Welcome back to this week’s Battery Business Insights article. Today, we address a critical issue shaping the global auto industry: China’s electric vehicle overproduction. What began as a strategic push for green technology leadership has spiraled into a complex situation with deep consequences. The country is now grappling with a saturated domestic market, forcing its carmakers into a difficult position and triggering protectionist responses from Western nations.

Facts In Numbers

Here are some of the key figures that define the current situation:

- 20+ million: The projected surplus of EV units in China by 2025, with production capacity at 36 million against a sales forecast of 14 million.

- 45%: The mandated share of new car sales that must be EVs in China by 2027, showing continued domestic policy support despite the overcapacity.

- 50%: The estimated factory utilization rate for various Chinese automakers, which is below the 80% breakeven point.

- 3.21 months: The average vehicle inventory held by BYD dealers, a clear indicator of oversupply vs. 1.38 months of industry average.

- 34%: The price cut offered by BYD on certain models, fueling a domestic price war.

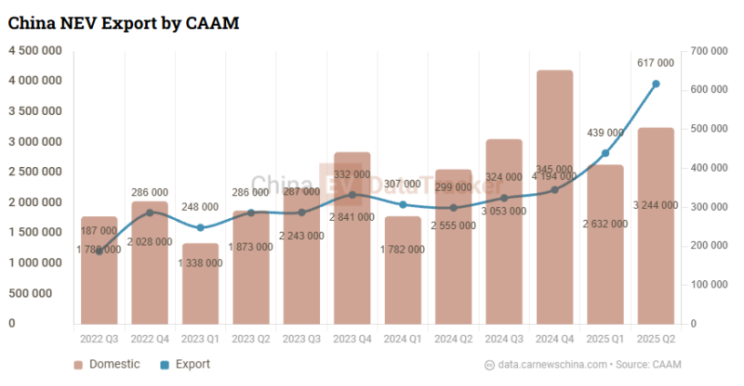

- 33%: NEVs (EVs and PHEVs) now account for 1/3 of all car exports from China.

- 100+ %: The tariff rate imposed by the U.S. on Chinese-made EVs as of May 2025, and ranging between 132.5% and 247.5% (during US-China trade dispute in 2025).

- Up to 38%: The peak tariff rate imposed by the EU on certain Chinese EV imports starting in July 2025.

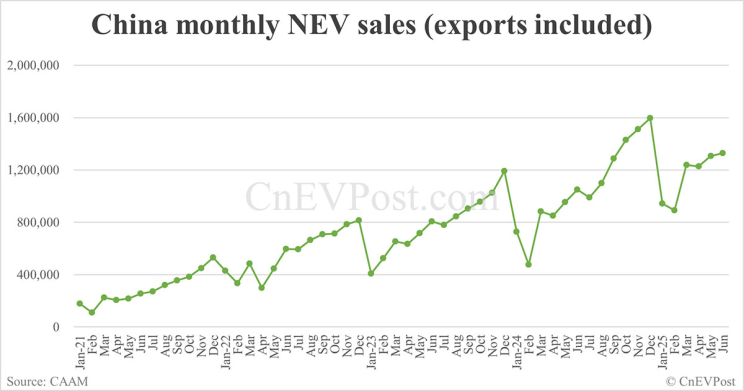

Background: A Boom Fueled by Policy

For years, China’s government poured resources into its EV sector. Through generous subsidies, manufacturing incentives, and favorable policies, it nurtured a sprawling industrial base designed to put the nation at the center of the e-mobility transition. This strategy was highly effective, giving rise to manufacturing giants like BYD and a vast network of suppliers. The goal was to not only meet domestic demand for cleaner transportation but also to establish a powerful export industry. This state-directed growth, however, encouraged companies to build production capacity far beyond actual market needs, setting the stage for the current oversupply.

