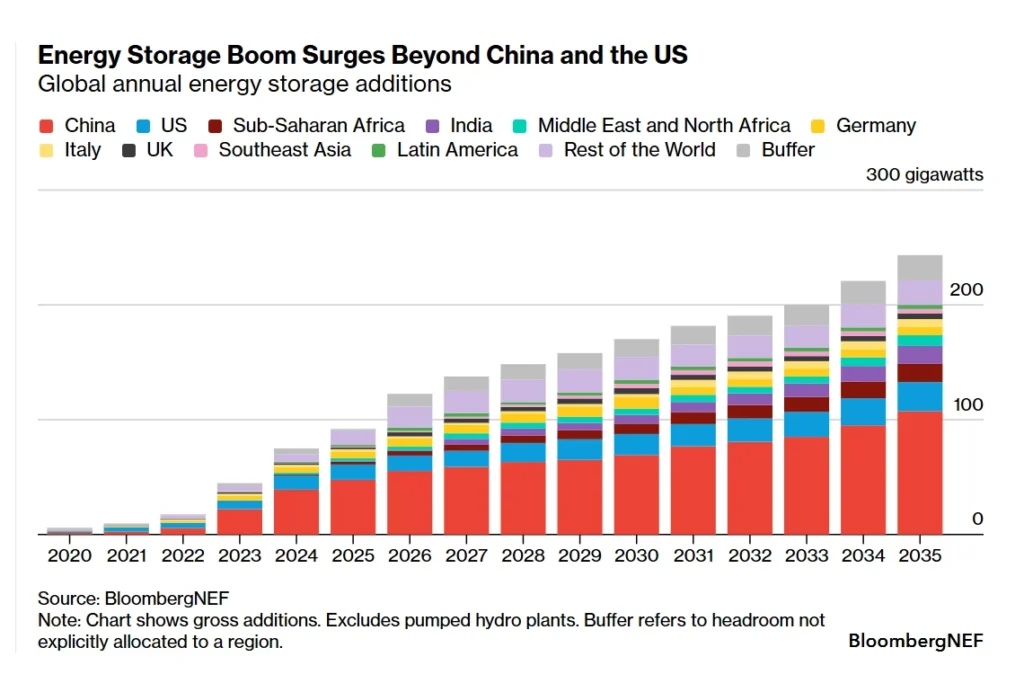

According to BloombergNEF, global energy storage deployments excluding pumped hydropower are expected to reach 92 GW (247 GWh) in 2025, marking a 23% increase from 2024. China is projected to contribute over half of the new capacity, followed by the United States at around 14 percent. Other markets, including Germany, the United Kingdom, Australia, Canada, Saudi Arabia and sub-Saharan Africa, are also scaling installations, supported by favorable policies, utility procurement and evolving power market conditions.

Looking further ahead, cumulative global energy storage capacity is forecast to reach 2 TW (7.3 TWh) by 2035—roughly eight times the level anticipated in 2025. Utility-scale projects are expected to continue dominating applications as countries seek to integrate higher shares of renewables and improve grid reliability.

Policy shifts in the two largest markets have not derailed growth prospects. In China, the removal of storage mandates for renewables earlier in the year raised concerns, but a new nationwide storage target announced in September underscores continued commitment to the sector. Regulators are also promoting a shift toward market-driven growth through the introduction of a spot trading market and a provincial compensation scheme for storage projects.

In the U.S., evolving federal policies—such as adjustments to import tariffs and restrictions on certain Chinese-made equipment—have introduced uncertainty. Market participants, however, are adapting quickly, supported in part by domestic battery production initiatives from key manufacturers. With electric-vehicle battery demand growth slowing unexpectedly, many producers are pivoting to stationary storage applications.

On the technology front, lithium-ion battery systems are extending discharge durations beyond four hours, with projects of six to eight hours now under development. Lithium iron phosphate (LFP) chemistry remains the leading choice for stationary storage due to its cost advantage and longer cycle life compared to nickel-based alternatives. These multi-hour installations are being planned or procured in markets such as the U.K., Australia, Canada, Japan, South Korea and Italy, enabling energy storage to compete more effectively with long-duration alternatives.

Source: BloombergNEF