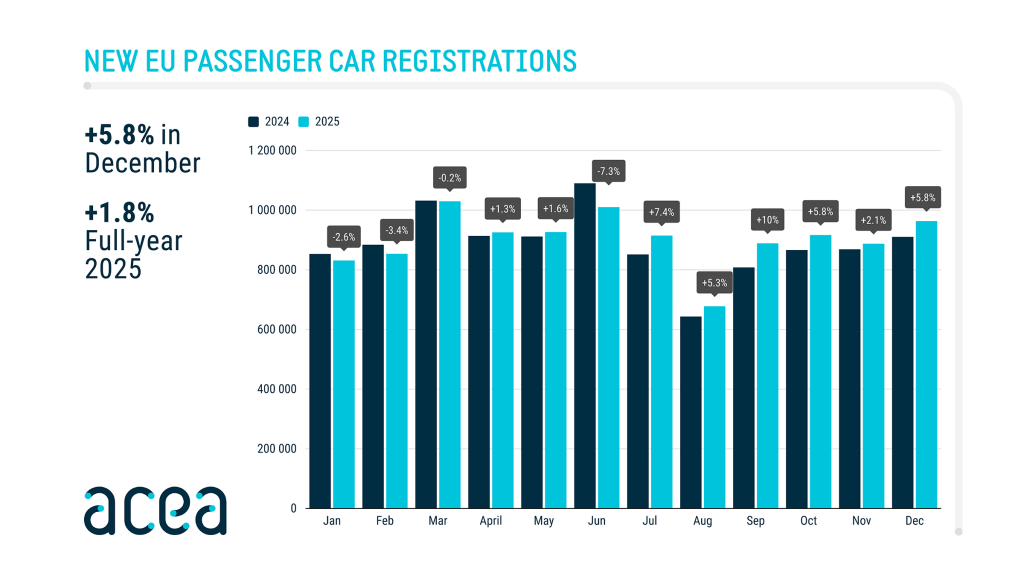

According to data from ACEA, new passenger car registrations in the European Union rose by 1.8% in 2025 compared with the previous year, although total volumes remain below pre-pandemic levels. Electrified powertrains continued to gain ground, with battery-electric vehicles (BEVs) capturing 17.4% of the market, hybrid-electric vehicles (HEVs) accounting for 34.5%, and plug-in hybrids (PHEVs) reaching 9.4%.

In 2025, 1,880,370 new BEVs were registered across the EU, up from 13.6% market share in 2024. Growth was particularly strong in Germany (+43.2%), the Netherlands (+18.1%), Belgium (+12.6%) and France (+12.5%), which together represent 62% of all BEV registrations. HEVs saw 3,733,325 registrations, supported by increases in Spain (+23.1%), France (+21.6%), Germany (+8.0%) and Italy (+7.9%).

| Powertrain | Units (2025) | Market Share (2025) | Note |

|---|---|---|---|

| BEV Battery-electric | 1,880,370 | 17.4% | ACEA reported |

| HEV Hybrid-electric1 | 3,733,325 | 34.5% | ACEA reported |

| PHEV Plug-in hybrid | 1,015,887 | 9.4% | ACEA reported |

| Petrol | 2,880,298 | 26.6% | ACEA reported |

| Diesel | ≈963,709 | 8.9% | Units estimated2 |

| Other fuels3 | ≈354,600 | ≈3.2–3.3% | Share & units estimated2 |

|

1) Includes full & mild hybrids. 2) Diesel & “Other” units derived from ACEA shares and petrol share math; rounding causes small discrepancies. 3) Includes fuel-cell, natural gas, LPG, E85/ethanol and other fuels. |

|||

| Country | 2025 YoY Change |

|---|---|

| Germany | +43.2% |

| Netherlands | +18.1% |

| Belgium | +12.6% |

| France | +12.5% |

| These four markets account for ~62% of EU BEV registrations in 2025. | |

| Country | 2025 YoY Change |

|---|---|

| Spain | +23.1% |

| France | +21.6% |

| Germany | +8.0% |

| Italy | +7.9% |

| Country | 2025 YoY Change |

|---|---|

| Spain | +111.7% |

| Italy | +86.6% |

| Germany | +62.3% |

| Country | 2025 YoY Change |

|---|---|

| France | -32.0% |

| Germany | -21.6% |

| Italy | -18.2% |

| Spain | -16.0% |

| Year | ICE Share |

|---|---|

| 2024 | 45.2% |

| 2025 | 35.5% |

PHEV registrations climbed to 1,015,887 units, up from 7.2% to 9.4% of the total market, driven by Spain (+111.7%), Italy (+86.6%) and Germany (+62.3%). Year-over-year figures for December 2025 showed a 51% increase for BEVs, 36.7% for PHEVs and 5.8% for HEVs.

Conventional powertrains continued to contract. Petrol registrations fell by 18.7%, with 2,880,298 new vehicles and a market share decline to 26.6% from 33.3% in 2024. All major markets recorded decreases, led by France (–32%), Germany (–21.6%), Italy (–18.2%) and Spain (–16%). Diesel registrations dropped 24.2%, reducing their share to 8.9%, while December 2025 year-over-year declines were 19.2% for petrol and 22.4% for diesel. Combined, petrol and diesel vehicles now represent 35.5% of the EU market, down from 45.2% a year earlier.

The data highlights the ongoing shift toward electrified mobility, with HEVs remaining the most popular choice, while BEVs and PHEVs continue to expand their presence. To support the EU’s decarbonization goals, further growth in electric vehicle adoption and continued investment in charging infrastructure will be crucial as overall market volumes gradually recover.

Source: ACEA