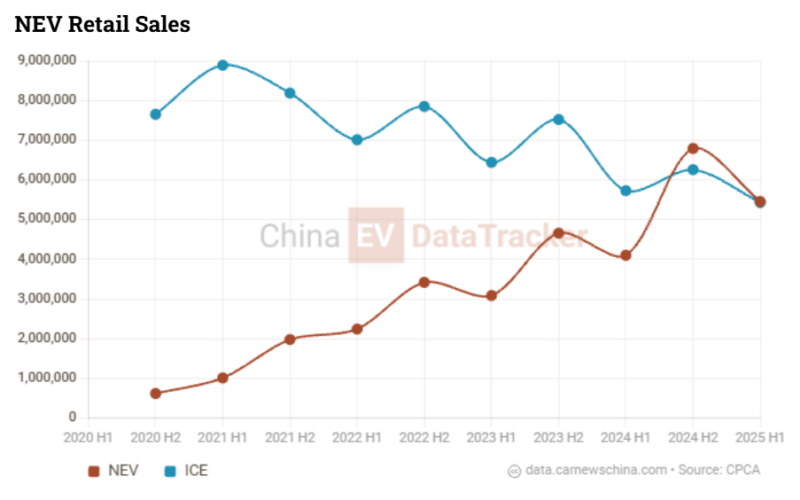

Where We Stand: A Market at Its Limit

The domestic consequences of this rapid expansion are now clear. With too many factories producing too many cars, Chinese automakers have been forced into aggressive price wars to move unsold vehicles. This has created a crisis for auto dealers, with inventory levels for a market leader like BYD reaching 3.21 months — well over double the industry average of 1.38 months. In response to the growing stockpile, BYD and other manufacturers have started to reduce production shifts and postpone plans for new factories. The China Auto Dealers Chamber of Commerce has publicly urged automakers to stop the extreme discounting, but the pressure to sell remains immense.

Impact: From Price Wars to Trade Wars

The problem of overcapacity is no longer a domestic issue. To find buyers for their surplus vehicles, Chinese companies have aggressively targeted international markets, often at prices that Western competitors cannot match. This has led to accusations of unfair competition due to the role of government subsidies in China’s EV industry. The response from the West has been forceful. In May 2025, the United States quadrupled tariffs on Chinese EVs to 100%. The European Union followed on July 4, 2025, imposing its own set of tariffs reaching as high as 38% on certain automakers. These measures are designed to protect domestic auto industries from a flood of low-cost imports, effectively escalating the situation into a global trade conflict.

Navigating a Saturated Market

Caught between a saturated home market and growing trade barriers abroad, Chinese EV makers face a difficult road ahead. The intense price competition is eroding profitability, and many analysts believe the industry is heading for a major consolidation. Weaker brands may not survive the financial strain, leading to bankruptcies or acquisitions by larger, more stable companies. Meanwhile, China’s government is showing signs that it wants to manage the fallout from its own policies, signaling that it may intervene to cool down the “irrational competition.” How it balances supporting its industrial champions with the need for a market correction will be a key factor in the industry’s future.

What’s Next

The Chinese EV industry is at a crossroads. The era of unchecked, subsidy-fueled growth appears to be over, replaced by a painful period of market correction and heightened international tension. We can expect to see a shakeout in the Chinese domestic market, with a smaller number of more resilient companies emerging from the current price wars.

Globally, the focus will shift to how trade relationships evolve. The new tariffs from the U.S. and EU create a significant barrier for Chinese exporters, who may pivot to other markets in Southeast Asia, Latin America, and the Middle East. For automakers in Europe and North America, the tariffs provide temporary breathing room, but the underlying challenge of competing with China’s efficient and low-cost EV manufacturing remains.

Opinion

China’s EV overproduction dilemma is a powerful example of how industrial policy can have unintended consequences. The push for market dominance succeeded in creating a world-class industry but also led to market instability and geopolitical friction. The coming months will be critical in determining whether this situation leads to a more balanced global market or a deepening of trade conflicts that could reshape automotive supply chains for years to come.