Welcome back to this week’s Battery Business Insights. China’s Ministry of Commerce and the General Administration of Customs announced on October 9, 2025 that a new set of export controls will cover select lithium-ion batteries, cathode and anode materials, and related equipment and technologies. The measures take effect November 8, 2025 and raise immediate questions for EV and large-scale storage manufacturers worldwide.

By the Numbers: Facts overview and key metrics

- 300 Wh/kg energy density threshold for controlled lithium-ion cells and packs (SMM Analysis / Metal.com, Oct 9, 2025).

- 2.5 g/cm³ and 156 mAh/g compaction density and specific capacity thresholds for LFP cathode control (SMM Analysis / Metal.com, Oct 9, 2025).

- Announcement No. 58 takes effect on November 8, 2025 (SMM Analysis / Metal.com, Oct 9, 2025).

- From January to August 2025, China’s shipments of ~3.0 billion lithium-ion batteries had an export value of ~$48.3 billion (Caixin / Mysteel, Oct 10 / Sept 22, 2025).

- Licensing processing time: Previous Chinese export control reviews on related items have taken weeks to months for some applications; authorities frequently handle cases individually (Benchmark / Rhomotion, Oct 10, 2025).

- Effect on the market: Immediately following the announcement, shares of significant Chinese battery manufacturers dropped (Reuters, Oct. 10, 2025).

Background: How China extended export controls into batteries and anodes

China’s Announcement No. 58 of 2025 (find the original announcement below) expanded its export‑control perimeter to include parts of the lithium‑ion battery value chain previously treated as largely commercial goods. The list targets high‑energy cells and packs (threshold: gravimetric energy density ≥ 300 Wh/kg), several cathode chemistries and precursors, and artificial‑graphite anode materials and their processing technologies. It also lists a wide set of production equipment—winding and stacking machines, electrolyte filling systems, formation/grading equipment, granulation reactors, graphitization furnaces, coating, and spray‑drying systems, and CVD rotary kilns—bringing “material‑equipment‑technology” nodes under licensing requirements. Exporters must indicate “Subject to dual‑use items” on customs forms and apply for export licenses under China’s Export Control Law and related statutes.

Key developments that led here include earlier 2023–2025 restrictions on graphite, lithium refining tech, and certain rare‑earth items, plus a broader Chinese policy trend of asserting regulatory control over strategic supply chains.

Where We Stand: What the new rules cover and how they will be applied

Scope and technical thresholds: The controls explicitly cover rechargeable lithium‑ion cells and packs with energy density ≥ 300 Wh/kg; LFP cathode material meeting compaction density ≥ 2.5 g/cm³ and ≥ 156 mAh/g; precursors for NCM/NCA chemistry; lithium‑rich manganese cathodes; artificial graphite anode materials and mixes with natural graphite; plus associated equipment and processing technologies (granulation, continuous graphitization, liquid‑phase coating).

Implementation: The measures take effect on November 8, 2025. Exporters must apply for licenses from MOFCOM; customs will scrutinize declarations and may hold shipments pending verification. For items close to listed thresholds, exporters must declare actual parameters for review.

Legal and official framing: Chinese authorities cite national security and non‑proliferation obligations as legal grounds and said the measures are not directed at any particular country. The legal basis includes the Export Control Law, Foreign Trade Law, Customs Law, and the Regulations on Export Control of Dual‑Use Items.

Impact: What this means for supply chains, manufacturers, and markets

Short term — inventory and approvals squeeze: The announcement arrives ahead of the November 8 effective date. Experience from prior Chinese export measures shows a pre‑implementation surge in shipments to build inventories, followed by a slowdown while exporters and customs adapt to licensing. This pattern may last weeks to a few months as permit workflows and case‑by‑case reviews settle.

Medium term — selective constraint on high‑end segments: The controls focus on high‑energy cells and advanced material inputs rather than bulk commodity grades, meaning they concentrate friction on next‑generation EVs and high‑energy storage projects that need ≥300 Wh/kg cells or specific high‑performance cathode and anode chemistries.

