one of the region’s earliest traditional venture capital firms, MVP supports founders from early development through expansion phases, building companies that generate market value and employment across industries while delivering products or services designed to positively affect communities at scale.

MVP takes a selective approach to funding, reviewing over 500 business plans each year and investing in four to five startups annually. Investment checks range from pre-seed through Series A, with a focus on early growth and expansion stages. Now deploying its fourth fund, the firm offers hands-on support and access to a broad network of industry advisors across technology and life sciences. This model helps companies refine their product offerings, scale operations, attract further capital and expand into domestic and international markets.

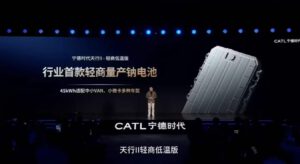

In addition to investments in software, biotech and healthcare diagnostics, MVP has backed clean technology initiatives. Its portfolio includes EcoATM, a leader in e-waste recycling, and UCAP Power, which develops ultracapacitor-based energy storage solutions as an alternative to conventional batteries. MVP led UCAP Power’s Series A round in 2021 and joined its Series B in 2025. While these investments reflect interest in sustainable technology and advanced storage, they sit alongside ventures in other sectors rather than defining the firm’s sole investment thesis.