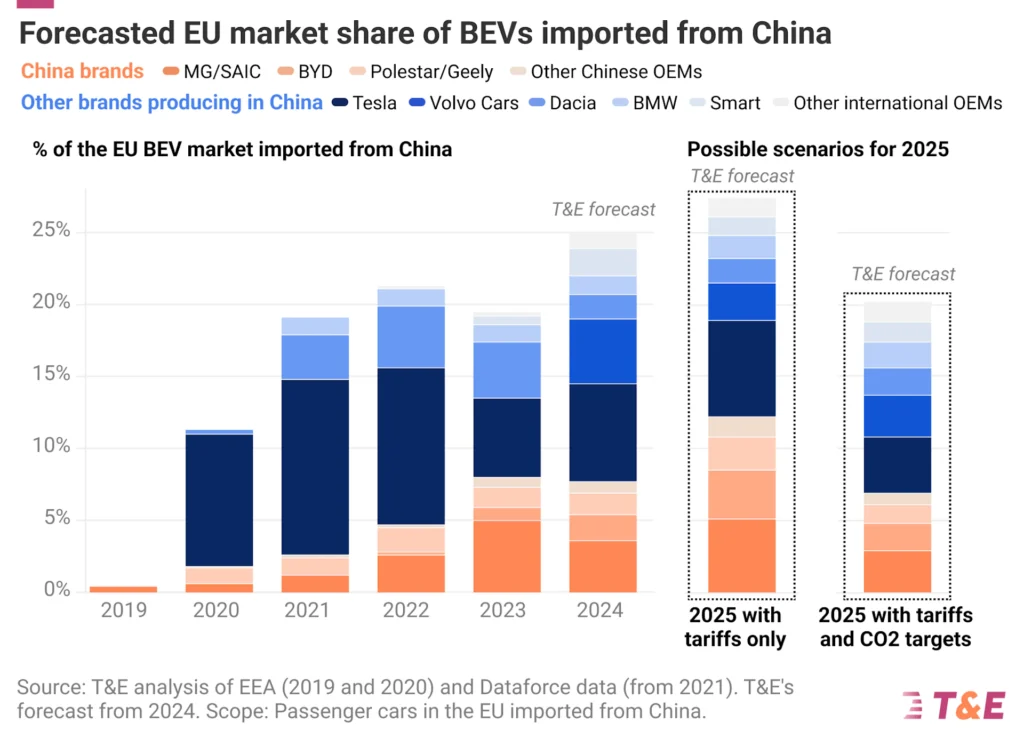

European car manufacturers stand to regain a significant portion of the electric vehicle (EV) market lost to Chinese imports if the European Union upholds its car CO2 emissions targets in addition to implementing EU tariffs, according to a new forecast by Transport & Environment (T&E). The organization reports that European automakers are set to introduce a range of more affordable EV models in 2025 to meet these emissions standards.

Imports from China—including brands like Tesla, BMW, and Volvo—are expected to constitute 25% of EVs sold in Europe this year, T&E finds. This market share could decline to 20% in 2025 and 18% in 2026 if both the tariffs on China-made EVs and the EU’s emissions standards proceed as planned.

However, should the EU delay the 2025 CO2 targets and rely solely on tariffs, Chinese EVs could expand their market share to 27% next year, according to T&E’s estimates. Some European carmakers have advocated for postponing or easing the upcoming standards, which could lead to a stagnation in European EV sales as manufacturers might focus on more profitable combustion engine vehicles, delaying the rollout of affordable electric models.

Julia Poliscanova, Senior Director for Vehicles & E-Mobility Supply Chains at T&E, commented: “Higher EV tariffs are right but only in tandem with the car CO2 targets. They are part of a coherent industrial policy to boost electric car production in Europe. However, the EU risks having the worst of both worlds if it delays the 2025 CO2 targets while limiting the affordable models imported from China.”

The impact of EU tariffs on Chinese EVs has been mixed, according to T&E’s analysis of the EV-Volumes database. MG experienced its largest-ever drop in European EV market share, falling from 4.1% in August 2023 to 2.4% in August 2024. BYD continued to expand its EU presence, albeit at a slower rate, increasing from 1.6% to 2.9% over the same period. Geely’s market share grew from 1.3% to 2% between August 2023 and August 2024.

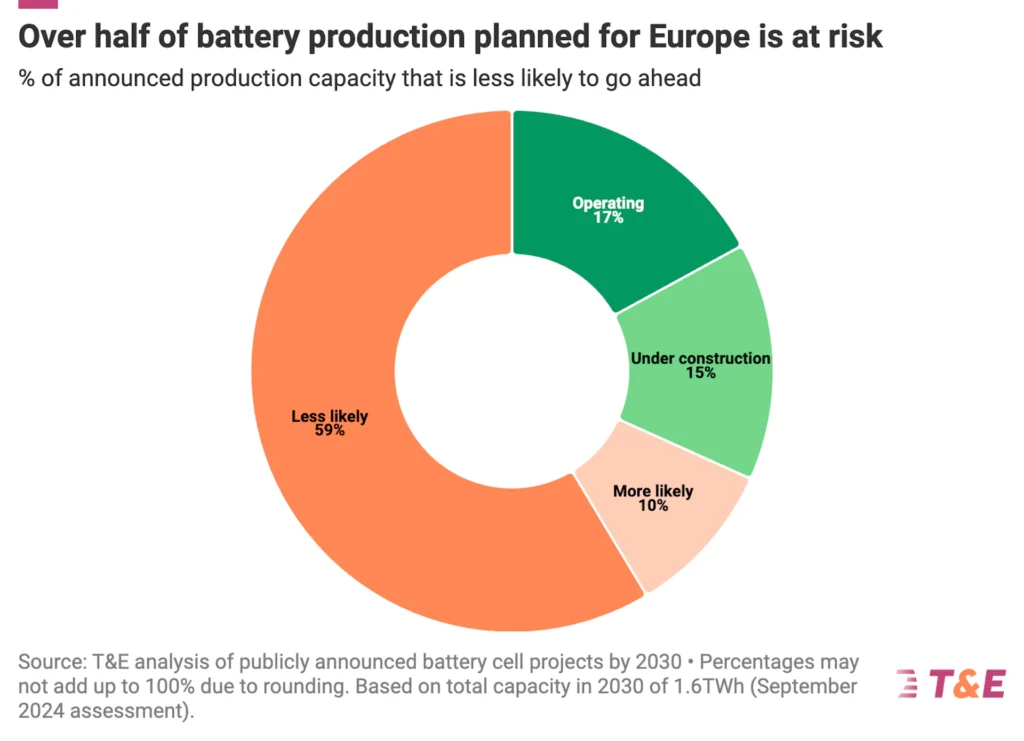

Beyond electric vehicles, T&E highlighted the need for a cohesive strategy for Europe’s domestic battery industry, which faces challenges from global market dynamics and competition with low-cost Chinese batteries. The organization estimates that 59% of planned battery production in Europe is at risk of being canceled, potentially resulting in the loss of billions in investment and nearly 100,000 jobs. T&E called for an EU investigation into battery cells to facilitate trade defense measures.

“It makes no sense to jeopardize the billions of investment in EU gigafactories while keeping the lowest battery tariff in the world at just above 1%,” Poliscanova added. “The EU needs to look seriously at trade defense measures while also supporting domestic production with an EU Battery Fund and policies that reward clean battery manufacturing.”