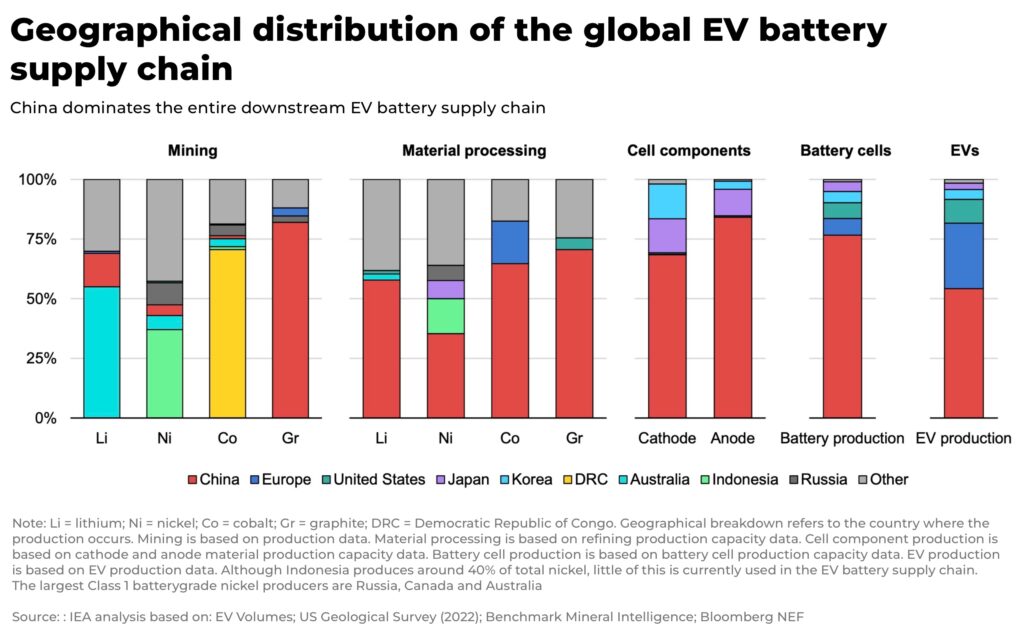

Market reaction and leverage: Chinese battery firms’ shares dropped after the announcement, reflecting investor concern about export volumes and international business. China’s dominant share of global graphite processing and cathode precursor production gives the measures real leverage: trends and industry estimates show China controls a very large share of refining and processing capacity, which amplifies short‑term effects on downstream buyers in Korea, Japan, Europe, and the U.S.

Policy drivers, precedent, and compliance burdens

MOFCOM has framed the move as a security and compliance step; the government has already extended controls across rare earths, superhard materials, and selected battery tech in 2023–2025. These announcements also include compliance recordkeeping mechanisms that trace controlled content through supply chains.

License applications typically require company data, product specs, customer and end‑use information, and sometimes end‑user certificates. Past licensing regimes showed that approvals can be uneven across recipients and regions—permitting authorities may apply discretion case by case. Exporters should expect additional admin lead time and possible shipment holds during verification.

The rules impose licensing; compliant applications can be approved. But additional friction and selective denials or slow approvals can materially reduce effective exports of controlled high‑end items.

Opinion: What companies and policymakers should consider next

What companies and policymakers should consider next.

Exporters and overseas buyers should immediately map exposure to the controlled list, focusing on any products or inputs near the specified thresholds (especially cells ≥300 Wh/kg and LFP with the listed parameters). Build a short‑term inventory and priority‑allocation plan where supply is critical, while avoiding stockpiling that could run afoul of contractual or regulatory limits.

Buyers should accelerate qualification and capacity development of non‑Chinese suppliers for anode and cathode materials where feasible, and consider long‑term vertical integration or strategic offtakes with geographically diversified producers.

Policymakers outside of China will require prompt, practical responses. These responses should include the establishment of government-to-government channels for urgent licensing cases, the acceleration of domestic capacity programs where strategically beneficial, and the updating of procurement and contingency planning to account for potential permit delays.

Final Take

China’s Announcement No. 58 introduces licensing requirements that target high‑end battery cells, selected cathode chemistries, artificial graphite anode materials, and key equipment and processes—measures that will add export friction without imposing an outright ban. Given China’s central role in processing and production, the measures will pressure global EV and energy‑storage supply chains in the near term and accelerate diversification and local capacity development over the medium term.

