BMW is evaluating the use of batteries sourced from China for its U.S.-assembled Neue Klasse electric vehicles after Automotive Energy Supply Corp. (AESC) paused construction on a $1.6 billion battery cell factory in Florence, South Carolina. The supplier cited policy and market uncertainty, as well as challenges securing financing and rising U.S. tariffs on imported equipment. AESC, majority-owned by China’s Envision Group, has confirmed it will continue to invest in U.S. operations but offered no update on project timelines.

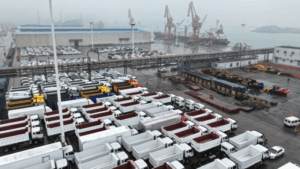

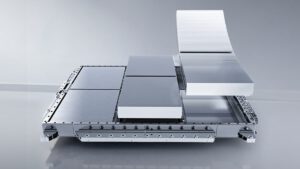

Faced with these delays, BMW may temporarily import lithium-ion cells from AESC’s established production sites in China, despite a planned 82 percent tariff on such batteries in 2026. The company remains committed to launching its Neue Klasse models at its Greer, South Carolina assembly plant in late 2026. These vehicles will employ BMW’s sixth-generation cylindrical cells, which are designed to deliver 30 percent more driving range than the current fifth-generation prismatic cells, along with higher energy density and faster charging capabilities.

Switching to a different battery source could introduce integration challenges, as vehicle platforms, battery management software, and powertrain systems are validated around specific cell designs. Stephanie Brinley, an S&P Global Mobility analyst, noted that even with matching chemistry, extensive testing and integration work may need to be revisited. Conrad Layson of AutoForecast Solutions added that system validation can take 18 months or more, potentially affecting production schedules.

Industry analysts expect BMW’s interim reliance on Chinese imports while it seeks a long-term U.S. supplier. This scenario reflects broader shifts in the EV sector, where recent federal policy changes have prompted General Motors and Ford to scale back or delay planned battery plants. According to Atlas Public Policy, over $13 billion in U.S. storage and EV battery projects have been canceled in the past year.

These developments highlight ongoing supply-chain risks and potential cost pressures for automakers. While temporary imports could help maintain production timelines and consumer availability, BMW’s approach will test the industry’s ability to balance tariffs, regulatory changes, and local production commitments.

Source: EVXL