Sources: SMM Analysis / Metal.com Oct 9, 2025; Taylor Wessing Oct 9, 2025; Reuters Oct 10, 2025

Original announcement:

Ministry of Commerce, General Administration of Customs Announcement No. 58 of 2025 on the Decision to Implement Export Controls on Items Related to Lithium Batteries and Artificial Graphite Anode Materials

Pursuant to the provisions of the Export Control Law of the People’s Republic of China, the Foreign Trade Law of the People’s Republic of China, the Customs Law of the People’s Republic of China, and the Regulations of the People’s Republic of China on the Export Control of Dual-Use Items, and in order to safeguard national security and interests and fulfill international obligations such as non-proliferation, approved by the State Council, it is decided to implement export controls on the following items:

I. Items related to lithium batteries

(a) 3A001 Rechargeable lithium-ion batteries (including battery cells and battery packs) with a gravimetric energy density greater than or equal to 300 Wh/kg (Reference tariff line: 85076000).

(b) 3B901.a. Equipment used for manufacturing rechargeable lithium-ion batteries:

1. Winding machines (Reference tariff line: 84798999);

2. Stacking machines (Reference tariff line: 84798999);

3. Electrolyte filling machines (Reference tariff line: 84798999);

4. Hot pressing machines;

5. Formation and capacity grading systems;

6. Capacity grading cabinets.

(c) 3E901.a. Technology used for producing the items controlled under item 3A001.

II. Items related to cathode materials

(a) 3C901.a.1. LFP cathode material with a compaction density greater than or equal to 2.5 g/cm³ and a capacity per gram greater than or equal to 156 mAh/g (Reference tariff line: 28429040).

(b) 3C901.a.2. Items related to precursors for ternary cathode materials:

a. Nickel-cobalt-manganese hydroxide (Reference tariff line: 28539030);

b. Nickel Cobalt Aluminum Hydroxide (Refer to Tariff Heading: 28539050).

(c) 3C901.a.3. Lithium-rich Manganese-based Cathode Material.

(d) 3B901.b. Equipment for Manufacturing Rechargeable Lithium-ion Battery Cathode Materials:

1. Roller Hearth Kiln;

2. High-speed Mixer;

3. Sand Mill;

4. Airflow Crusher.

III. Graphite Anode Material Related Items

(a) 3C901.b.1. Artificial Graphite Anode Material.

(b) 3C902.b.2. Anode Material Composed of a Mixture of Artificial Graphite and Natural Graphite.

(c) 3B901.c.1. Granulation Process Equipment for Producing Graphite Anode Materials:

a. Vertical Granulation Reactor with a Granulation Volume Greater Than or Equal to 5 m³;

b. Continuous Granulation Reactor with a Granulation Volume Greater Than or Equal to 5 m³.

(d) 3B901.c.2. Graphitisation Equipment for Producing Graphite Anode Materials:

a. Box Furnace;

b. Acheson Furnace;

c. Internal Series Furnace;

d. Continuous Graphitisation Furnace.

(e) 3B901.c.3. Coating Modification Equipment for Producing Graphite Anode Materials:

a. Fusion Coating Equipment with a Volume Greater Than 300 L;

b. Spray Drying Equipment with a Volume Greater Than 60 m³;

c. Chemical Vapor Deposition (CVD) Rotary Kiln with a Barrel Diameter Greater Than 0.5 m.

(f) 3E901.b. Processes and Technologies for Producing Graphite Anode Materials:

1. Granulation Process;

2. Continuous Graphitisation Technology;

3. Liquid Phase Coating Technology.

Export operators exporting the aforementioned items shall apply for a license from the competent department of commerce under the State Council in accordance with the relevant provisions of the Export Control Law of the People’s Republic of China and the Regulations of the People’s Republic of China on the Export Control of Dual-Use Items.

Export operators shall be responsible for the authenticity of declared goods, strengthen the identification of export items. For items subject to control, they must indicate “Subject to Dual-Use Items” in the remarks column of the customs declaration form and list the export control code for dual-use items; for items not subject to control but with parameters, indicators, or performance close to controlled items, they must indicate “Not Subject to Controlled Items” in the remarks column and provide specific parameters and indicators. If the completeness, accuracy, or authenticity of the above declaration information is in doubt, customs will question it according to law, and during the questioning period, the export goods will not be released.

This announcement shall take effect from November 8, 2025.《The Export Control List of Dual-Use Items of the People’s Republic of China was updated simultaneously.

Ministry of Commerce General Administration of Customs

Oct 9, 2025